EUR/USD

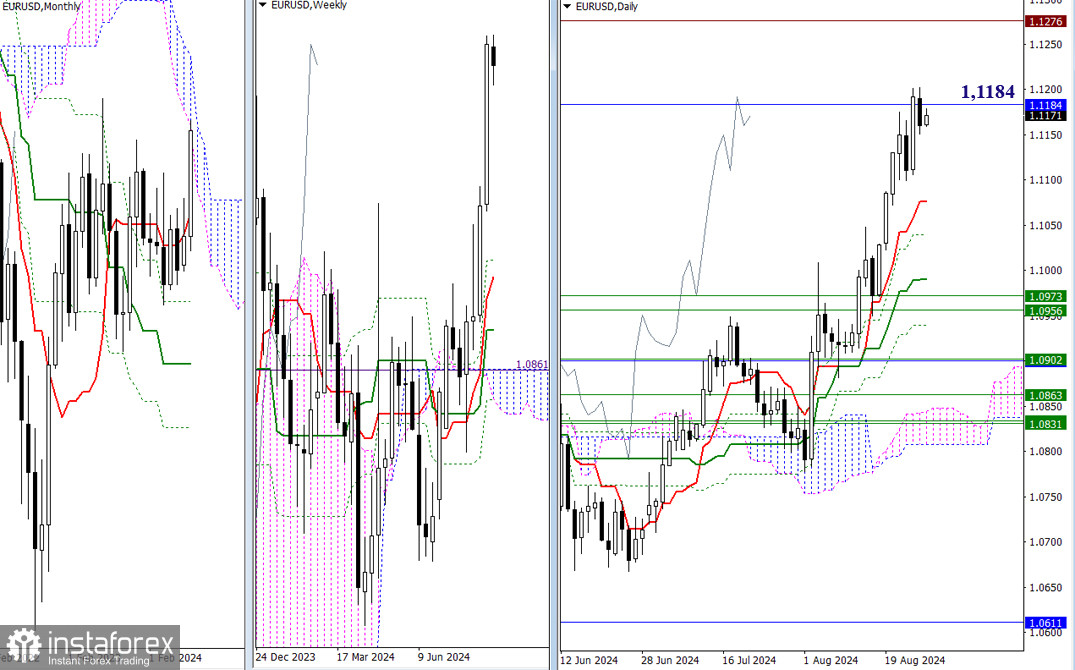

Higher time frames

Interaction with the lower boundary of the monthly cloud (1.1184) continues. This interaction is already marked by a slowdown and a slight downward correction. This resistance is on the monthly time frame, so the daily result cannot be definitive. At the end of the week, we will close the week and the month, and the final outcome will be important. A breakout will open opportunities for testing and updating the high of 2023 (1.1276). A rebound will direct attention to support levels, with the first market encounter being the daily Ichimoku cross (1.1076 – 1.1040 – 1.0990 – 1.0940), reinforced by weekly levels (1.0973 – 1.0956).

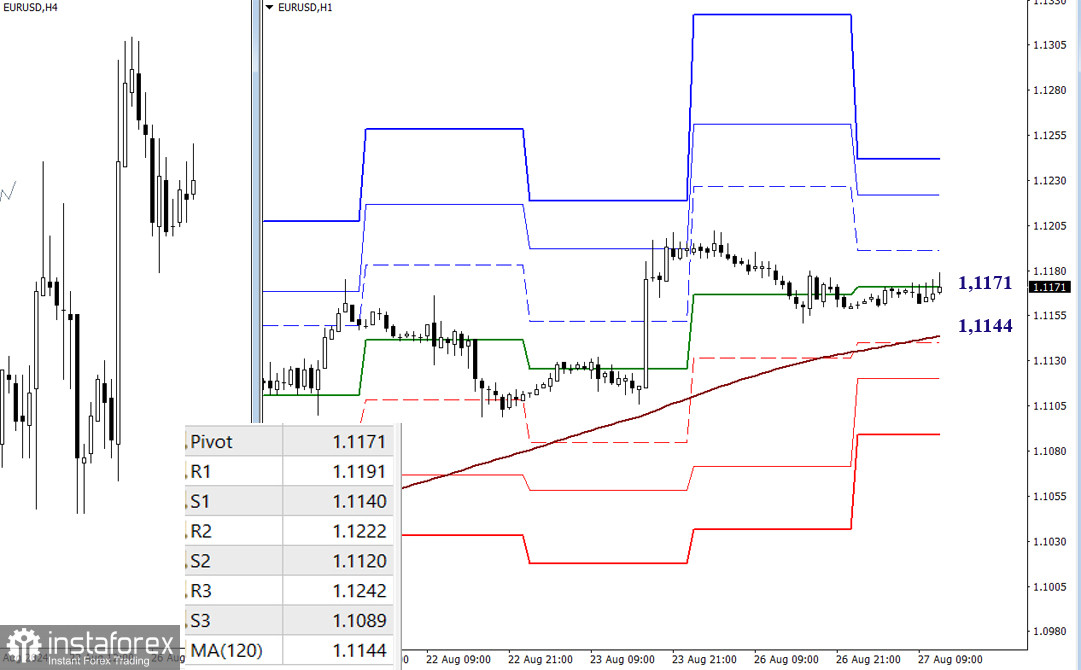

H4 – H1

Currently, sideways movement persists on the lower time frames, with the central pivot level of the day (1.1171) as its center. Bullish traders continue to hold the upper hand. Testing and breaking the weekly long-term trend (1.1144) may affect the current balance of power, as a trend reversal and trading below this level will focus on further strengthening bearish sentiment. The next support will be the classic pivot levels (1.1120 – 1.1089). Maintaining the strength in favor of the bulls could stimulate bullish activity. For intraday bulls, the resistance levels of the classic pivots (1.1197 – 1.1222 – 1.1242) will be of interest.

***

GBP/USD

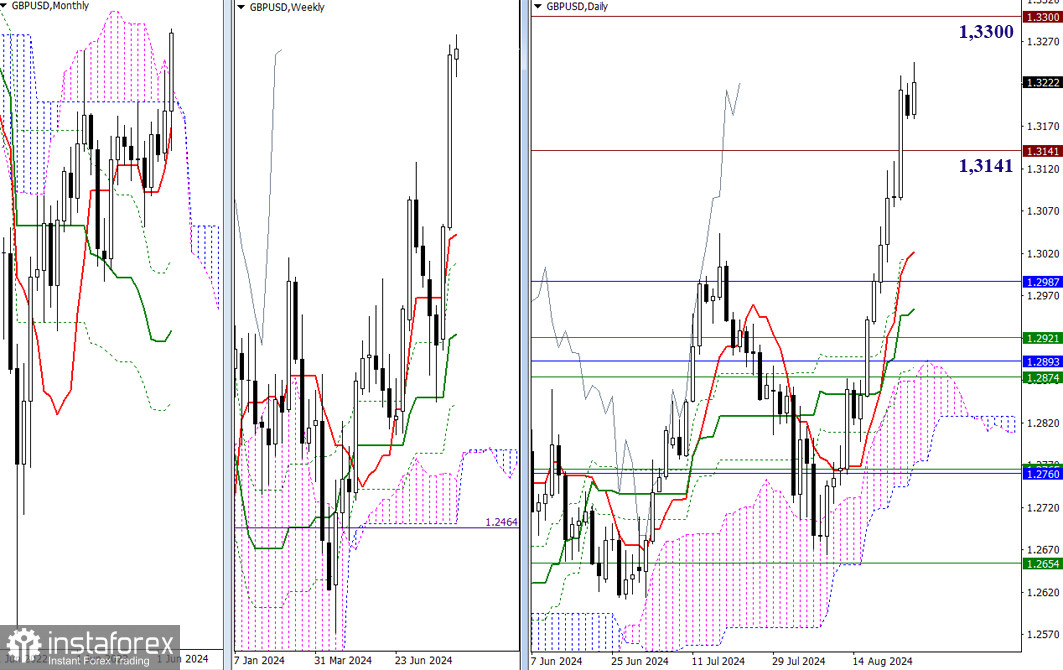

Higher time frames

Yesterday, we observed a slowdown, but today, the pair has already updated last week's high and may continue to rise. Time will show whether bullish traders will be able to resume the uptrend. In the current situation, psychological levels 1.3300, 1.3400, and 1.3500 are key targets for the rise. If yesterday's slowdown develops further and the pause turns into a corrective decline, the previously reached high of 2023 (1.3141) could act as support, and then the market will encounter the daily short-term trend (1.3022).

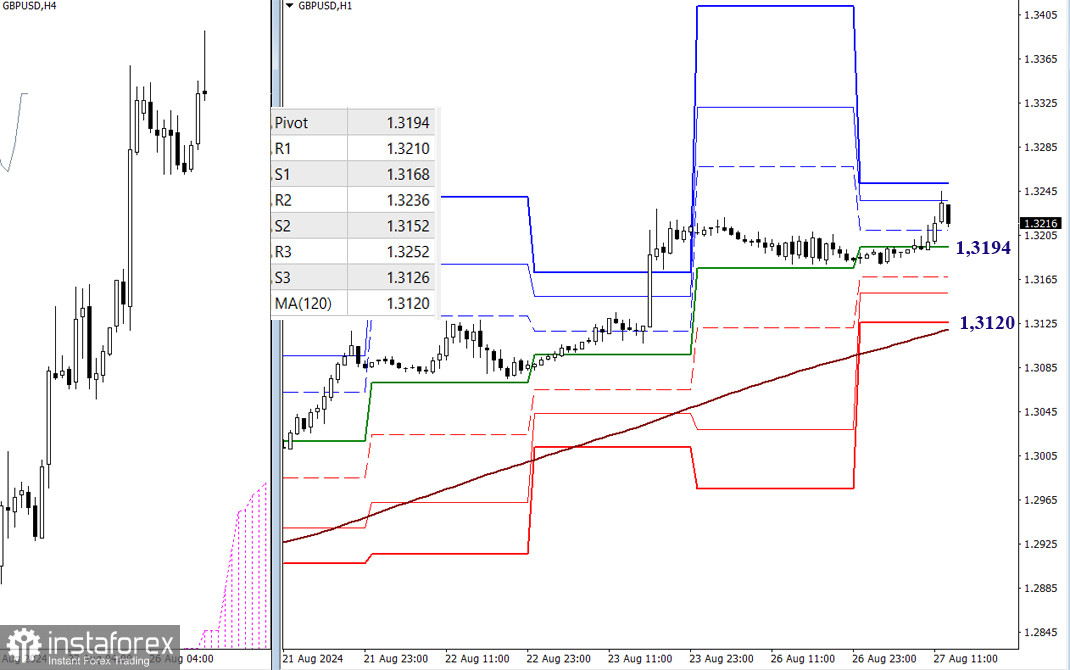

H4 – H1

Bullish traders hold the main advantage in lower time frames. Today, the range of classic pivot levels is not very wide. The pair has almost surpassed it already, with only the R3 level (1.3252) remaining untouched. If the rise continues, attention will shift to the targets in the higher time frames. If a corrective decline occurs, the key levels on the lower time frames will be important, including the central pivot level of the day (1.3194) and the weekly long-term trend (1.3120). Intermediate support along the way can be noted at the S1 level (1.3168) and the S2 level (1.3152).

***

This technical analysis is based on the following ideas:

Larger time frames - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 – classic pivot points + 120-period Moving Average (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română