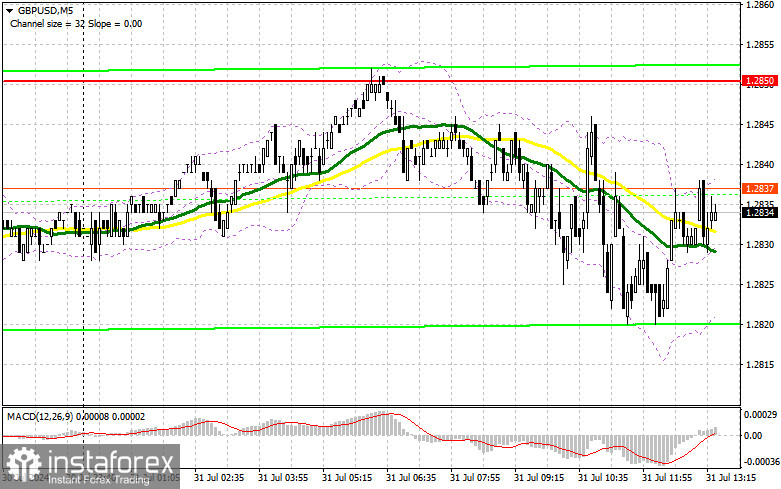

In my morning forecast, I highlighted the 1.2850 level and planned to make trading decisions from there. Let us look at the 5-minute chart and analyze what happened. There was a rise, but it didn't reach the level for a test and formation of a false breakout. Low volatility did not provide suitable entry points into the market. The technical picture was slightly revised for the second half of the day.

To Open Long Positions on GBP/USD:

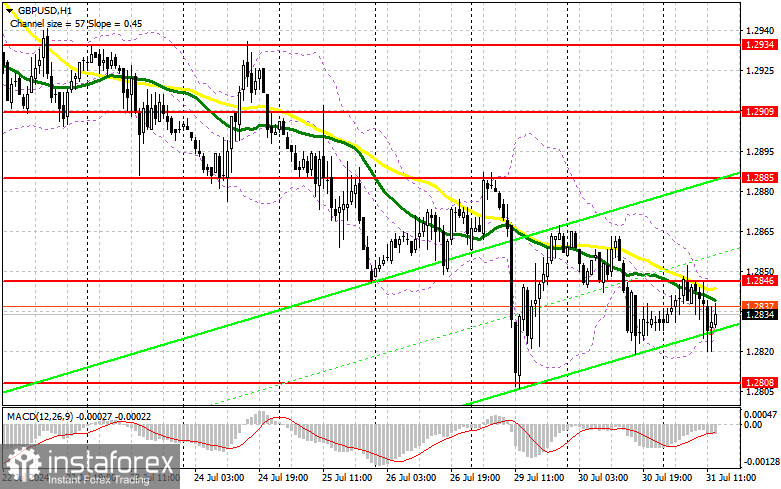

We have a series of very important statistics ahead that could favor buyers of risky assets. However, for this to happen, the FOMC's accompanying statement after the rate decision needs to be dovish, as does the speech by Fed Chair Jerome Powell. ADP employment change data will play a role in the pair's direction, but if it matches economists' expectations, it will likely be ignored. In case of a decline in GBP/USD, I plan to enter around the major support at 1.2808, which we didn't reach in the first half of the day. A false breakout formation will provide an entry point aiming to return to 1.2846, where the moving averages favor sellers. A breakout and reverse test from top to bottom of this range will restore chances for pound growth, leading to an entry point for long positions with the potential to rise to 1.2885. The furthest target will be the 1.2909 level, where I plan to take profit. If GBP/USD continues to decline and there is no bull activity around 1.2808 in the second half of the day, this technically important level will lead to a decline and update the next support at 1.2778, increasing the chances of a larger drop in the pair early in the week. Therefore, only a false breakout formation will be suitable for opening long positions. I plan to buy GBP/USD immediately on a rebound from the 1.2756 minimum with the target of a 30-35 point intraday correction.

To Open Short Positions on GBP/USD:

Sellers are also not rushing and are waiting for new benchmarks. Only a false breakout formation around the new resistance at 1.2846, amidst weak U.S. labor market statistics, will provide a chance to open new short positions, continuing the bearish trend and aiming to update the 1.2808 level. A breakout and reverse test from bottom to top of this range will impact buyers' positions, trigger stop-loss orders, and open the way to 1.2778. The furthest target will be the 1.2756 area, where I plan to take profit. Testing this level will only strengthen the new bearish trend. In the case of a GBP/USD rise and no activity at 1.2846 in the second half of the day, buyers will have a good chance for a larger upward move – especially if the Fed Chair's position is dovish. In this case, I will postpone sales until a false breakout at the 1.2885 level. If there is no downward movement from there, I will sell GBP/USD immediately on a rebound from 1.2909, but only expecting a downward correction of 30-35 points within the day.

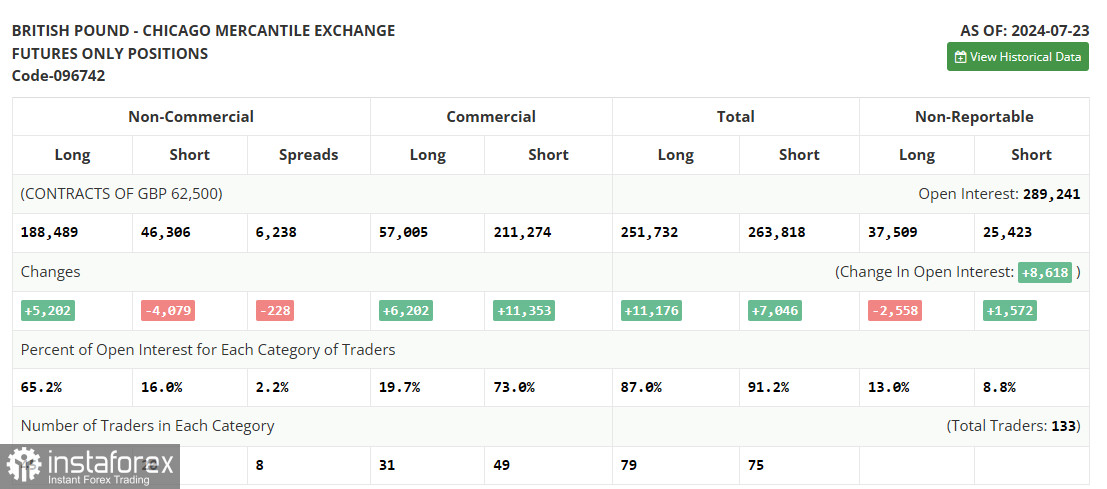

In the Commitment of Traders (COT) report for July 23, there was an increase in long positions and a decrease in short ones. The focus is on the Federal Reserve meeting, where rates are expected to remain unchanged, but investors hope to hear more arguments for a rate cut in September. Meanwhile, the Bank of England's decision, also coming soon, could cause much noise. Economists expect the British regulator to cut rates as early as this summer, which theoretically should weaken the British pound against the U.S. dollar even more, so it's unlikely to expect a return to the bull market observed in June anytime soon. The latest COT report indicates that long non-commercial positions increased by 5,202 to 188,489, while short non-commercial positions decreased by 4,079 to 46,306. As a result, the spread between long and short positions decreased by 228.

Indicator Signals:

Moving Averages:Trading is conducted below the 30 and 50-day moving averages, indicating a possible continuation of the pair's decline.Note: The author considers the period and prices of the moving averages on the hourly H1 chart and differs from the general definition of classic daily moving averages on the daily D1 chart.

Bollinger Bands:In the case of a decline, the lower boundary of the indicator, around 1.2820, will act as support.

Indicator Descriptions:

- Moving average: Smooth out volatility and noise to determine the current trend. Period – 50. Marked in yellow on the chart.

- Moving average: Smooth out volatility and noise to determine the current trend. Period – 30. Marked in green on the chart.

- MACD (Moving Average Convergence/Divergence): EMA Fast – Period 12. EMA Slow – Period 26. SMA – Period 9.

- Bollinger Bands: Period – 20.

- Non-commercial traders: Speculators like individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions: Total long open positions of non-commercial traders.

- Short non-commercial positions: Total short open positions of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română