If the Bank of Japan changes its stance as frequently as one changes gloves, why not reverse its July decision to raise the overnight rate to 0.25%? At the press conference following the last Board of Governors meeting, Kazuo Ueda noted that a weak yen is among the key reasons for tightening monetary policy, and the cycle of monetary restriction will continue. A few days later, his deputy, Shinichi Uchida, shocked investors by announcing that rates would not be raised during market turbulence. The USD/JPY bears were forced to retreat, but the question remains: how long?

In reality, the Bank of Japan was simply stating the facts. Monetary policy is the primary factor influencing exchange rates on Forex, and exchange rates, in turn, affect the decisions of central banks. This is especially true in cases of rapid depreciation or appreciation of a currency. Some may use verbal or currency interventions in such situations, while others may start discussing the fate of interest rates.

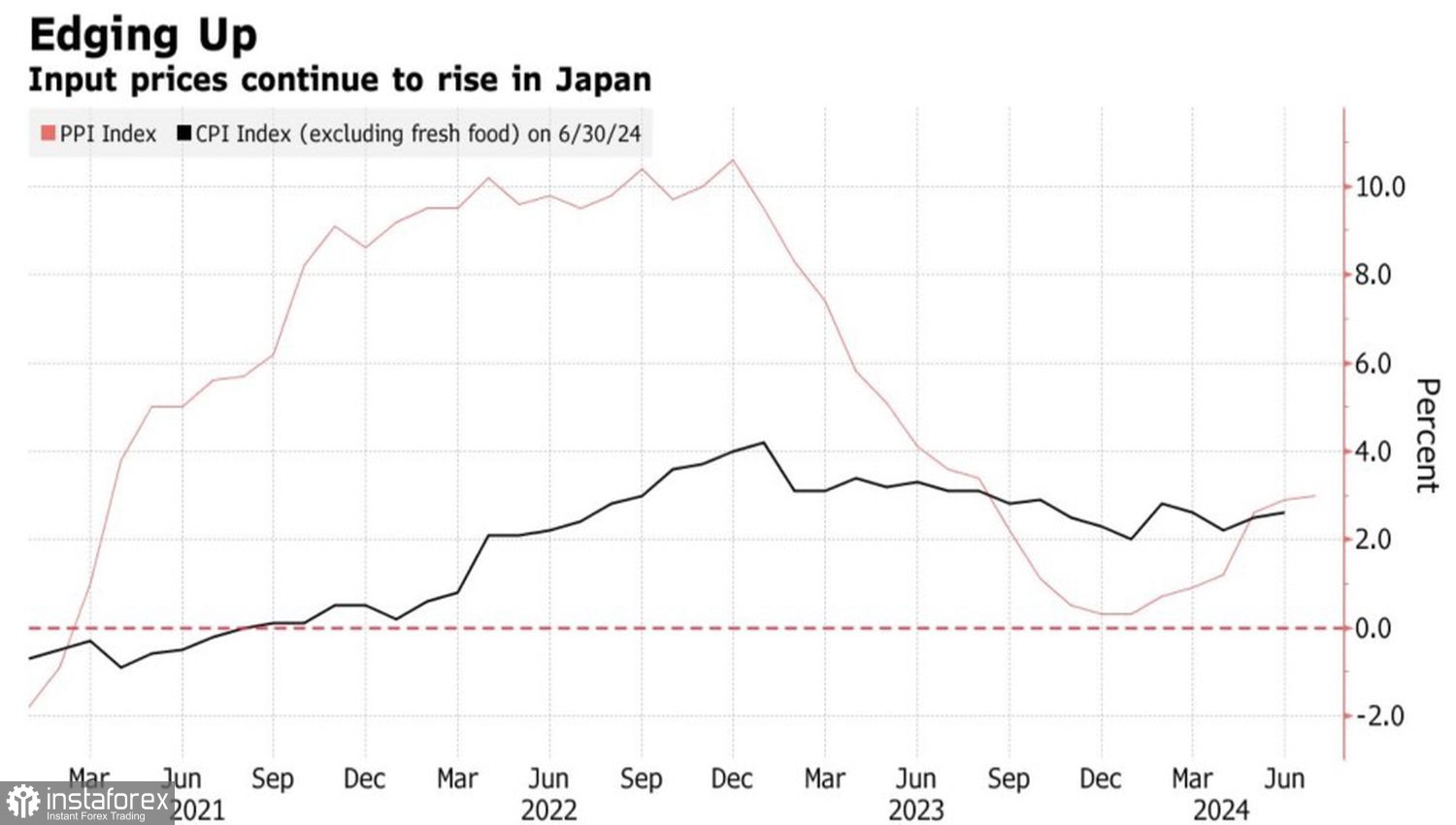

Japan's producer prices rose for the eighth consecutive month, reaching a record high of 123.1. This, along with an acceleration in July from 2.9% to 3% and an increase in import prices from 10.6% to 10.8% year-on-year, is pushing the BoJ to continue its cycle of monetary policy normalization, especially since the panic in the markets seems to have subsided.

Trends in Japanese Inflation

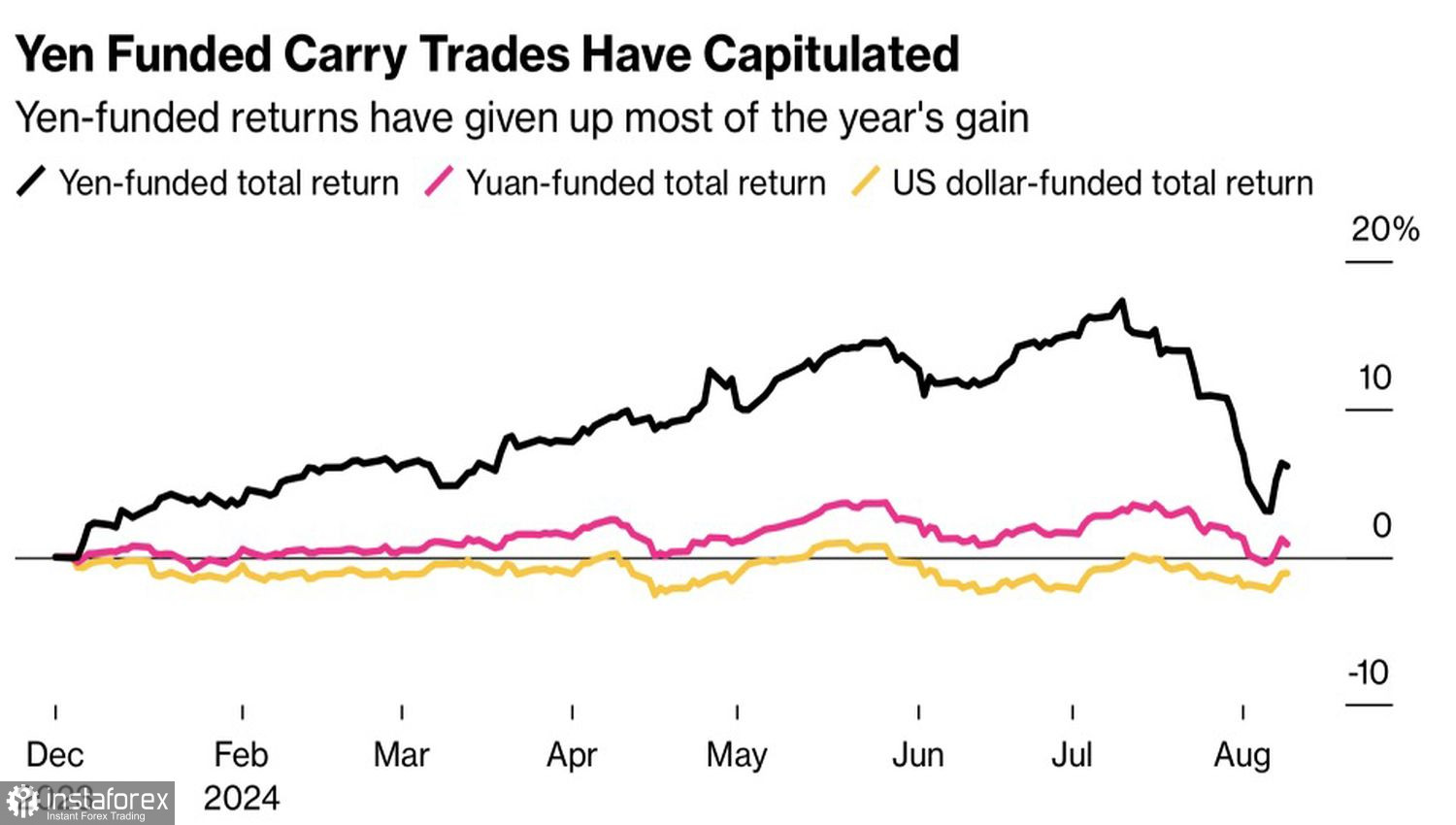

Derivatives traders anticipate another overnight rate hike by the end of 2024, along with a 100 basis point reduction in the federal funds rate. Under such conditions, USD/JPY quotes should be falling, but instead, they are rising. Markets are unsure that this is how things will unfold. The Fed may be more patient, while the Bank of Japan may be more hesitant to act. As a result, the interest rate differential will remain elevated, and carry traders will re-engage in their strategies.

The situation is painfully reminiscent of the beginning of the year. Back then, there was also much talk about significant easing of the Fed's monetary policy and normalization by the BoJ, which automatically made the yen a favorite on Forex. In reality, accelerating inflation in the U.S. dashed the ambitious plans of USD/JPY bears.

Performance of Carry Trade Operations

It is no surprise that investors are cautious ahead of the release of U.S. PPI and CPI inflation data. An acceleration in inflation will boost demand for the U.S. dollar, similar to what happened in the first quarter. If the actual data is close to the forecasts, it will indicate the development of a deflationary process in the U.S. and provide a reason to sell the pair.

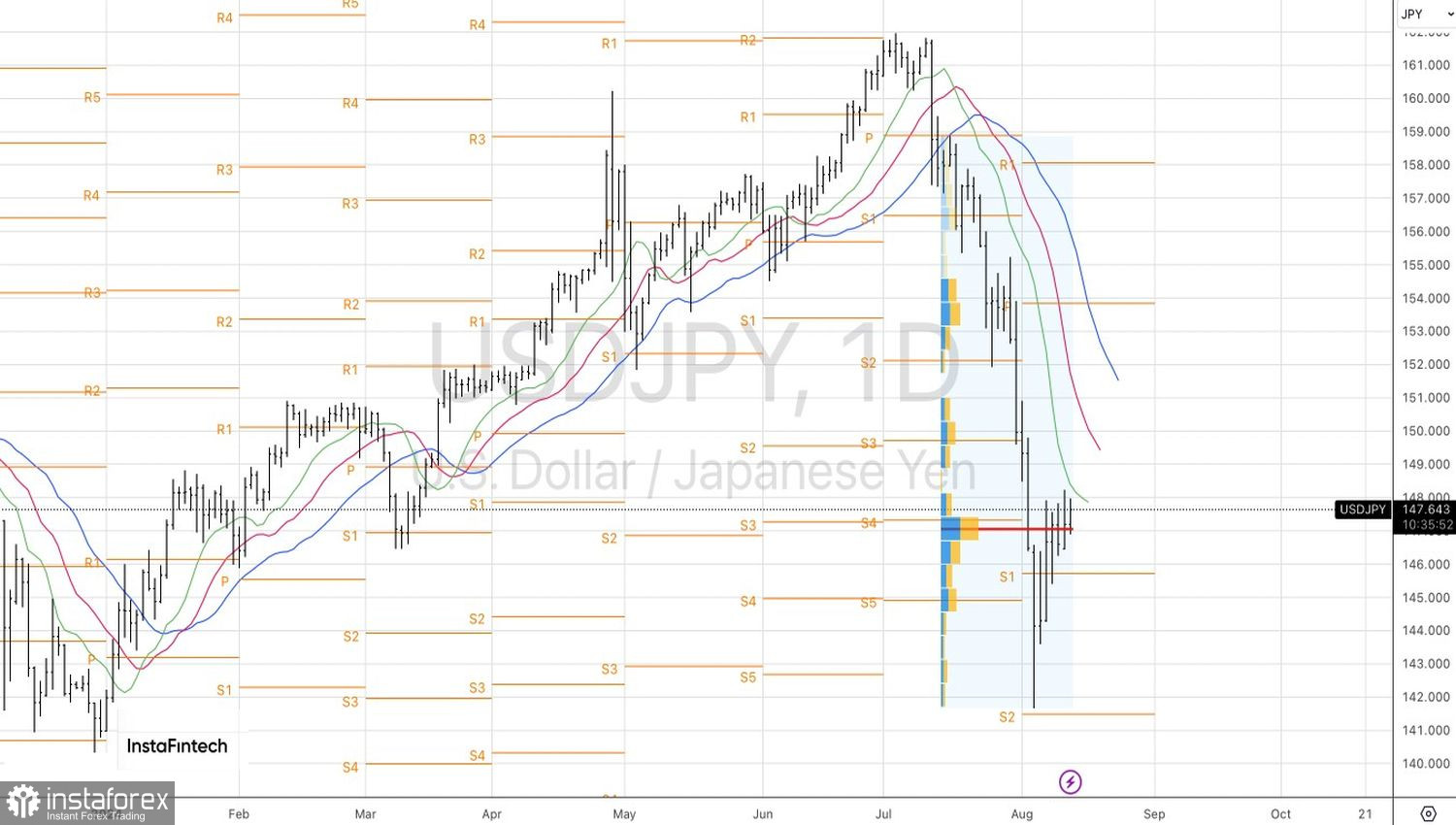

Technically, on the daily chart, USD/JPY is experiencing a pullback within a downward trend. It makes sense to hold and periodically increase the long positions in the U.S. dollar against the Japanese yen established from the 145.8 level. As long as the pair's quotes remain above the 147 mark, the bulls are in control of the situation.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română