To Open Long Positions in GBP/USD:

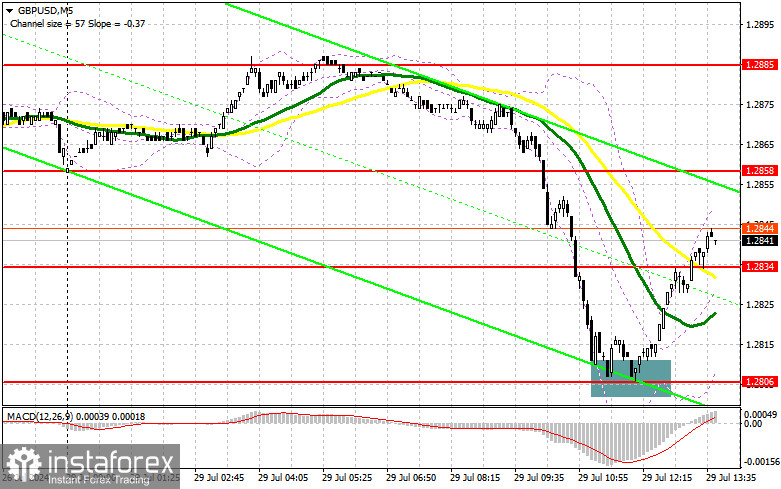

Without U.S. statistics, pound buyers can compensate for part of the decline observed in the first half of the day. However, given the ongoing sales, it is best to act on the decline after forming a false breakout around 1.2806, similar to what was discussed above. The target will be resistance at 1.2849, slightly above the moving averages, favoring the sellers. A breakout and reverse test from top to bottom of this range will restore chances for the pound's growth, leading to a point of entry into long positions with the possibility of reaching 1.2885 – the daily high. The furthest target will be the area of 1.2909, where I will be taking profit. In the scenario of a further decline in GBP/USD and no activity from the bulls at 1.2806 in the second half of the day, as this level has already worked once today, it will lead to a decline and update the next support at 1.2778, increasing the chances of a more significant fall in the pair at the beginning of the week. Therefore, only forming a false breakout will be suitable for opening long positions. I plan to buy GBP/USD immediately on a rebound from the minimum of 1.2756, targeting a correction of 30-35 points within the day.

To Open Short Positions on GBP/USD:

Sellers have asserted themselves, and now their important task will be to protect the new resistance at 1.2849, where the pair is currently correcting. Only forming a false breakout amid the absence of U.S. news will provide a chance to open new short positions to continue the bearish trend, targeting the support at 1.2806. A breakout and reverse test from the bottom to the top of this range will blow buyers' positions, triggering stop-loss orders and opening the way to 1.2778. The furthest target will be the area of 1.2756, where I will be taking profit. Testing this level will only strengthen the new bearish trend. In the scenario of GBP/USD rising and no activity at 1.2849 in the second half of the day, buyers will have a good chance to establish market equilibrium. In this case, I will postpone sales until a false breakout at 1.2885. If there is no movement down, I will sell GBP/USD immediately on a rebound from 1.2909, but only expecting a downward correction of the pair by 30-35 points within the day.

Commitments of Traders (COT) Report:

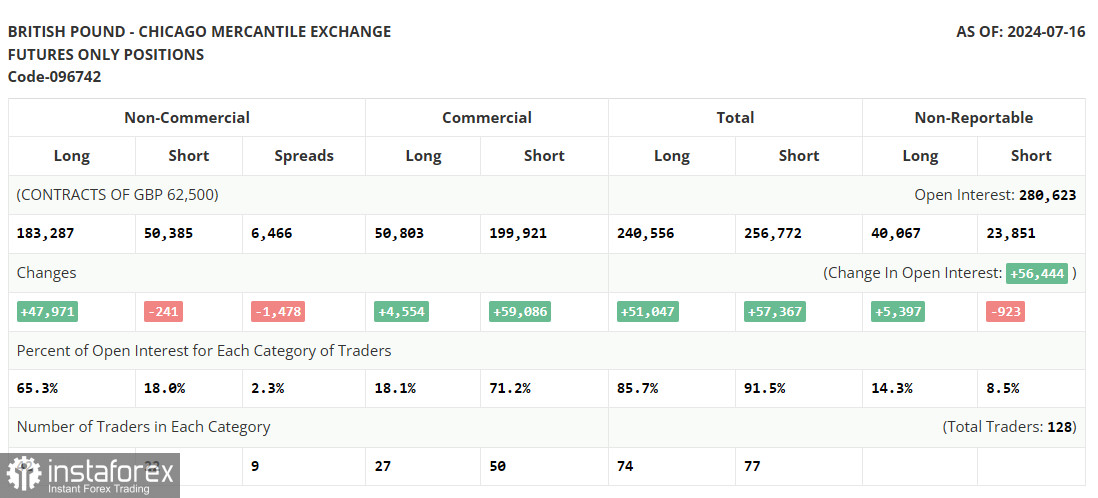

The COT report for July 16 showed an increase in long positions and a decrease in short positions. The Bank of England's decision to leave everything unchanged allowed the pound to grow quite well – especially against the expectations of U.S. rate cuts. The change in political power also contributed to some growth in GBP/USD. However, the market is now experiencing a break, which may lead to the pair stalling in a sideways channel, or we may see a further technical correction. But the lower the pound, the more attractive it will be for purchases. The latest COT report indicates that long non-commercial positions increased by 47,971 to 183,287, while short non-commercial positions fell by 241 to 50,385. As a result, the spread between long and short positions fell by 1,478.

Indicator Signals:

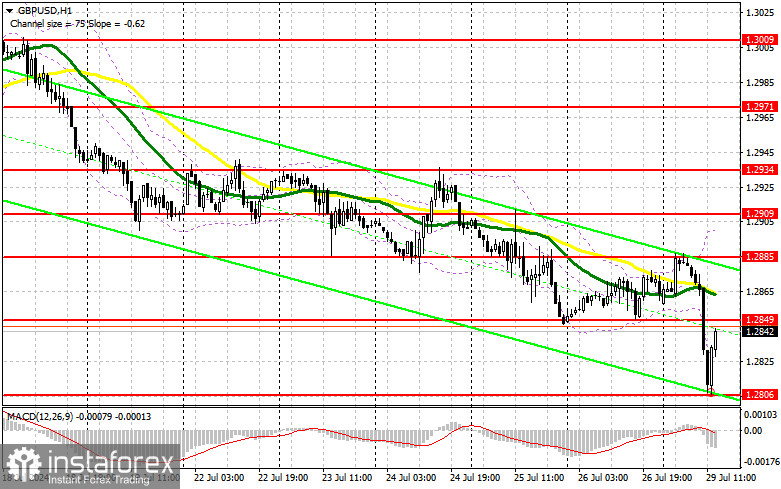

Moving Averages: Trading is conducted below the 30 and 50-day moving averages, indicating a possible continuation of the pair's decline.

Bollinger Bands: In case of a decline, the lower boundary of the indicator, around 1.2806, will act as support.

Indicator Descriptions:

- Moving average: Determines the current trend by smoothing out volatility and noise. Period – 50. Marked in yellow on the chart.

- Moving average: Determines the current trend by smoothing out volatility and noise. Period – 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA – period 12. Slow EMA – period 26. SMA – period 9.

- Bollinger Bands: Period – 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions: Represent the total long open position of non-commercial traders.

- Short non-commercial positions: Represent the total short open position of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română