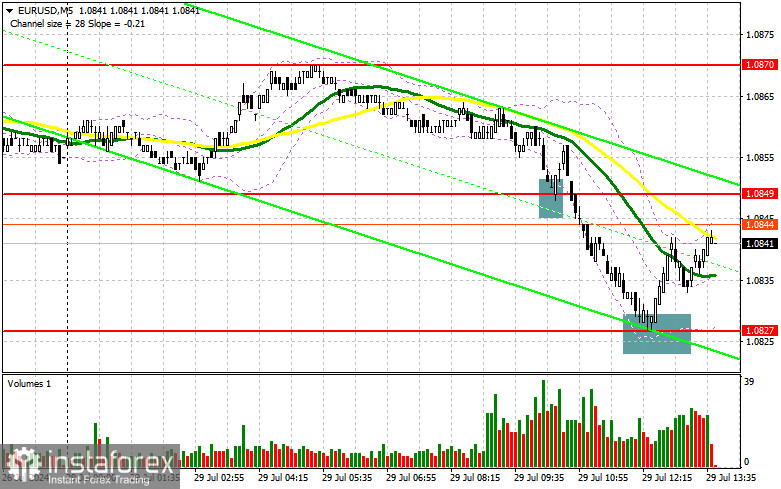

In my morning forecast, I highlighted the levels of 1.0849 and 1.0827 and planned to make market entry decisions based on these levels. Let's look at the 5-minute chart and see what happened. The decline and the formation of a false breakout provided a point of entry for buying the euro. The pair rose only by 10 points the first time, while the second rebound amounted to more than 15 points. The technical picture was revised for the second half of the day.

To Open Long Positions on EUR/USD:

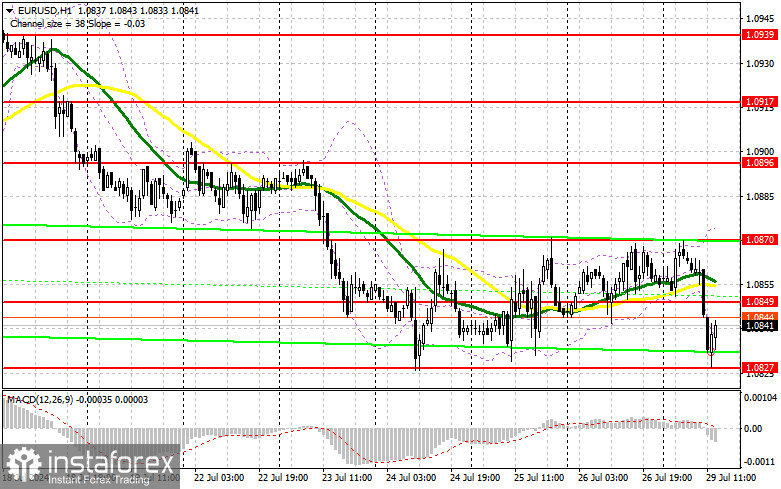

Considering the complete absence of statistics in the second half of the day, euro buyers will likely have a chance to compensate for part of the decline, especially since trading continues within a sideways channel, and the morning decline in the euro did not significantly impact the overall picture. In the case of a decline, forming a false breakout at 1.0827, similar to what I discussed above, will be a suitable condition for increasing long positions in anticipation of a pair's upward surge, with the prospect of updating the channel's middle at 1.0849. A breakout and an update of this range from top to bottom will strengthen the pair, with a chance to rise towards the 1.0870 area. The furthest target will be the 1.0896 high, where I will be taking a profit. If the EUR/USD declines and there is no activity around 1.0827 in the second half of the day, sellers will regain the initiative and act actively, counting on the pair's further fall. In this case, I will enter only after forming a false breakout around the next lower boundary of the sideways channel at 1.0808. I plan to open long positions immediately on a rebound from 1.0785 with the aim of an upward correction of 30-35 points within the day.

To Open Short Positions on EUR/USD:

Sellers remain, and in the case of an upward correction of the pair in the second half of the day, amid the absence of important fundamental statistics, only forming a false breakout around the new resistance at 1.0849 will confirm the presence of large players betting on the euro's decline, providing a suitable point for entering short positions with the target of lowering EUR/USD to the support at 1.0827 – the lower boundary of the channel. A breakout and consolidation below this range, followed by a reverse test from bottom to top, will give another point for selling, moving towards 1.0808, where I expect more active buyer intervention. The furthest target will be the 1.0785 area, where I will be making a profit. If EUR/USD moves up in the second half of the day and there are no bears at 1.0849, buyers will feel empowered for a larger rise. In this case, I will delay sales until the next resistance at 1.0870 is tested. I will also sell, but only after a failed consolidation. I plan to open short positions immediately on a rebound from 1.0896 with the aim of a downward correction of 30-35 points.

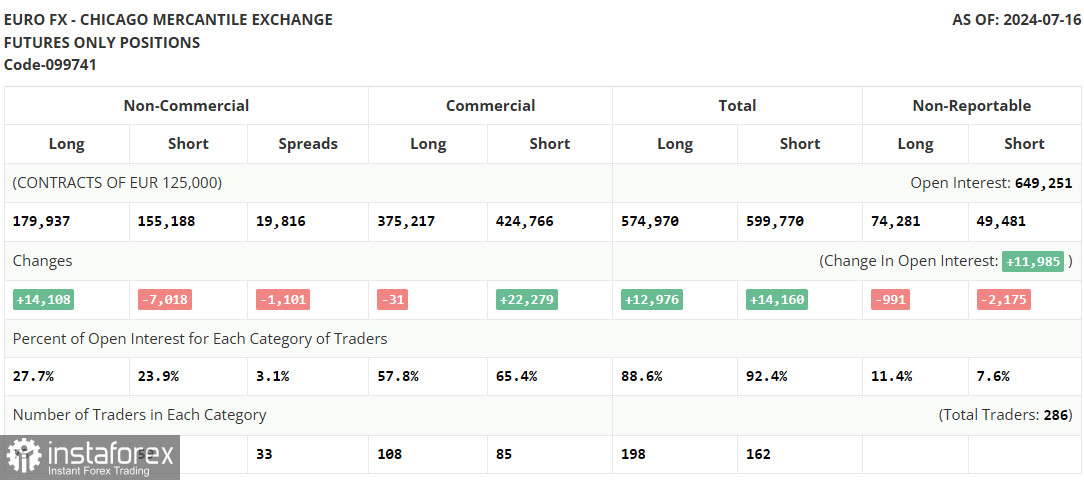

The COT report for July 16 showed a reduction in short and an increase in long positions. Discussions around U.S. rate cuts and the pause planned by the European Central Bank fueled demand for risk assets, including the euro, which helped the market rise. However, after all the important data was published and decisions made – referring to the ECB meeting and the rates remaining unchanged – the market calmed down, which may last until the end of the month. Only GDP data could trigger a spike in volatility. Therefore, it is best to adhere to cautious trading within the channel. The COT report indicated that long non-commercial positions increased by 14,108 to 179,937, while short non-commercial positions fell by 7,018 to 155,188. As a result, the spread between long and short positions narrowed by 1,101.

Indicator Signals:

Moving Averages:Trading is conducted below the 30 and 50-day moving averages, indicating a decline in the euro.

Bollinger Bands:In case of a decline, the lower boundary of the indicator, around 1.0840, will act as support.

Indicator Descriptions:

- Moving average: Determines the current trend by smoothing out volatility and noise. Period – 50. Marked in yellow on the chart.

- Moving average: Determines the current trend by smoothing out volatility and noise. Period – 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA – period 12. Slow EMA – period 26. SMA – period 9.

- Bollinger Bands: Period – 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions: Represent the total long open position of non-commercial traders.

- Short non-commercial positions: Represent the total short open position of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română