Analysis of Trades and Tips for Trading the Euro

There were no tests of the levels I mentioned in the first half of the day. The uneventful market was due to low volatility and economic data from Germany that matched economists' expectations. Most likely, the second half of the day will unfold similarly, as there is no significant data from the U.S., which will also impact market volume and volatility. As for intraday strategy, I plan to act based on the execution of Scenario #2.

Buy Signal

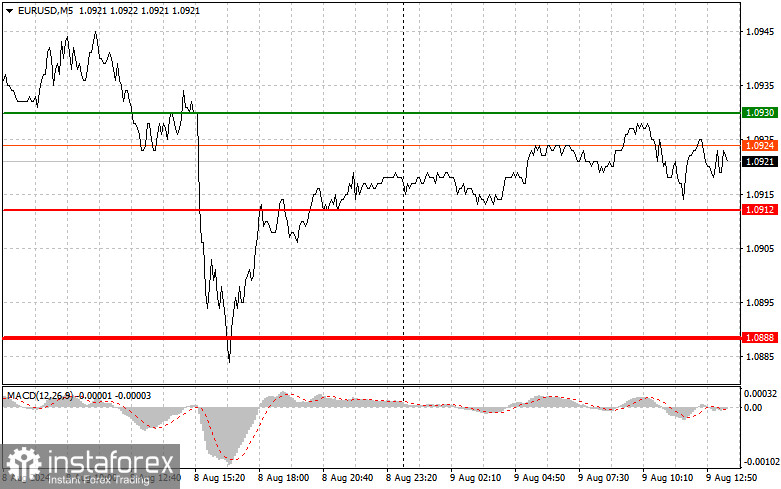

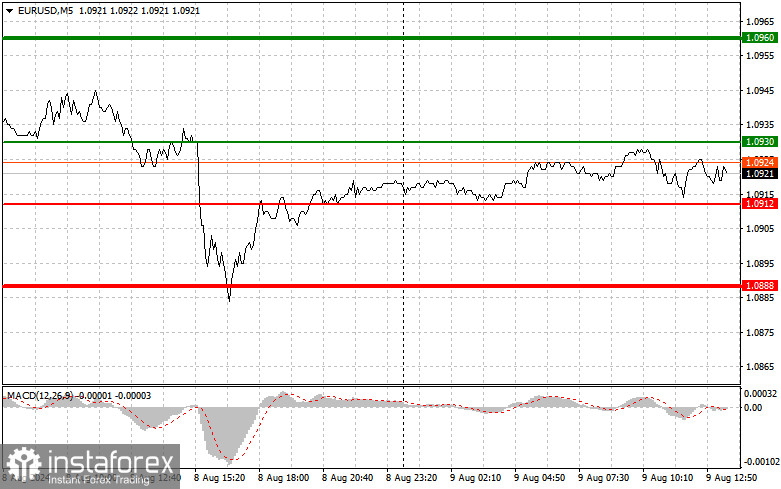

Scenario #1: Today, I plan to buy the euro when the price reaches the area around 1.0930 (the green line on the chart) with the target of rising to the 1.0960 level. At 1.0960, I will exit the market and then sell the euro, targeting a move of 30-35 points from the entry point. Significant upward movement in the euro is unlikely today, so it's better to trade within the channel. Important! Before buying, ensure that the MACD indicator is above the zero mark and is just beginning to rise from it.

Scenario #2: I also plan to buy the euro today if the 1.0912 price level is tested twice consecutively when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. A rise to the opposite levels of 1.0930 and 1.0960 can be expected.

Sell Signal

Scenario #1: I will sell the euro after it reaches the 1.0912 level (the red line on the chart). The target will be the 1.0888 level, where I plan to exit the market and immediately buy the euro, targeting a move of 20-25 points in the opposite direction from the level. Pressure on the pair will return if the price fails to rise above the daily high. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just beginning its decline from it.

Scenario #2: I also plan to sell the euro today if the 1.0930 price level is tested twice consecutively when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward market reversal. A decline to the opposite levels of 1.0912 and 1.0888 can be expected.

Chart Overview:

- Thin green line – The entry price at which you can buy the trading instrument.

- Thick green line – The suggested price where you can set Take Profit or manually fix profits, as further growth above this level is unlikely.

- Thin red line – The entry price at which you can sell the trading instrument.

- Thick red line – The suggested price where you can set Take Profit or manually fix profits, as further decline below this level is unlikely.

- MACD Indicator – When entering the market, it is important to consider overbought and oversold zones.

Important: Beginner traders on the Forex market need to be very cautious when making entry decisions. It is best to stay out of the market before the release of important economic reports to avoid being caught in sharp price swings. If you decide to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you don't use risk management and trade with large volumes.

And remember, for successful trading, it is essential to have a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are a losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română