Analysis of macroeconomic reports:

There is only one macroeconomic event scheduled for Monday. In principle, these reports are not needed right now because what we are seeing are daily dollar sales regardless of any fundamental or macroeconomic backdrop. Indicators, events, news, reports, patterns—none of these have any relevance at the moment. Therefore, the report on durable goods orders in the U.S. may indeed provoke a market reaction and even a rise in the American currency, but how this reaction and growth will impact the market globally remains uncertain.

Analysis of fundamental events:

Monday's fundamental events didn't offer anything significant, as the market had already digested all the necessary information on Friday. The key takeaway is Jerome Powell's indication of the Federal Reserve's readiness to ease monetary policy in September; everything else is irrelevant. The market is currently not interested in the European Central Bank's or the Bank of England's monetary policy or its prospects. It is also not concerned with how quickly the Fed will lower rates or whether it will lower them at all after September, as inflation in the U.S. remains quite high.

General conclusions:

During the first trading day of the new week, both currency pairs might experience a slight retracement downward. However, it should be understood that this is only a technical assumption that must be confirmed by sell signals. Both pairs could continue to rise as the market constantly makes purchases unrelated to specific factors or dependent on anything particular.

Basic rules of the trading system:

1) The strength of a signal is determined by the time it takes for the signal to form (bounce or level breakthrough). The less time it took, the stronger the signal.

2) If two or more trades around a certain level are initiated based on false signals, subsequent signals from that level should be ignored.

3) In a flat market, any currency pair can form multiple false signals or none at all. In any case, it's better to stop trading at the first signs of a flat market.

4) Trades should be opened between the start of the European session and midway through the U.S. session. After this period, all trades must be closed manually.

5) In the hourly time frame, trades based on MACD signals are only advisable amidst substantial volatility and an established trend confirmed by a trendline or trend channel.

6) If two levels are too close to each other (5 to 20 pips), they should be considered support or resistance.

7) After moving 15-20 pips in the intended direction, the Stop Loss should be set to break even.

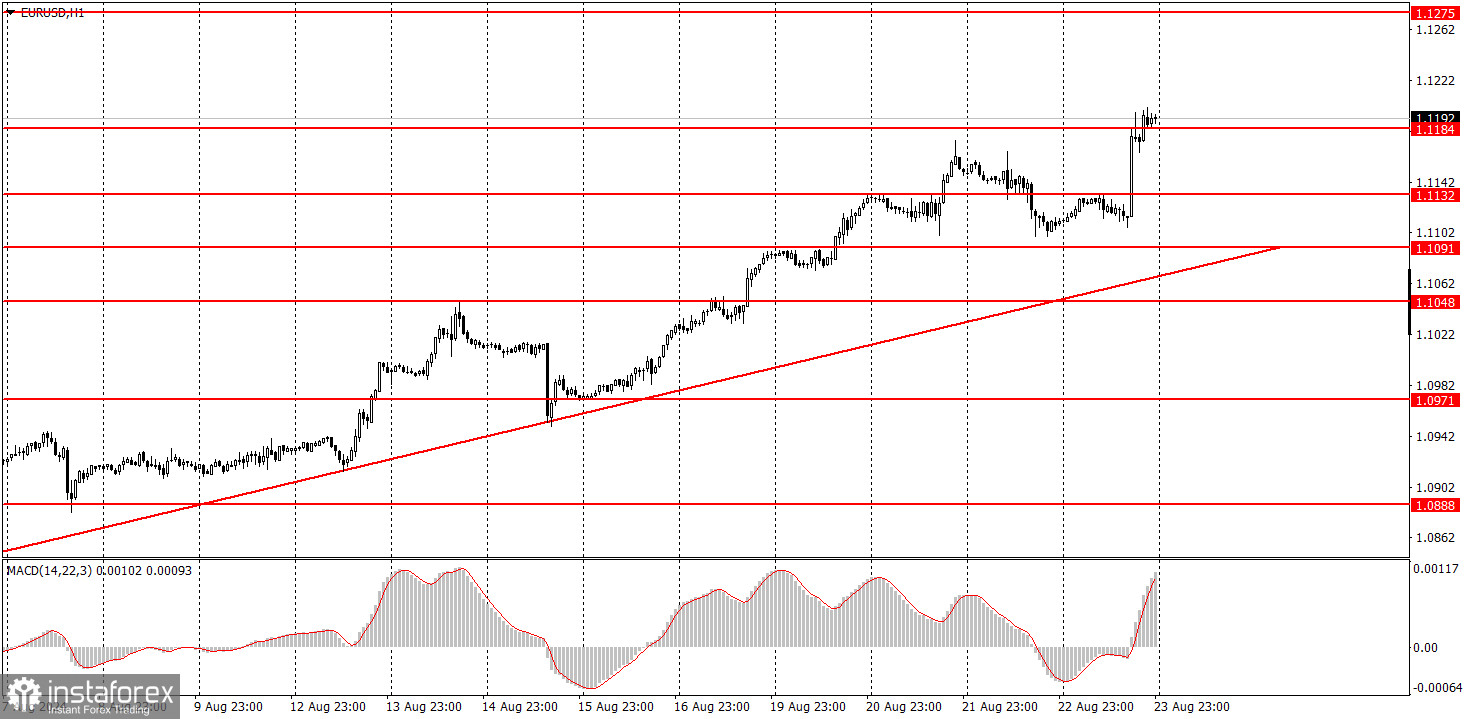

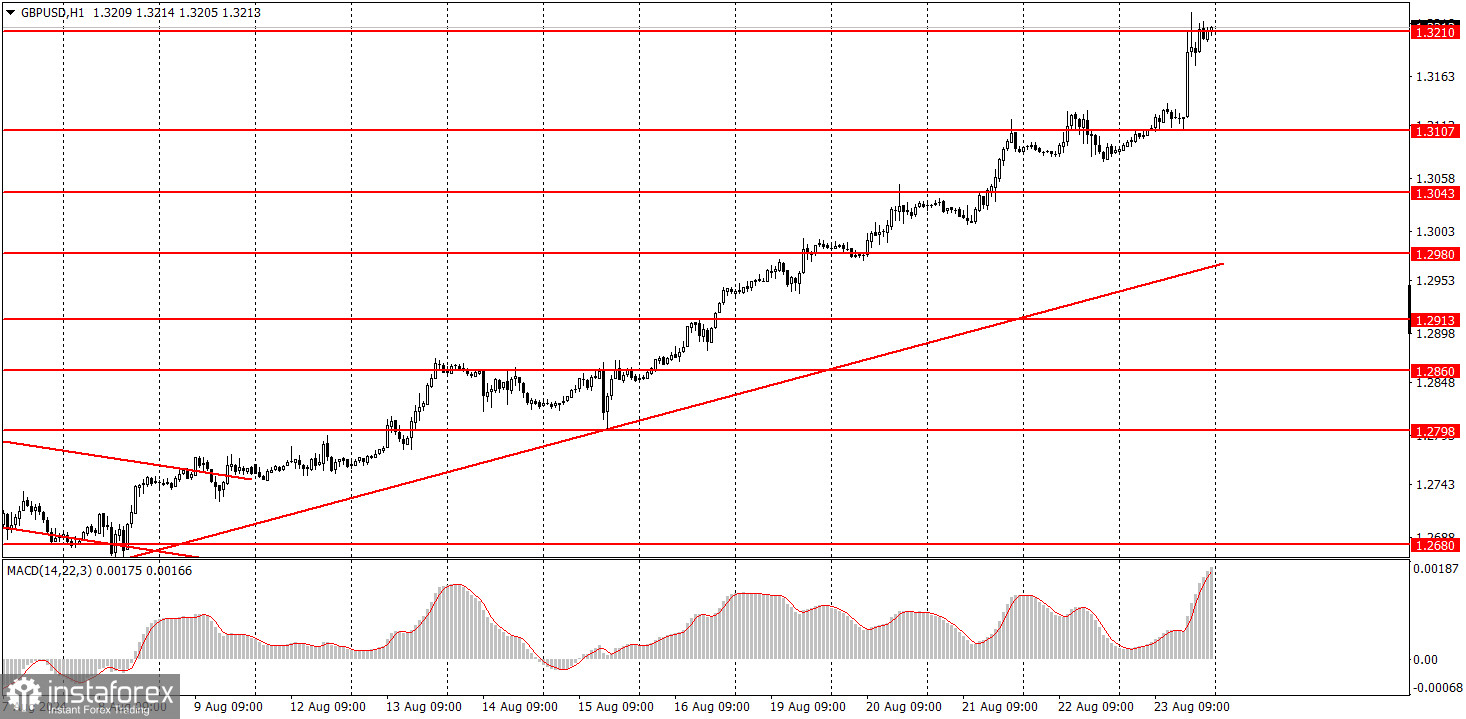

What's on the charts:

Support and Resistance price levels: targets for opening long or short positions. You can place Take Profit levels near them.

Red lines: channels or trend lines that depict the current trend and indicate the preferred trading direction.

The MACD (14,22,3) indicator, encompassing both the histogram and signal line, acts as an auxiliary tool and can also be used as a source of signals.

Important speeches and reports (always noted in the news calendar) can profoundly influence the movement of a currency pair. Hence, trading during their release calls for heightened caution. It may be reasonable to exit the market to prevent abrupt price reversals against the prevailing trend.

Beginners should always remember that not every trade will yield profit. Developing a clear strategy and effective money management is key to success in trading over a long period.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română