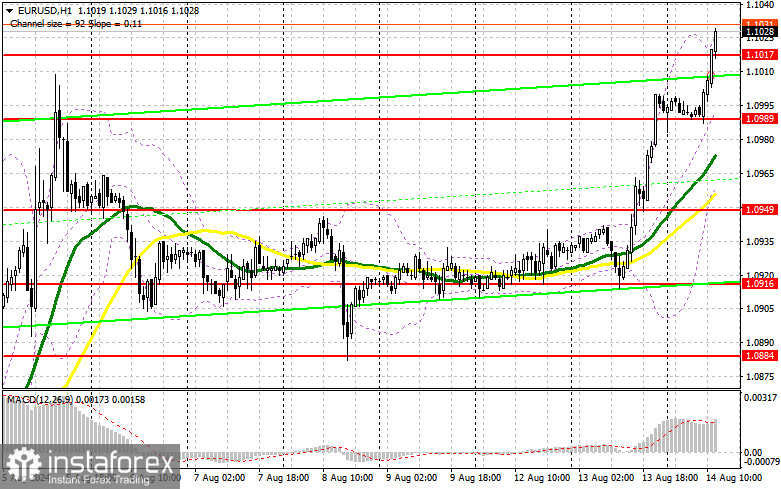

In my morning forecast, I focused on the 1.1007 level and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened. The pair rose to the 1.1007 level, but there was no false breakout, nor did I see a retest of this level to increase long positions. For this reason, I did not enter any trades in the first half of the day. The technical outlook for the second half of the day has been revised.

To Open Long Positions on EUR/USD:

The euro continued to rise following the Eurozone GDP report, which predictably remained unchanged, triggering an increase in long positions ahead of crucial U.S. inflation figures. These figures are highly anticipated, as they could provide direct evidence supporting a rate cut by the Federal Reserve this fall. It's essential to see if the U.S. Consumer Price Index (CPI) slows down in July and what happens with core prices. A further slowdown in growth would negatively impact the U.S. dollar. However, considering how much the euro has already risen in the first half of the day, I prefer to wait for a pullback and a false breakout formation around the new support at 1.1017, formed by today's trading. The target is to test the resistance at 1.1047, where I expect the first signs of sellers. A breakout and subsequent retest of this range from top to bottom would strengthen the pair, with the potential to rise towards 1.1076. The furthest target is the 1.1111 maximum, where I will take profits. If EUR/USD declines and there's no activity around 1.1017 in the second half of the day, sellers will regain the initiative and start building a downward correction. In that case, I will consider entering long positions only after a false breakout near 1.0949, where the moving averages are located. I plan to open long positions immediately on a rebound from 1.0916, targeting an intraday correction of 30-35 points.

To Open Short Positions on EUR/USD:

Sellers continue to lose initiative. Defending 1.1047 with a false breakout will be a priority task for the second half of the day and a suitable scenario for opening short positions, targeting a decline to intermediate support at 1.1017. A breakout and consolidation below this range, followed by a retest from bottom to top, would provide another selling opportunity, targeting 1.0989, where I expect to see more active buyers. The furthest target would be the 1.0949 level, where I would take profits. Testing this level would undermine the euro buyers' plans to establish an uptrend. If EUR/USD rises in the second half of the day on weak U.S. statistics and there's no selling activity at 1.1047, buyers will continue to build a new uptrend. In that case, I would postpone selling until the next resistance at 1.1076 is tested. I would also consider selling only after a failed consolidation. I plan to open short positions immediately on a rebound from 1.111, targeting a downward correction of 30-35 points.

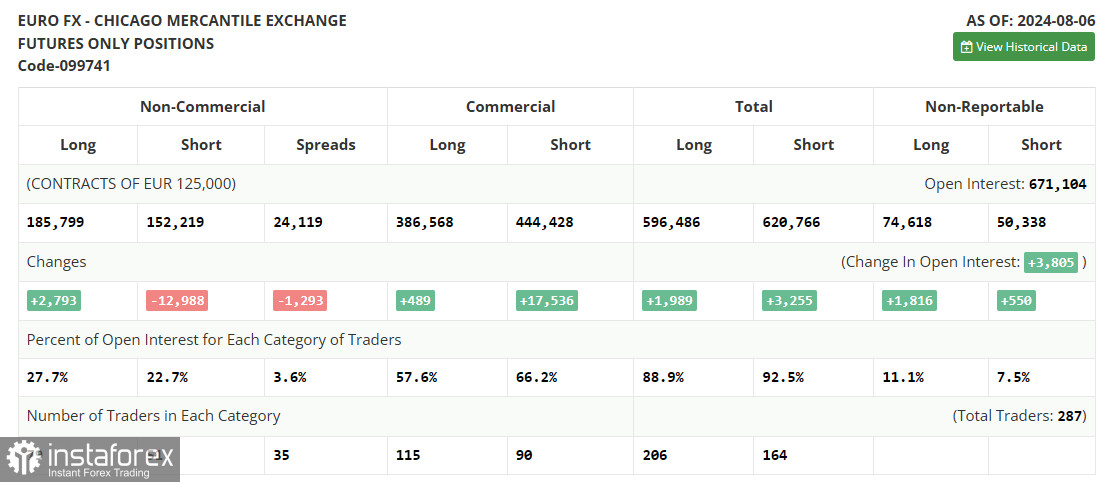

In the COT report (Commitment of Traders) for August 6, there was an increase in long positions and a reduction in short positions. It is evident that the Federal Reserve's new direction towards monetary policy easing has not gone unnoticed. Despite similar actions expected from the ECB, the euro has a strong chance to recover against the dollar, as the U.S. regulator could surprise everyone by cutting rates by half a percentage point this fall. A series of statistics will be released soon, which will determine the Fed's next steps, so keep a close eye on the economic calendar. The COT report indicates that long non-commercial positions increased by 2,793 to 185,799, while short non-commercial positions decreased by 12,988 to 152,219. As a result, the spread between long and short positions decreased by 1,293.

Indicator Signals:

Moving Averages:

- Trading is conducted above the 30-day and 50-day moving averages, indicating further growth for the pair.

- Note: The periods and prices of the moving averages are considered by the author on the H1 hourly chart and differ from the classical daily moving averages on the D1 daily chart.

Bollinger Bands:

- In case of a decline, the lower boundary of the indicator around 1.0989 will act as support.

Indicator Descriptions:

- Moving Average (MA): Defines the current trend by smoothing out volatility and noise. Period 50. Marked in yellow on the chart.

- Moving Average (MA): Defines the current trend by smoothing out volatility and noise. Period 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific criteria.

- Long non-commercial positions: Represent the total long open positions of non-commercial traders.

- Short non-commercial positions: Represent the total short open positions of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română