EUR/USD

Yesterday, Tesla's stock caused quite a stir, losing 12% due to a 7% revenue drop. The S&P 500 lost 2.31%. There was significant intraday volatility in government bond yields, and gold decreased by 0.38%. The US Dollar Index dropped 0.08%, primarily due to the pound's and euro's resilience; the yen strengthened by 1.18%, while the Australian dollar fell by 0.58%. The euro lost only 12 pips.

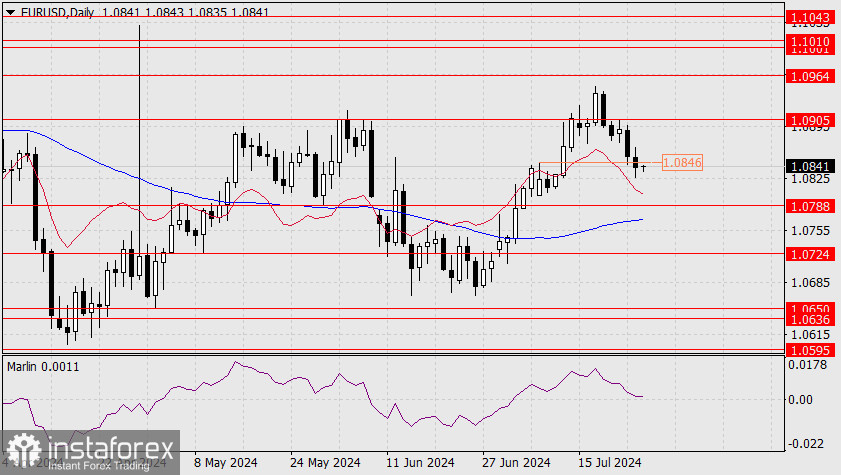

We expect further risk aversion in the stock and commodity markets (see the S&P 500 review). The euro has broken through the intermediate support level of 1.0846 on the daily chart, so we anticipate reaching the next target at 1.0788. However, there is one nuance: the Marlin oscillator remained in positive territory yesterday. It could return to this territory if the price breaks below yesterday's low of 1.0826.

On the 4-hour chart, the price has lingered in the 1.0840/6 range, noticeably expanding it. The Marlin oscillator has corrected upwards. Nevertheless, we expect the price to break below yesterday's low and for the euro to continue its decline.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română