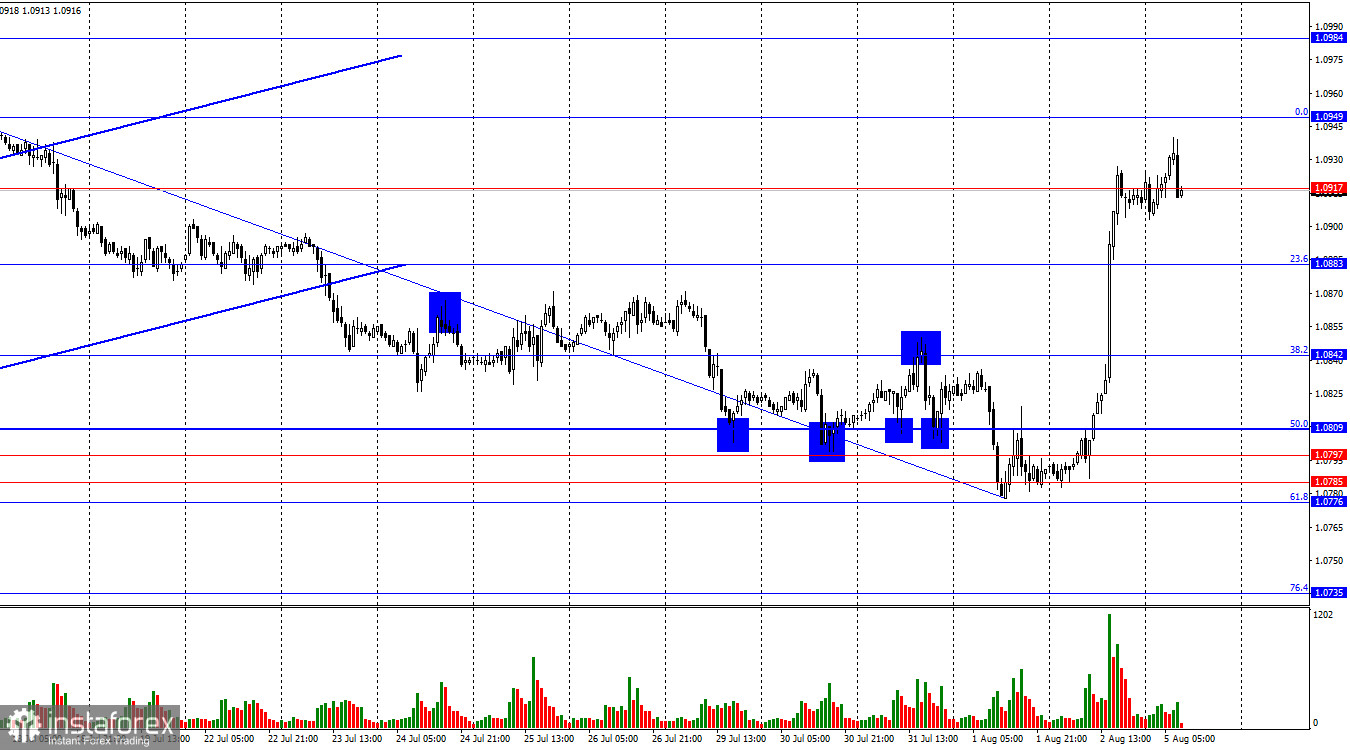

On Friday, the EUR/USD pair made a reversal in favor of the European currency in the support zone of 1.0776 – 1.0809. Last week, I mentioned that it would be difficult for bears to overcome this zone, which contains four levels. On Friday, the bullish sentiment was helped by the information background, causing the quotes to rise immediately to the 1.0917 level. Today, a corrective pullback may start with targets at 1.0883 and 1.0842.

The wave situation has become a bit more complicated, but overall it raises no questions. The last completed downward wave did not break the low of the previous wave, and the new upward wave has not yet broken the peak of the previous wave. Thus, the "bullish" trend still holds. For the "bullish" trend to be canceled, bears now need to break the low of the last downward wave, which is around the level of 1.0778. Even better would be a consolidation below the zone of 1.0776 – 1.0809, which acts as the strongest support.

The information background on Friday was not as ambiguous as on the previous days of the week. A block of news was released at the opening of trading in America. Two reports, which bears were heavily relying on, again showed values incompatible with the growth of the American currency. The number of non-farm jobs was 50% lower than expected, and the unemployment rate jumped by 0.2% in July, which was 0.2% higher than expected. Thus, the worst fears regarding the American economy were confirmed. If the economy itself continues to grow and generally feels quite good, then the labor market continues to cool down. It is difficult to say how these reports will affect the FOMC's decision on rates in September. If the economy grows and inflation remains much higher than the target level, then, most likely, it would be advisable not to lower the rates. If so, the dollar's decline should stop as quickly as it began.

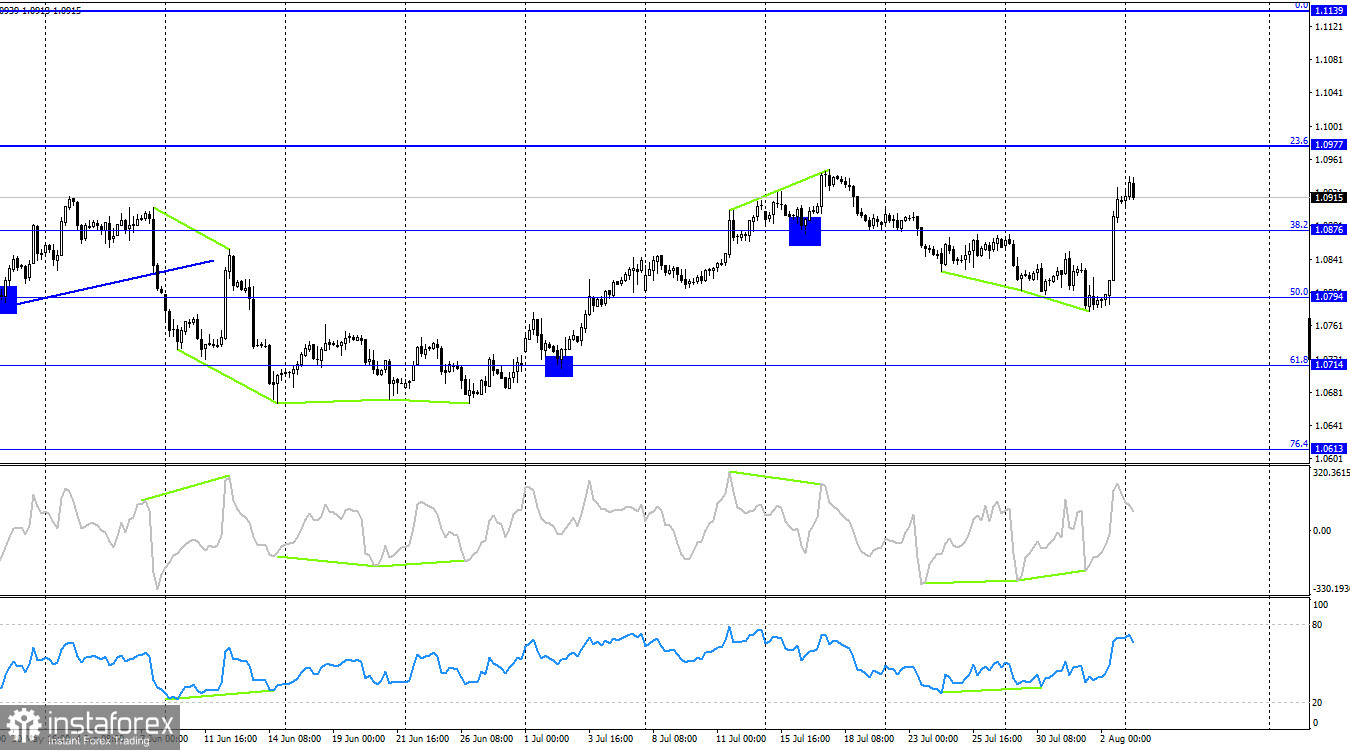

On the 4-hour chart, the pair made a reversal in favor of the EU currency near the 50.0% corrective level at 1.0794 after forming a second consecutive "bullish" divergence. The pair secured above the 38.2% Fibo level at 1.0876, allowing it to continue rising towards the 23.6% corrective level at 1.0977. However, at this time I would focus more on the hourly chart. The pair's rise on Friday was too sharp, so it could end just as quickly.

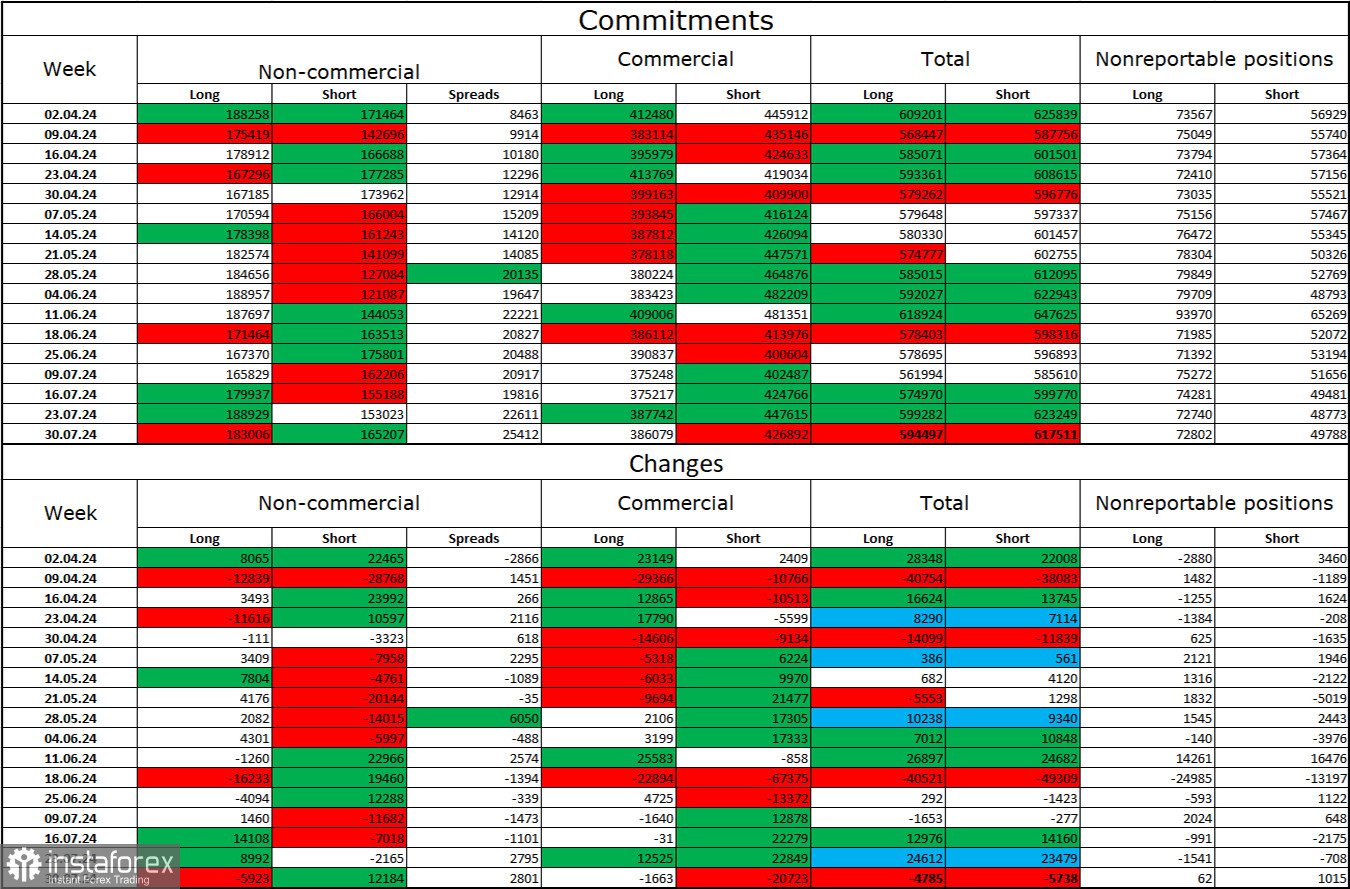

Commitments of Traders (COT) Report:

I still believe that the situation will continue to change in favor of bears. I see no long-term reasons for buying the euro, as the ECB has started easing monetary policy, which will lower the yields on bank deposits and government bonds. In America, they will remain at a high level at least until September, making the dollar more attractive to investors. The potential for a decline in the European currency looks impressive. However, one should not forget about the graphic analysis, which currently does not allow for confidently speaking of a strong fall in the euro currency, as well as the information background, which regularly throws obstacles for the dollar.

News Calendar for the USA and the Eurozone:

- Eurozone – Consumer Price Index in the services sector in Germany (07:55 UTC).

- Eurozone – Business Activity Index in the services sector (08:00 UTC).

- USA – Business Activity Index in the services sector (13:45 UTC).

- USA – ISM Business Activity Index in the services sector (14:00 UTC).

On August 5, the economic event calendar again contains several interesting entries, among which the ISM index stands out. The impact of the informational background on traders' mood today can be felt again, but in the second half of the day.

EUR/USD Forecast and Tips for Traders:

Sales of the pair are possible today, but a clear signal near any level on the hourly chart (rebound or consolidation) is needed. After Friday's news, the pair today may be tossed from side to side. I would not consider new purchases after strong growth, but the ISM index could well support the bulls for EUR/USD again.

Fibonacci grids are built from 1.0668 to 1.0949 on the hourly chart and from 1.0450 to 1.1139 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română