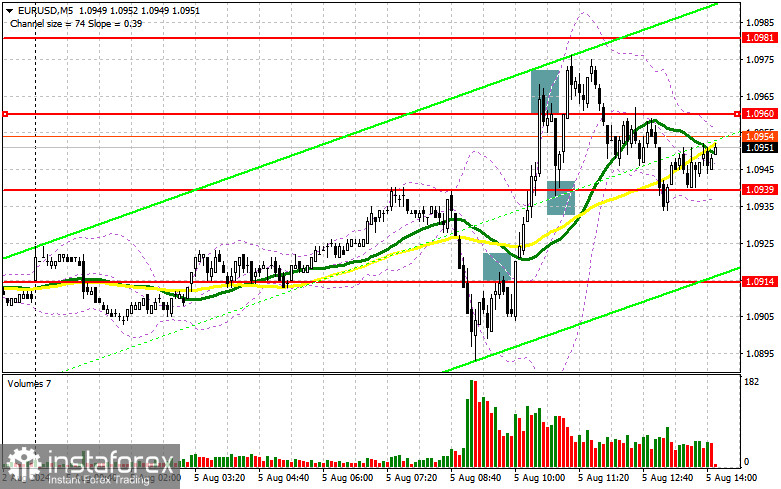

In my morning forecast, I highlighted several levels and planned to make market entry decisions based on them. Let's look at the 5-minute chart and analyze what happened. The breakout and retest of 1.0914 led to a sell signal, but a drop did not materialize, resulting in the locking of losses. This was followed by a fairly strong increase, after which active defense of 1.0960 allowed entering short positions and achieving a decent downward movement of 20 points. Buying on the false breakout from 1.0939 pulled another 30 points of profit from the market. The technical picture for the second half of the day has been revised.

For opening long positions on EUR/USD:

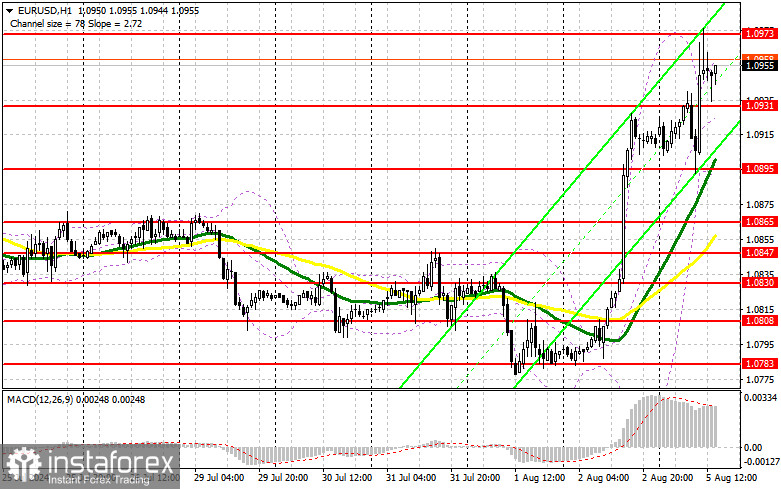

Varied data on service sector activity in the Eurozone for July led to a strong surge in volatility, allowing the euro to continue the growth observed since last Friday. Ahead of us are similar figures from the U.S. ISM service sector index and the composite PMI. And, as economists expect, this indicator should not bring any good news. Another month of contracting activity could significantly harm the U.S. dollar, strengthen demand for the European currency, and give a chance to continue the bullish market. With strong statistics, the euro could fall, which I plan to utilize. Forming a false breakout in the area of 1.0931 would be an ideal signal to build up long positions with the target of rising to 1.0973, a level that was not breached today. A breakout and update from above to below this range will strengthen the pair with a chance of rising to 1.0998. The furthest target will be the peak at 1.1015, where I plan to fix the profit. If EUR/USD falls and there is no activity around 1.0931 in the second half of the day, as this level is quite important from a technical perspective, sellers will regain the initiative and start building a downward trend. In that case, I will only enter after forming a false breakout in the area of 1.0895, where the moving averages that favor the bulls are located. I plan to open long positions immediately on a rebound from 1.0865 with a target of an upward correction within 30-35 points during the day.

For opening short positions on EUR/USD:

Sellers continue to lose initiative. Only very strong statistics will allow bears to re-enter the market in the second half of the day, and by defending 1.0973 along with a false breakout, there will be an appropriate scenario for opening short positions. In this case, the target would be the support at 1.0931, formed during the first half of the day. A breakout and consolidation below this range, and a reverse test from below-up amid a sharp increase in activity in the U.S. service sector, will ease market tension slightly, giving another selling point with movement towards 1.0895, where I expect to see more active behavior from buyers. The farthest target will be the area of 1.0865, where I will fix profits. In the case of EUR/USD moving upward in the second half of the day and a lack of bears at 1.0973, buyers will get a chance to establish a new upward trend. In such a case, I will postpone sales until the next resistance test at 1.0998. I will also sell there, but only after an unsuccessful consolidation. I plan to open short positions immediately on a rebound from 1.1015 with a target of a downward correction of 30-35 points.

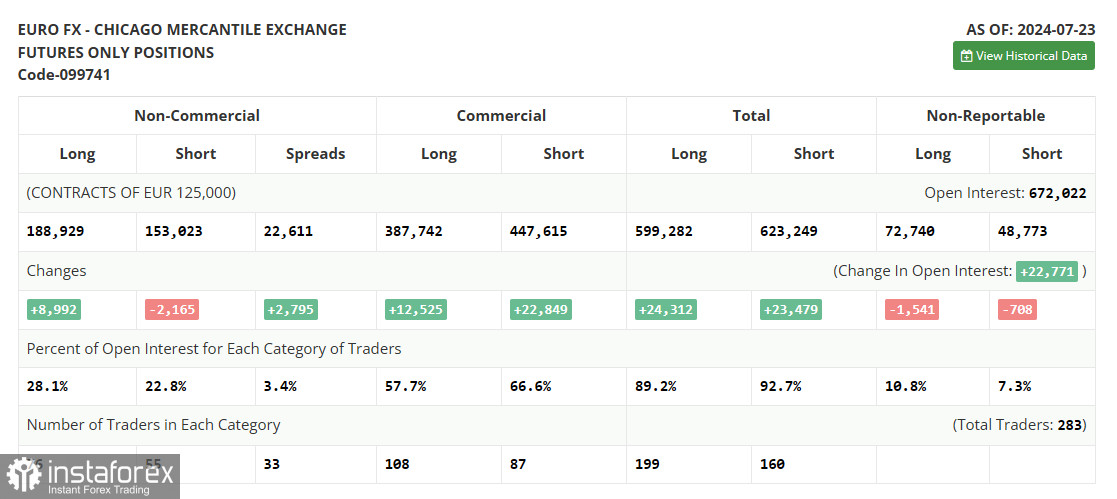

In the COT report (Commitment of Traders) as of July 23, there was a reduction in short positions and growth in long positions. However, if we analyze closely, the positioning has remained the same before the Federal Reserve meeting; no one set new priorities even amid talks that the American regulator needs to reduce interest rates, as evidenced by recent economic data. While the market remains balanced, traders can take advantage of cheaper risk assets, including the euro, and buy them in anticipation that the Fed will eventually start lowering rates this year. The COT report stated that non-commercial long positions increased by 8,992 to 188,929, while non-commercial short positions decreased by 2,165 to 153,023. As a result, the spread between long and short positions grew by 2,795.

Indicator signals:

Moving averages:

Trading is above the 30- and 50-day moving averages, indicating the euro's growth.

Note: The author considers the period and prices of the moving averages on the hourly chart H1 and differs from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands:

In the event of a decrease, the indicator's lower boundary at 1.0895 will act as support.

Description of indicators:

- Moving average: Defines the current trend by smoothing volatility and noise. Period 50. Marked yellow on the chart.

- Moving average: Defines the current trend by smoothing volatility and noise. Period 30. Marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence): Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions: Represent the total long open position of non-commercial traders.

- Short non-commercial positions: Represent the total short open position of non-commercial traders.

- The total net non-commercial position: The difference between non-commercial traders' short and long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română