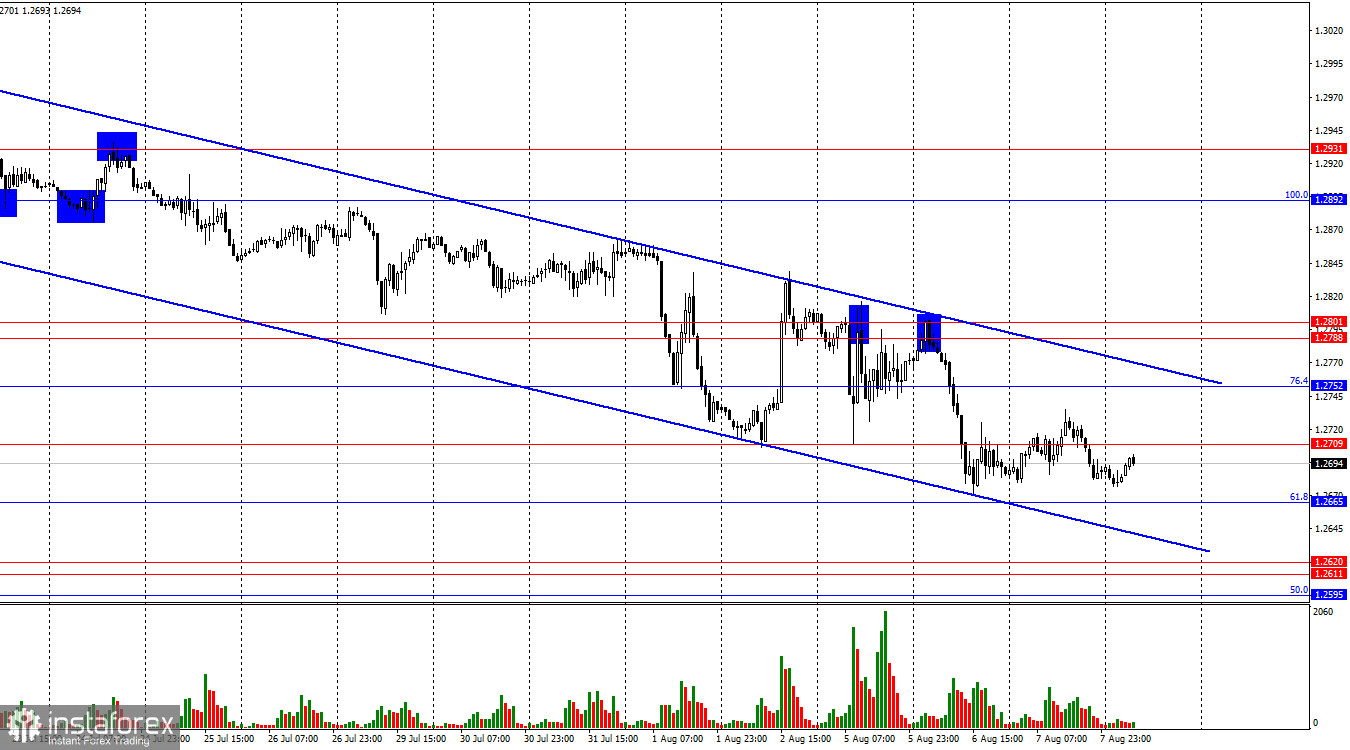

On Wednesday, the GBP/USD pair traded poorly on the hourly chart. The pair remains within a downward trend channel, allowing it to continue falling. However, the lack of information background is pushing traders to pause rather than engage in active trading. No good signals were formed near important levels. From current positions, the pound could start a correction or continue to decline.

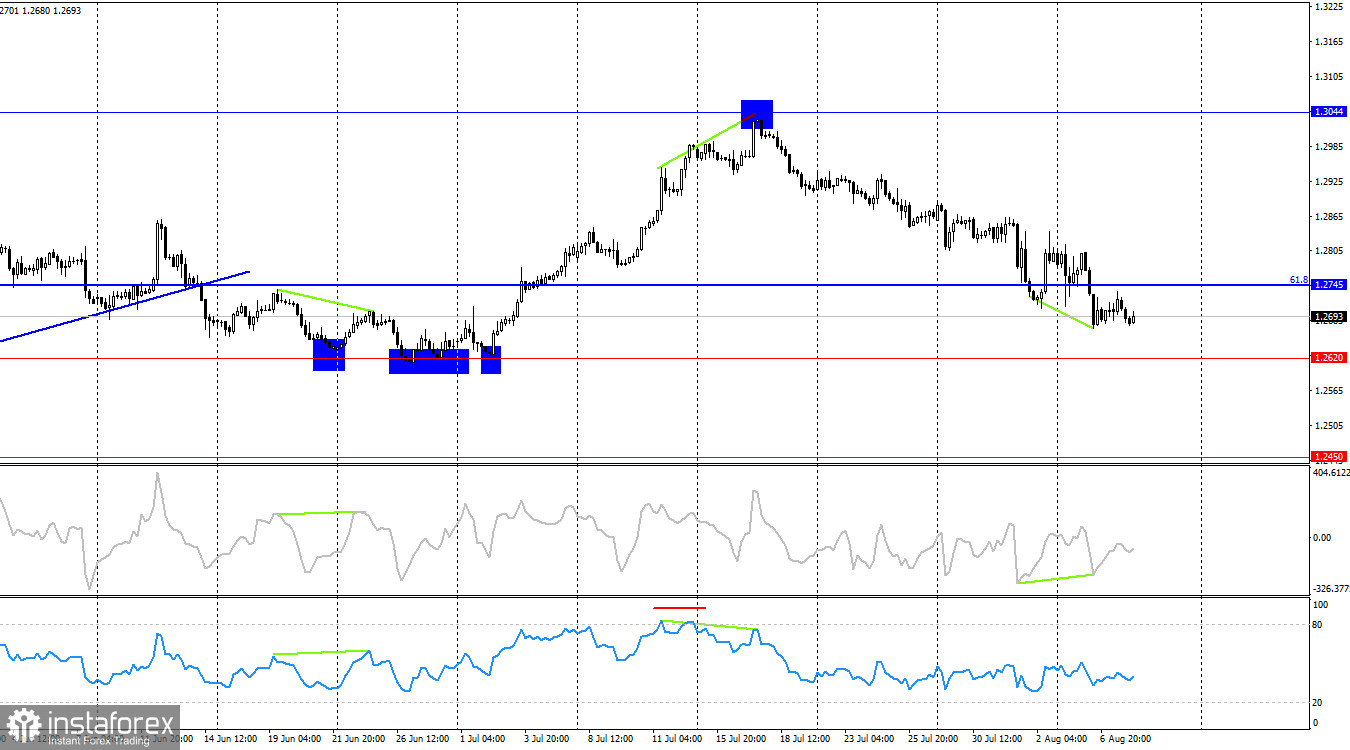

The wave situation has changed slightly. The last completed upward wave (which began forming on July 2) managed to break the low of the previous upward wave, but the last downward wave has not yet broken the low of the previous wave. Thus, we are currently dealing with a "bullish" trend and a deep corrective wave or series of waves. The pound's rise may resume. There is no talk of a trend change to "bearish" yet, in terms of waves. For this to happen, the pair needs to break the July 2nd low. However, the waves are now very long, and in the last few weeks, the pound has only been falling. Currently, the trend is "bearish."

There was no information background on Wednesday, but the U.S. currency generally strengthened against the pound. I want to note that this may be a temporary phenomenon or a fall before a strong new rise. Overall, the dollar is currently under market pressure because many players believe the Fed missed the right time to start easing monetary policy. Inflation is slowing somewhat, the labor market has been contracting for quite some time, and the unemployment rate has been rising from 3.3%. That is, nothing extraordinary happened in August. We just saw another set of reports indicating a negative trend that began six months ago. Meanwhile, the U.S. economy continues to grow at high rates. It is not hindered by rising unemployment or a decrease in the number of new jobs. There is no recession, and it is not expected in the near future. In my opinion, the Fed is clearly following its planned path.

On the 4-hour chart, the pair settled below the 61.8% corrective level at 1.2745, which suggests a continued decline towards the next level at 1.2620. A "bullish" divergence has formed on the CCI indicator, which may temporarily halt the pound's decline. On the hourly chart, a strong rise should be expected after securing above the downward trend channel.

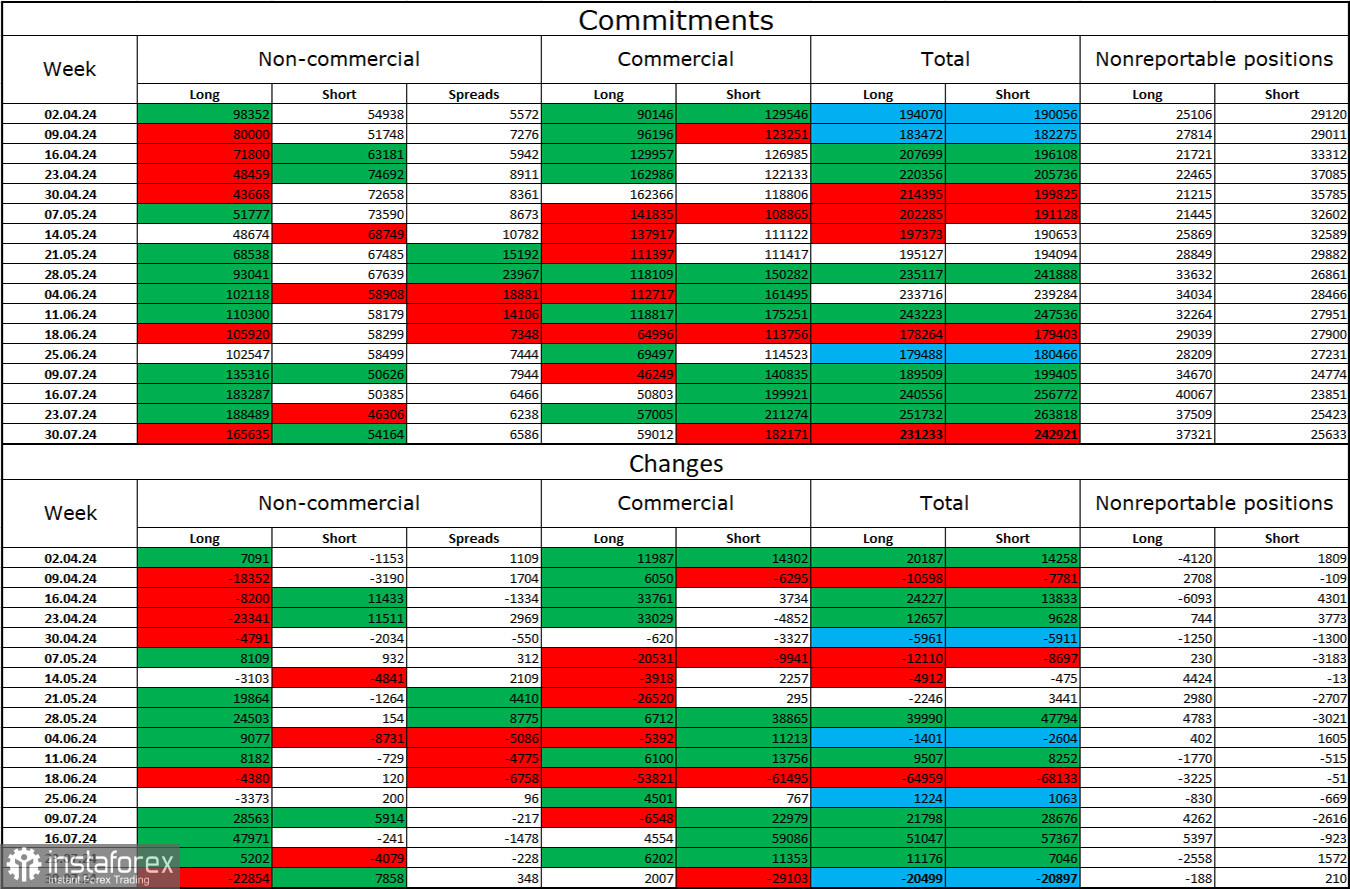

Commitments of Traders (COT) Report

In my opinion, the pound still has prospects for a decline, but the COT reports currently indicate otherwise. Over the last 3 months, the number of long positions has grown from 98,000 to 165,000, while the number of short positions has remained unchanged at 54,000. I believe that over time, professional players will start to get rid of long positions or increase short positions, as all possible factors for buying the British pound have already been worked out. However, it should be noted that this is just a supposition. Graphical analysis indicates a highly likely decline in the near future, but this does not mean that the decline will last several months or half a year.

News Calendar for the USA and the UK

USA – Change in the number of jobless claims (12:30 UTC).

On Wednesday, the economic events calendar contains one entry. The influence of the information background on market sentiment today will be very weak or absent.

Forecast for GBP/USD and trading advice

The market started the new week very nervously. On Monday and Tuesday, traders could use rebounds from the resistance zone of 1.2788–1.2801 on the hourly chart. The targets for the decline (1.2709 and 1.2665) were almost fully worked out. I consider purchases possible after securing quotes above the downward channel.

Fibonacci Levels Grids

Hourly Chart: 1.2892–1.2298

4-Hour Chart: 1.4248–1.0404

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română