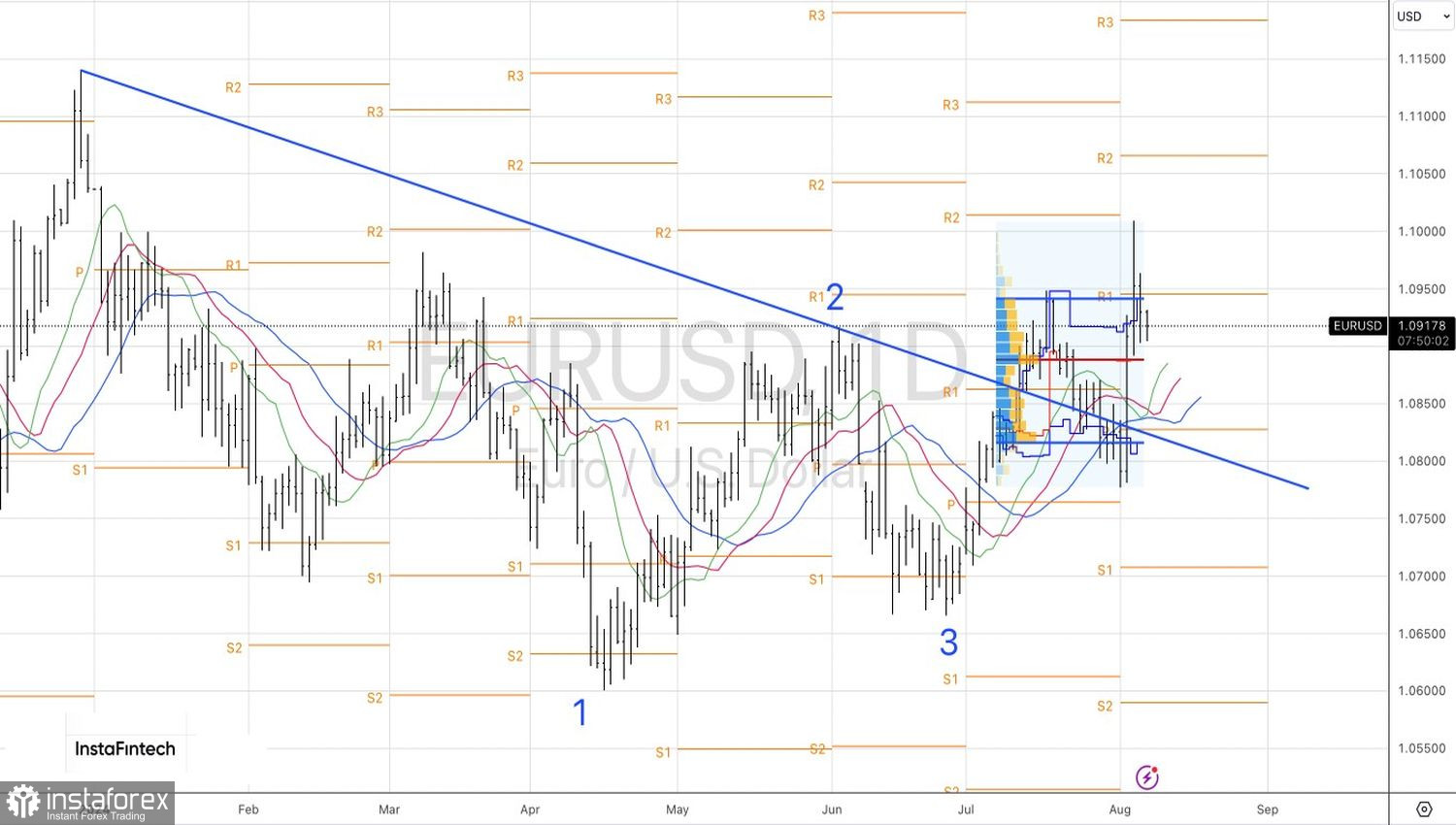

A tsunami results from an underwater earthquake displacing a large amount of water. It has to go somewhere before it settles. The same is true for a market tsunami. There are reasons. In the case of Black Monday on August 5, it was the tightening of monetary policy by the Bank of Japan and fears of a recession in the US economy following a disappointing employment report for July. There are consequences. For EUR/USD, it soared above the 7-month high of 1.1. Afterwards, the water settles. The Federal Reserve and BOJ have reassured investors; many assets have gone on a rollercoaster ride.

The billion-dollar question: where will the USD index go? On one hand, the Fed makes no secret of its desire to cut the interest rate in September, which, coupled with the slowdown in the US economy, paints a bullish picture for EUR/USD. ING believes that the main currency pair will return above 1.1 soon, and MUFG forecasts its northern march to continue until the second quarter of 2025. Yes, the presidential elections in the US will increase turbulence in the financial markets, but they are unlikely to change the direction of the trend.

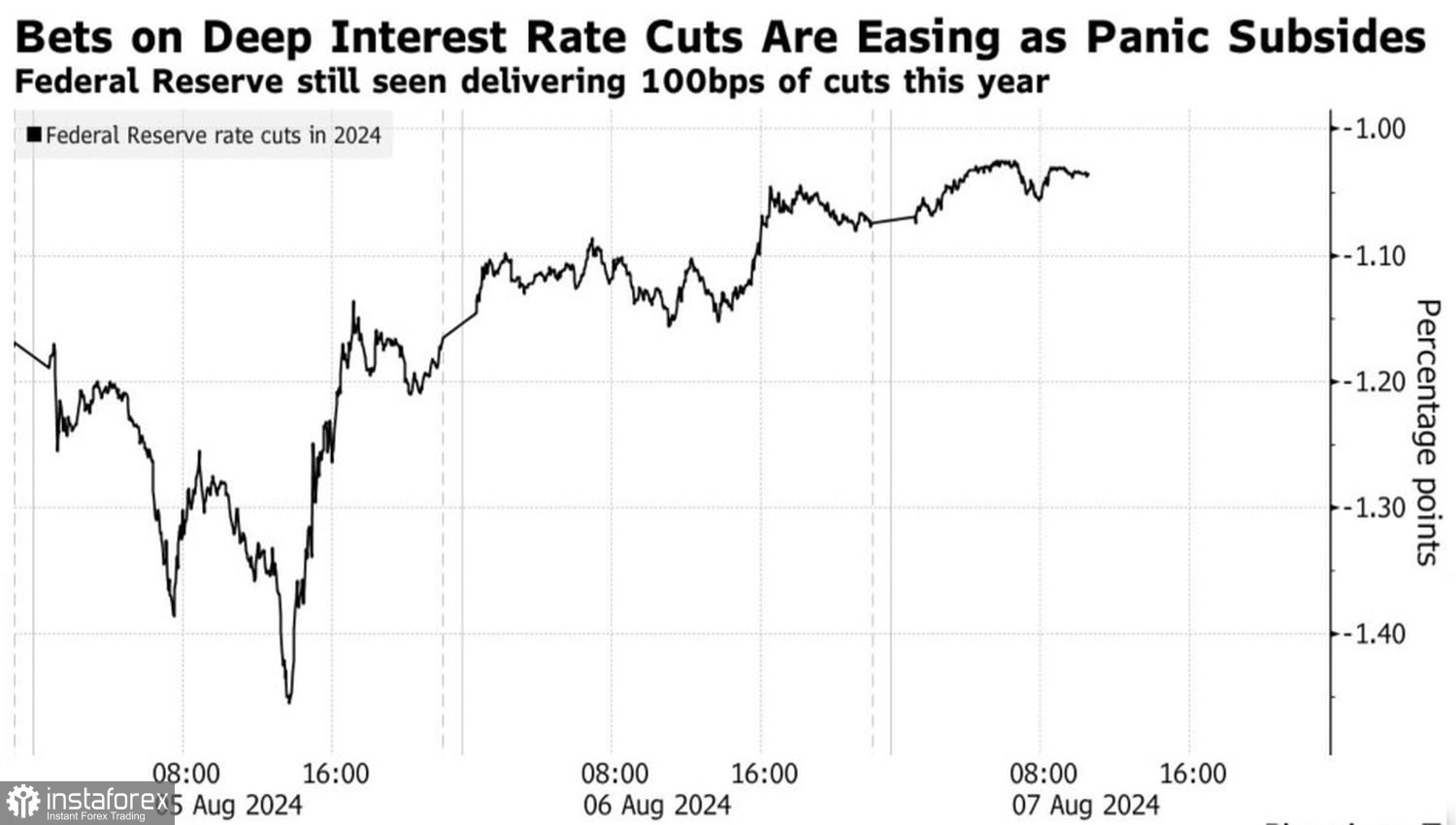

On the other hand, market expectations for a 100 basis point cut in 2024 are inflated. It is unlikely that the Fed will press the panic button in September and aggressively ease monetary policy as investors demand. According to FOMC officials, the economy is not in a recession, and if its health continues to deteriorate, a dovish rhetoric can be adopted.

Dynamics of market expectations for the scale of the Fed's monetary easing

At the peak of Black Monday, market expectations for the scale of the Fed's monetary easing this year reached 150 basis points, suggesting three rate cuts of 50 basis points each. Gradually, the panic subsided, the market is now recovering, assessments are changing, and the EUR/USD bulls retreated from 1.10.

Will they return there? Reuters experts suggest it is unlikely, at least in the near term. Their consensus estimate for the main currency pair is 1.08 in three months and 1.11 in twelve. The US dollar is more likely to strengthen against the euro rather than fall. And there are reasons for this.

The slowdown of the American economy is a sort of earthquake that affects the rest of the world. Global GDP is also slowing down, which is bad news for a pro-cyclical currency like the euro. The market has overestimated the extent of the interest rate cut in 2024, just as it did at the end of last year. As a result, the US dollar strengthened in the first quarter.

Technically, on the daily chart, EUR/USD consolidates within the Adam and Eve pattern. The formation of an inside bar provides an opportunity to define entry points for long positions from the level of 1.096 and shorts from 1.090. It remains to place pending orders and wait for their execution.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română