The situation in the market remains unchanged, and in general, the changes have been purely superficial for the entire week. This is partly due to an almost empty economic calendar. On the other hand, after the sharp increase in political uncertainty in the United States over the past weekend, following Joe Biden's announcement of his withdrawal from the election race, the situation had noticeably become more stable by Monday evening. This also contributed to the normalization of the currency market. Moreover, while at the beginning of the week, American media were trying to hype the potential for an interest rate cut this month, by mid-week, it seemed that everyone had forgotten about it. It appears that nothing will change today either, especially with the Federal Open Market Committee meeting approaching in the middle of next week. The media coverage will likely intensify on Monday, with countless predictions and discussions about the possibility of interest rate cuts.

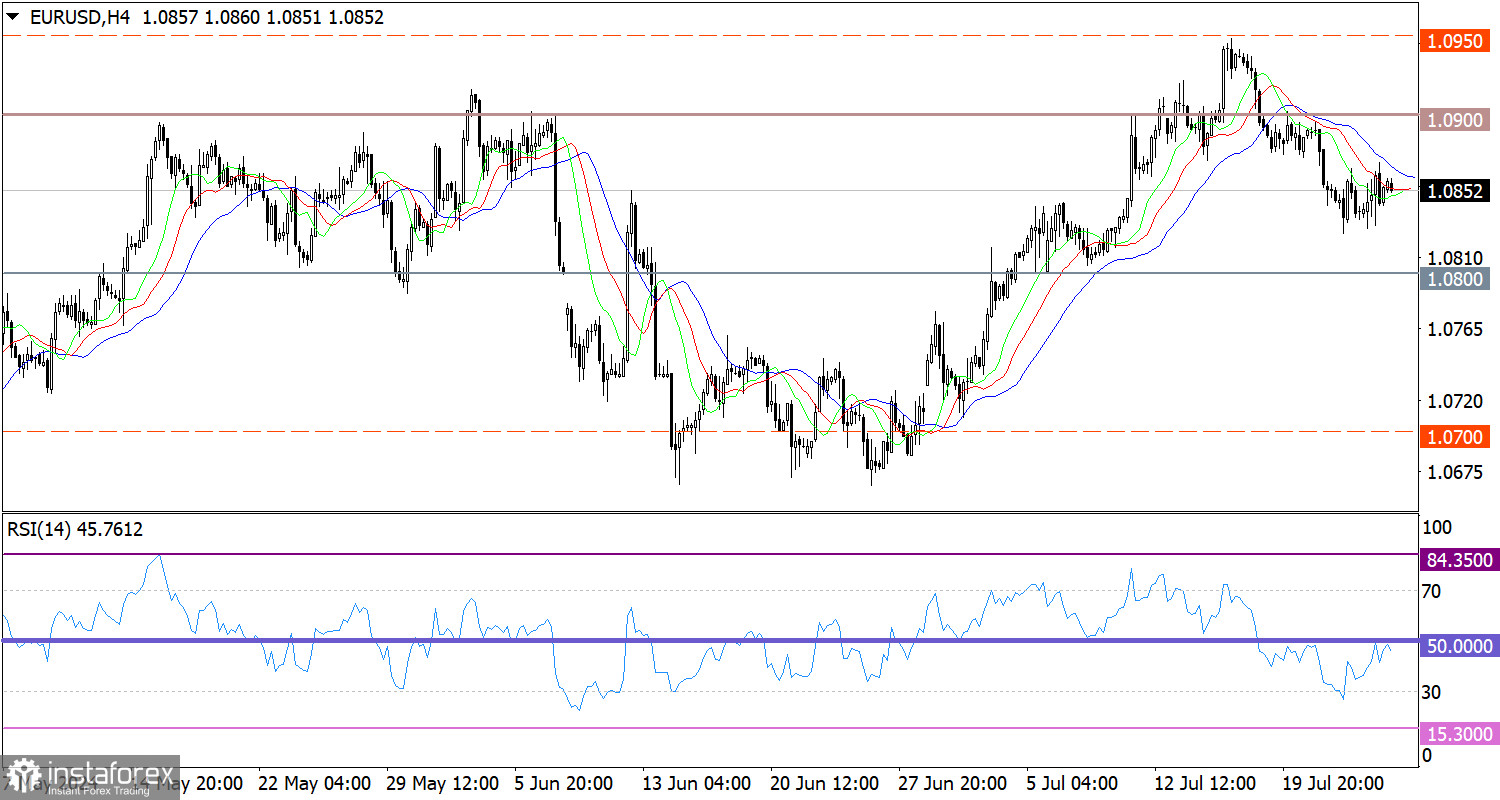

The corrective cycle slowed down around the 1.0825 level. This was followed by a pullback-stagnant phase, characterized by a typical realignment of trading forces.

On the 4-hour chart, the RSI indicator is moving in the lower area of the 30/50 range, which suggests that the bearish bias remains intact.

In the same time frame, the Alligator's MAs point downwards, aligning with the corrective cycle's direction.

Outlook

Assuming the bearish sentiment persists, the euro could fall to 1.0800. However, it is important to consider that the upward trend generally remains intact, and the current correction still fits within its cyclical phase. Therefore, traders should carefully analyze potential support levels from which the price could initiate a rebound, possibly marking the beginning of a recovery process in the euro.

In terms of the complex indicator analysis, we see that in the short term, technical indicators lack stable signals due to the stagnant phase. Meanwhile, in the intraday period, the indicators reflect a bearish cycle.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română