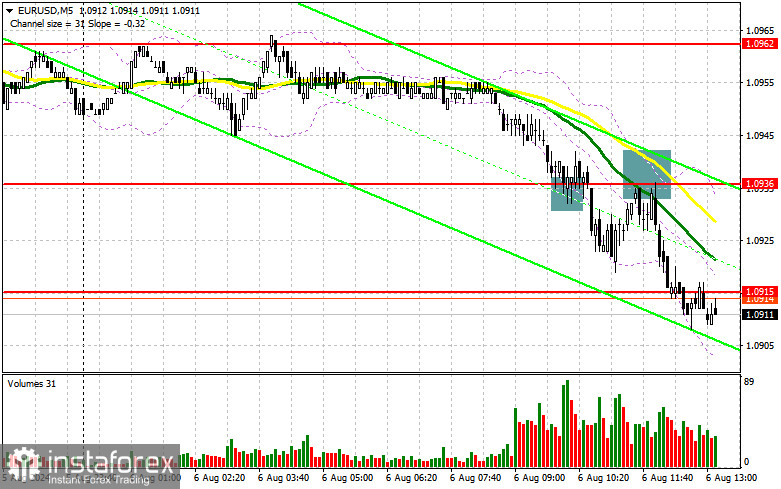

In my morning forecast, I focused on the level of 1.0936 and planned to make market entry decisions from it. Let's look at the 5-minute chart and see what happened there. The decline and the formation of a false breakout at this level led to an entry point for long positions, anticipating the euro's resurgence. However, as you can see on the chart, the upward movement did not materialize. The breakout and retest of 1.0936 allowed for an exit from purchases with minimal losses and also to enter short positions as the correction developed, resulting in a more than 20-point drop in the pair. The technical picture for the second half of the day was revised.

To open long positions on EUR/USD, it is necessary:

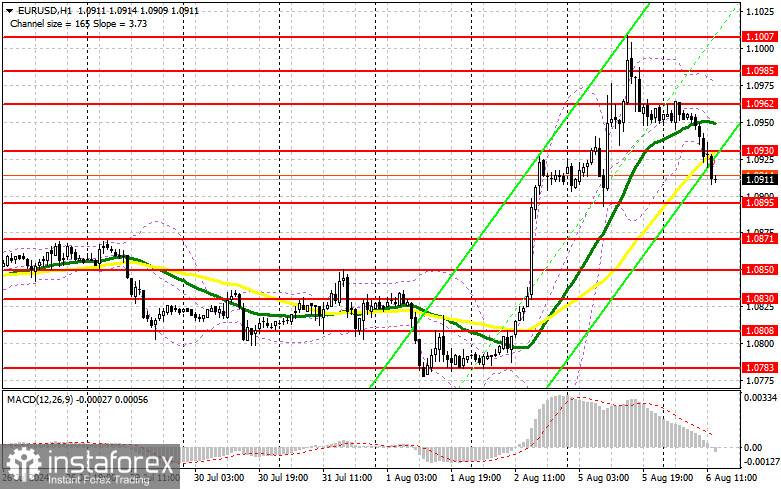

Volatility and pressure on the euro could be sustained into the second half of the day. This will be sufficient with good statistics on the US trade balance and the RCM/TIPP economic optimism index. If the pair decreases, the focus will be on the nearest support at 1.0895, where the pair is currently headed. Forming a false breakout will be a suitable option for building long positions with the target of returning to the new resistance at 1.0930, formed by the results of the first half of the day. The moving averages are also situated there, favoring sellers. A breakout and renewal from top to bottom of this range will strengthen the pair with a chance of rising to the area of 1.0962. The furthest target will be the maximum of 1.0985, where I plan to take profits. If EUR/USD decreases and there is no activity around 1.0895 in the second half of the day, a level that is quite important from a technical point of view, sellers will regain the initiative and begin building a downward trend. In such a case, I will only enter after forming a false breakout around 1.0871. I plan to open long positions immediately on a rebound from 1.0850, targeting an upward correction of 30-35 points within the day.

To open short positions on EUR/USD, it is necessary:

Sellers continue to regain initiative, and this is quite evident from their actions during any correction of the pair. Strong U.S. statistics will allow bears to re-enter the market in the second half of the day. Defending 1.0930 along with a false breakout will be a suitable scenario for opening short positions with the target of falling to the support at 1.0895, formed from yesterday's results. A breakout and consolidation below this range, as well as a reverse test from bottom to top, will provide another selling point with movement to the area of 1.0871, where I expect to see a more active manifestation of buyers. The furthest target will be the area of 1.0850, where I will take profits. Testing this level will overturn the plans of euro buyers to build an upward trend. In the case of an upward movement of EUR/USD in the second half of the day, and the absence of bears at 1.0930, buyers will have a good chance to regain initiative. In such a case, I will delay sales until testing the next resistance at 1.0962. I will also act, but only after an unsuccessful consolidation. I plan to open short positions immediately on a rebound from 1.0985, targeting a downward correction of 30-35 points.

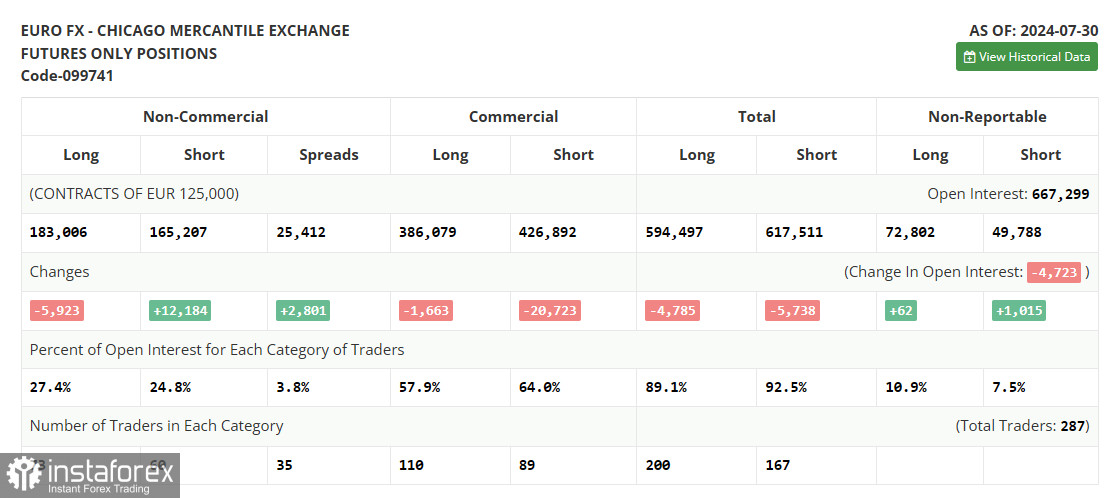

In the COT report (Commitment of Traders) for July 30, there was a reduction in long positions and a sharp increase in short positions. The ECB's decision to leave rates unchanged with a direct hint at lowering them in September coincided with the relatively soft stance of the Federal Reserve, which also hinted that it would lower rates at the beginning of this fall. Considering the recent data from the US economy, the regulator probably should have acted much earlier, leading to the current panic observed in the stock market and the risk of a recession next year, which is bad for the strength of the US dollar. The COT report indicates that non-commercial long positions decreased by 5,923 to 183,006, while non-commercial short positions increased by 12,184 to 165,207. As a result, the spread between long and short positions increased by 2,801.

Indicator signals:

Moving averages

Trading is taking place around the 30 and 50-day moving averages, indicating problems for euro buyers.

Note: The period and prices of the moving averages are considered by the author on the H1 hourly chart and differ from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands

In case of a decrease, the lower border of the indicator around 1.0911 will act as support.

Indicator descriptions:

- Moving average (smooths volatility and noise to determine the current trend). Period 50. Marked in yellow on the chart.

- Moving average (smooths volatility and noise to determine the current trend). Period 30. Marked in green on the chart.

- MACD (Moving Average Convergence/Divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands. Period 20

- Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain criteria.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română