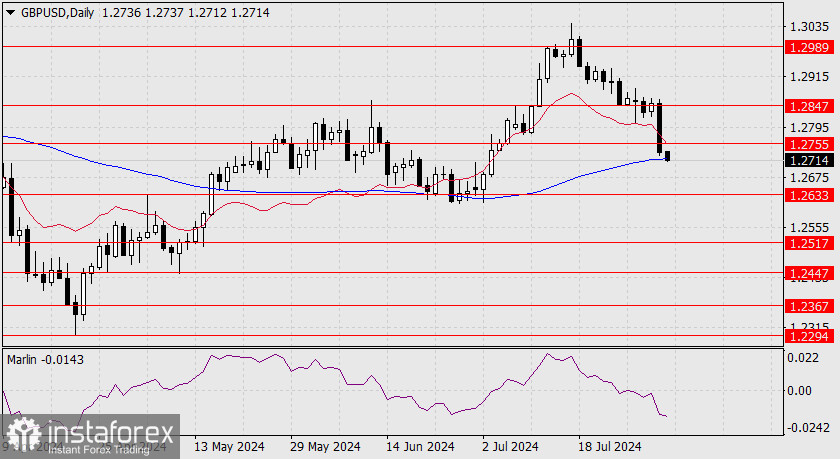

GBP/USD

Yesterday, the Bank of England reduced the base rate from 5.25% to 5%. As a result, the pound fell by 116 pips, struggling somewhat, but managed to break through the support at 1.2755 and reached the MACD line this morning.

In addition to the rate cut, the pound was also affected by related markets: S&P 500 -1.37%, oil -1.41%, and the dollar index +0.26%. There are no signs of a price reversal on the 4-hour chart, so we do not expect a strong or prolonged correction, especially considering today's release of U.S. employment data.

We believe the data will support the ongoing trend of a stronger dollar and weaker European currencies, meaning the shift away from risk will continue. The number of individuals receiving unemployment benefits in the U.S. has increased to 1.877 million, compared to the expected 1.860 million. The ISM Manufacturing Employment Index for July fell from 49.3 to 43.4, against a forecast of 49.0, which creates a risk of weaker non-farm payrolls today.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română