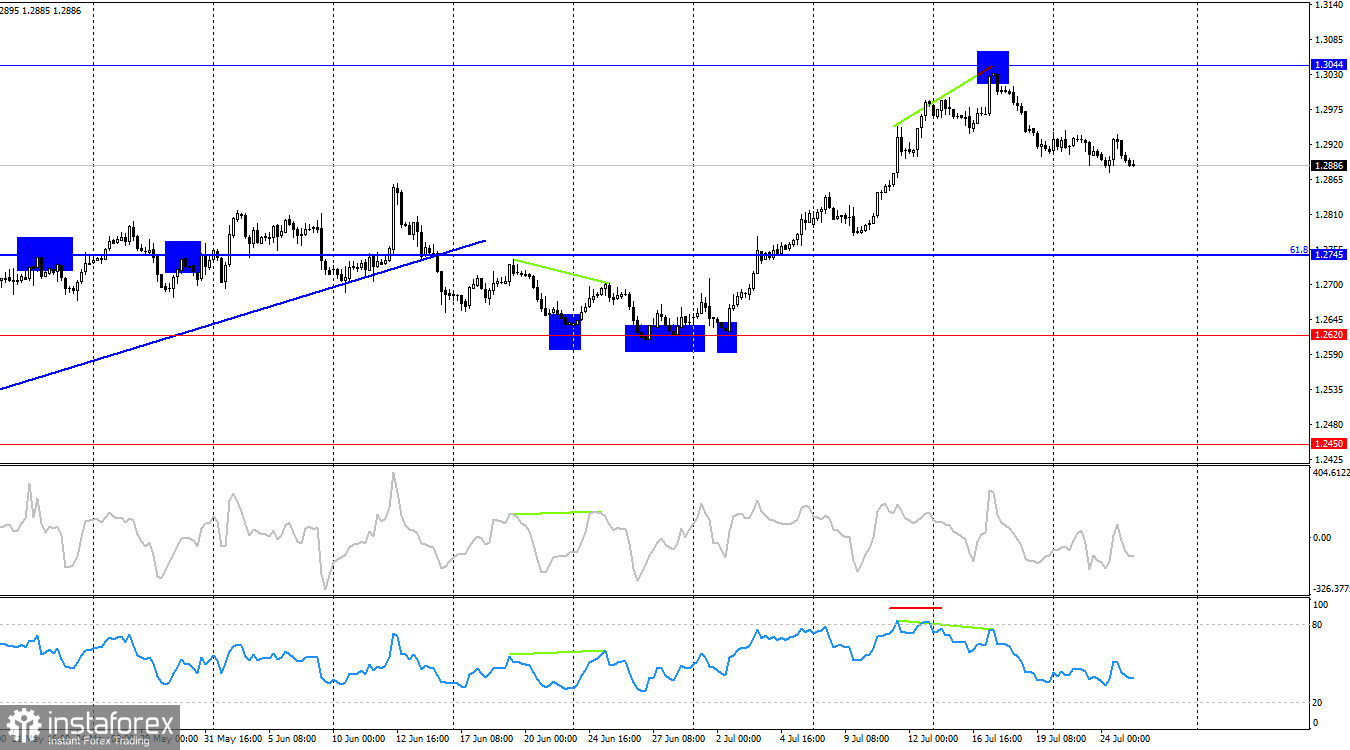

The wave situation changed last week. The last completed downward wave (forming since June 12th) managed to break the minimum of the previous downward wave, and the last upward wave managed to break the peak of the previous upward wave. Thus, we are currently dealing with a "bullish" trend. The pound's rise may continue, but traders must form at least a corrective downward wave. There is no indication of a trend change to "bearish" from a wave perspective. For this to happen, the pair must break the minimum from July 2nd. It is uncertain whether the bears can push the price to this level.

The information on Wednesday did not cause a rise in either the dollar or the pound. Today, the market started with sales in the morning, but all the most important events are scheduled for the second half of the day. GDP and durable goods orders are the key reports for Thursday. Traders expect US economic growth of 2% in the second quarter, which is a fairly high value. The first quarter saw a growth of 1.4%. The Fed rate remains at its peak level, so it is unclear what is driving the acceleration of US GDP. Nevertheless, the US economy is growing faster than the European or British economies. High expectations indicate that the market does not expect a recession or stagnation in the US. These factors favor the US currency, which may continue to strengthen today.

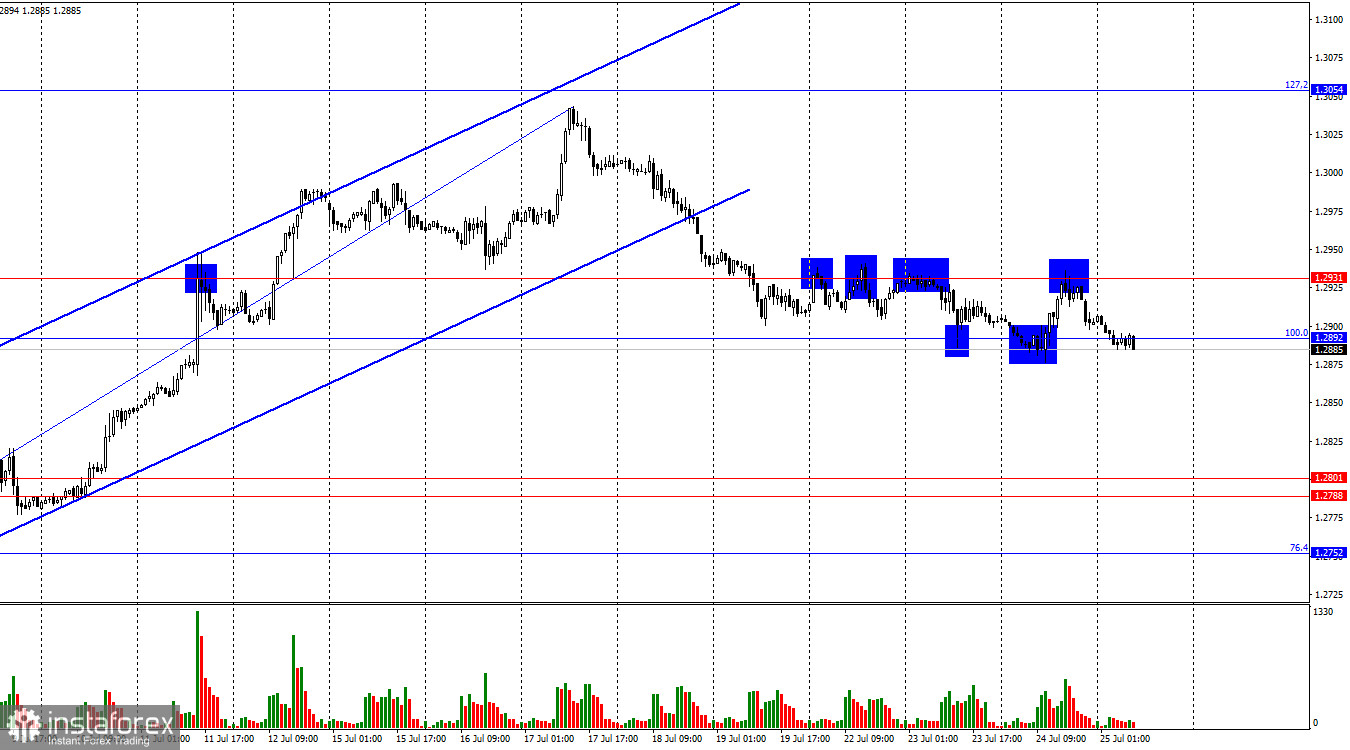

On the 4-hour chart, the pair rebounded from the 1.3044 level, forming a "bearish" divergence on the RSI indicator. Earlier, this indicator entered the overbought zone. Thus, several sell signals were received on the higher timeframe chart. The downward movement may continue towards the 61.8% corrective level at 1.2745. On the hourly chart, the bears closed below the trend channel, allowing further decline in the pair.

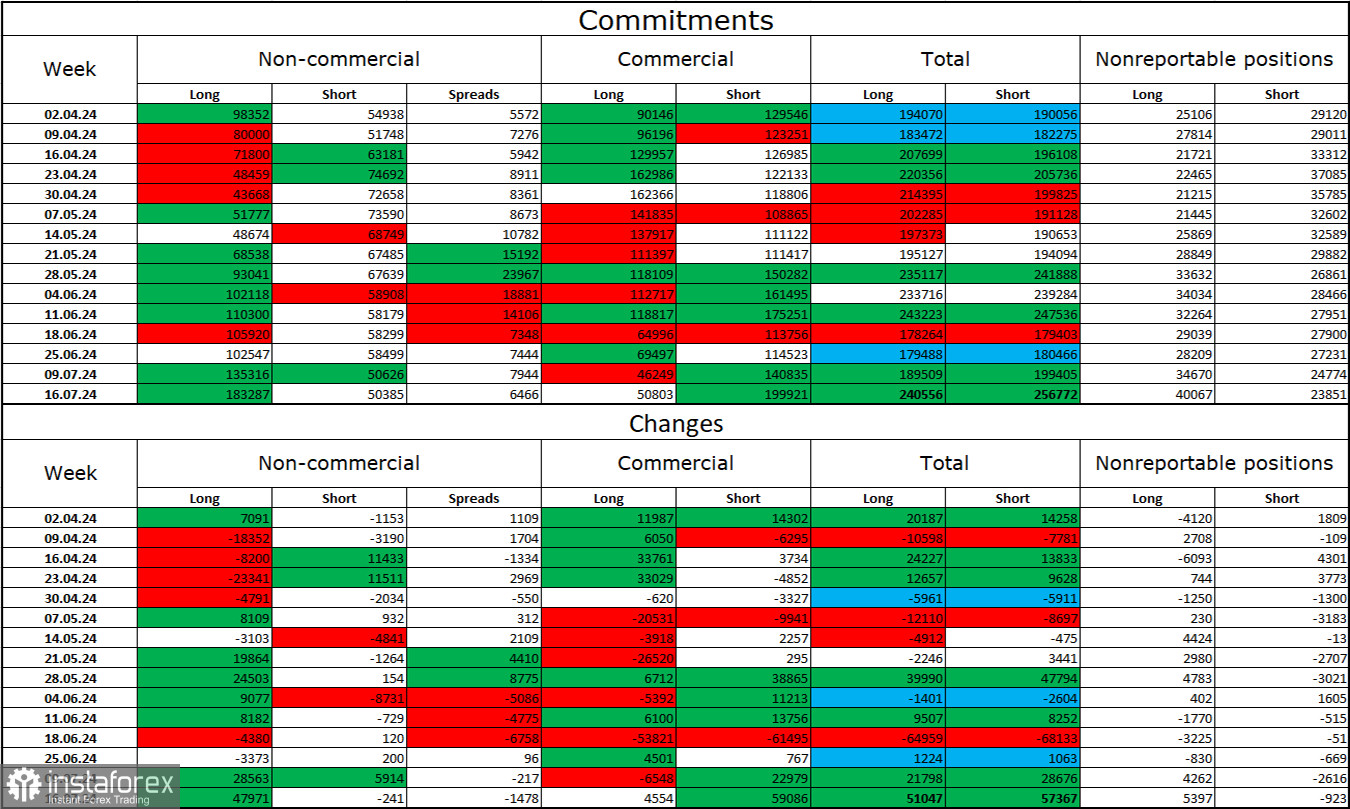

Commitments of Traders (COT) Report

The sentiment of the "Non-commercial" traders became even more "bullish" over the past week. The number of long positions held by speculators increased by 47,971, while the number of short positions decreased by 241. Bulls still have a solid advantage. The gap between long and short positions is already 133,000: 183,000 against 50,000.

The pound still has prospects for a decline, but the COT reports currently suggest otherwise. Over the last three months, the number of long positions increased from 98,000 to 183,000, while the number of short positions decreased from 54,000 to 50,000. Over time, professional traders are likely to reduce their ong positions or increase their short positions, as all possible factors for buying the British pound have already been worked out. However, this is just a hypothesis. Graphical analysis suggests a likely decline, but this does not negate the weakness of the bears, who have yet to manage to take the 1.2620 level.

News Calendar for the US and the UK:

- US – Initial Jobless Claims (12:30 UTC)

- US – Core Durable Goods Orders (12:30 UTC)

- US – Q2 GDP (12:30 UTC)

Thursday's economic events calendar contains several entries. The influence of economic data on market sentiment today may be moderate in strength, especially in the second half of the day.

GBP/USD Forecast and Trader Recommendations:

Selling the pound was possible after the rebound from the 1.3044 level on the 4-hour chart, targeting the lower boundary of the upward channel. On the hourly chart, these sales can now be kept open in anticipation of closing below the 1.2892–1.2931 zone. In this case, the target is the 1.2788–1.2801 zone. I do not consider buying in the next couple of days advisable.

Fibonacci retracement levels are built between 1.2892–1.2298 on the hourly chart and 1.4248–1.0404 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română