Overview of trading and tips on GBP/USD

The price test of 1.2856 coincided with the MACD indicator just starting to move down from the zero mark, confirming the correct entry point for selling the pound further along the trend. Unfortunately, although the U.S. Personal Consumption Expenditures Index increased moderately, a significant pound sell-off did not follow. Today, we have quite a large amount of data from the UK, but all of them are of secondary importance. UK reports on the M4 money supply, mortgage approvals, and net lending to individuals are all very interesting to bankers but not traders, so I expect traders to refrain from strongly reacting to these reports. As for the intraday strategy, I will rely more on realizing scenario No. 2.

Buy signals

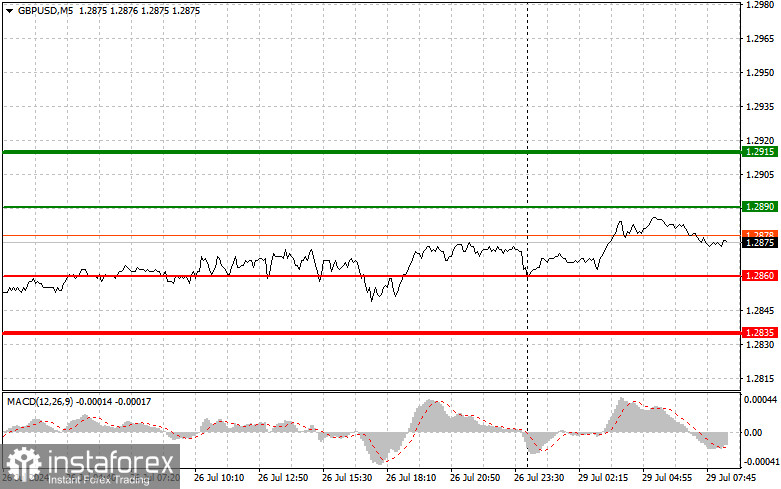

Scenario No 1. Today, I plan to buy the pound when the price reaches the entry point around 1.2890, plotted by the green line on the chart, with the goal of rising to 1.2915, plotted by the thicker green line on the chart. Around 1.2915, I plan to exit long positions and sell the pound in the opposite direction, counting on a movement of 30-35 pips from the level. We don't expect a solid rise in the pound today in the first half of the day. At most, we will see a minor correction and trading within the channel. Before buying, ensure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario No 2. I also plan to buy the pound today in case the price at 1.2860 is tested twice consecutively when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reverse market upturn. One can expect growth to the opposite levels of 1.2890 and 1.2915.

Sell signals

Scenario No 1. Today, I plan to sell the pound after testing the level of 1.2860 plotted by the red line on the chart, which will lead to a rapid decline in GBP/USD. The key target for sellers will be 1.2835, where I will exit short positions and immediately open long positions in the opposite direction (expecting a movement of 20-25 pips in the opposite direction from that level). You can sell the pound if buyers are not active near the intraday high. Before selling, make sure that the MACD indicator is below the zero mark and is just starting to decline from it.

Scenario No 2. I also plan to sell the pound today in case of two consecutive price tests of 1.2890 when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a reverse market downturn. One can expect a decline to the opposite levels of 1.2860 and 1.2835.

What's on the chart:

The thin green line is the entry price at which you can buy the trading instrument.

The thick green line is the estimated price where you can set Take-Profit (TP) or manually close positions, as further growth above this level is unlikely.

The thin red line is the entry price at which you can sell the trading instrument.

The thick red line is the price where you can set Take-Profit (TP) or manually close positions, as further decline below this level is unlikely.

MACD line: it is important to be guided by overbought and oversold areas when entering the market

Important: Novice traders in the forex market need to be very careful when making decisions to enter the market. It is best to stay out of the market before important fundamental reports are released to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you don't use money management and trade in large volumes.

And remember, for successful trading, it is necessary to have a clear trading plan, similar to the one I presented above. Spontaneously making trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română