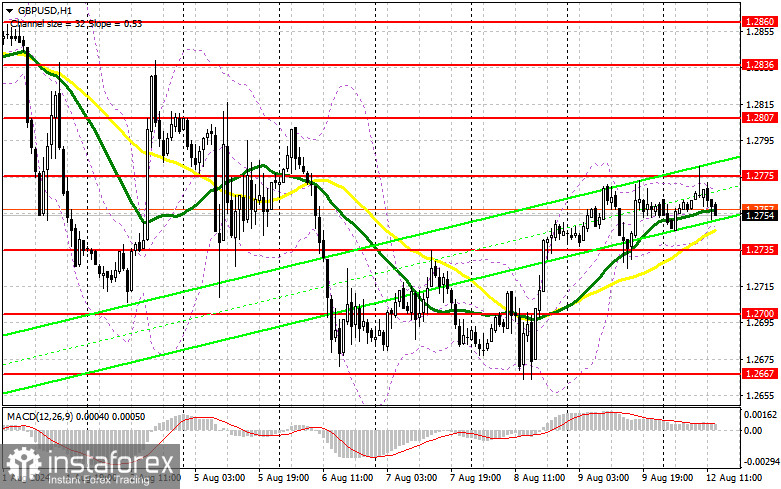

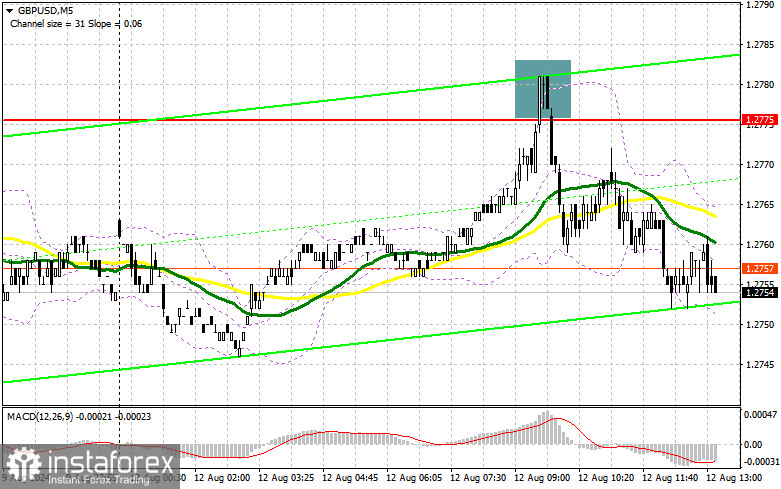

In my morning forecast, I focused on the 1.2775 level and planned to make trading decisions based on it. Let's look at the 5-minute chart and see what happened. The rise and subsequent false breakout at 1.2775 triggered a selling opportunity for the pound, leading to a 30-point drop in the pair. Since the target of 1.2735 hasn't been reached, the technical outlook has not been revised for the second half of the day.

To open long positions on GBP/USD:

Considering the lack of important statistics from the U.K., the active actions of the bulls around 1.2775 were not surprising, but we didn't see support from large players. The pair is likely to continue trading within a sideways channel in the second half of the day, given the absence of U.S. data or Federal Reserve speeches. Given that we've already seen attempts by buyers, it's unlikely anyone will try to break above the daily high again. In this context, I prefer to act on a decline around the nearest support at 1.2735, formed at the end of last week. Only a false breakout at the 1.2735 level will provide a suitable opportunity for opening long positions, targeting a rise to the 1.2775 resistance, which has already been tested once today. A breakout followed by a retest from top to bottom of this range will increase the chances of the pound rising, leading to a long position entry point with the possibility of reaching the 1.2807 level. The final target would be the 1.2836 level, where I plan to take profits. In the event of a decline in GBP/USD and a lack of bull activity around 1.2735 in the second half of the day, which I personally doubt, the pound could decline more significantly. This would lead to a decline and a test of the next support at 1.2700, increasing the chances of a more significant drop in the pair. Therefore, only a false breakout would be a suitable condition for opening long positions. I plan to buy GBP/USD immediately on a rebound from the 1.2667 low with the target of a 30-35 point correction within the day.

To open short positions on GBP/USD:

Sellers have proven they are still in the game. If the pair rises again, another false breakout at 1.2775, similar to the earlier analysis, will confirm the presence of major market participants betting on a further decline in the pound, providing an opportunity to open new short positions with the target of retesting the 1.2735 support. A breakout and retest from bottom to top of this range will deal a blow to buyers' positions, triggering stop orders and opening the way to 1.2700. The final target would be the 1.2667 level, where I will take profits. Testing this level will restore the bearish trend. If GBP/USD rises and there is no activity at 1.2775 in the second half of the day, buyers will have a good chance to recover the pair early in the week. In that case, I will postpone selling until a false breakout at the 1.2807 level. If there is no downward movement at that level, I will sell GBP/USD immediately on a rebound from 1.2836, but only expecting a 30-35 point downward correction within the day.

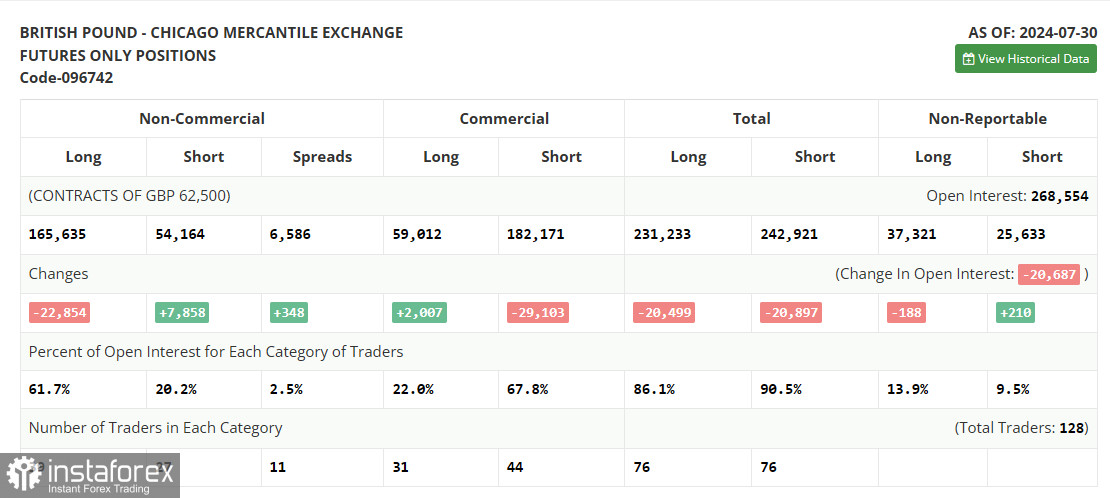

In the COT (Commitment of Traders) report for July 30, there was an increase in short positions and a reduction in long positions. This change in the balance of power is not surprising, as the Bank of England clearly indicated at its meeting that it plans to continue cutting interest rates. Now, more than ever, after tackling inflation, the economy needs special support. The Federal Reserve's decision to leave interest rates unchanged, in contrast to the Bank of England, has led to a decline in the pound, which is likely to continue in the near future. The latest COT report states that long non-commercial positions decreased by 22,854 to 165,635, while short non-commercial positions increased by 7,858 to 54,164. As a result, the gap between long and short positions increased by 348.

Indicator Signals:

- Moving Averages: Trading is taking place around the 30 and 50-day moving averages, indicating a sideways market.

- Note: The period and prices of the moving averages considered by the author are on the H1 hourly chart and differ from the general definition of classic daily moving averages on the D1 daily chart.

- Bollinger Bands: In the event of a decline, the lower boundary of the indicator around 1.2750 will act as support.

Indicator Descriptions:

- Moving Average (MA): Determines the current trend by smoothing volatility and noise. 50-period, marked in yellow on the chart.

- Moving Average (MA): Determines the current trend by smoothing volatility and noise. 30-period, marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA 12-period, Slow EMA 26-period, SMA 9-period.

- Bollinger Bands: 20-period.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Long non-commercial positions: Represent the total long open position of non-commercial traders.

- Short non-commercial positions: Represent the total short open position of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română