GBP/USD

After going through a difficult situation yesterday, with a broad retreat of investors from risk, the British pound managed to hold its ground at Tuesday's closing level. This resilience was likely due to optimistic PMI data. The Manufacturing PMI increased from 50.9 to 51.8, and the Composite PMI improved from 52.3 to 52.7.

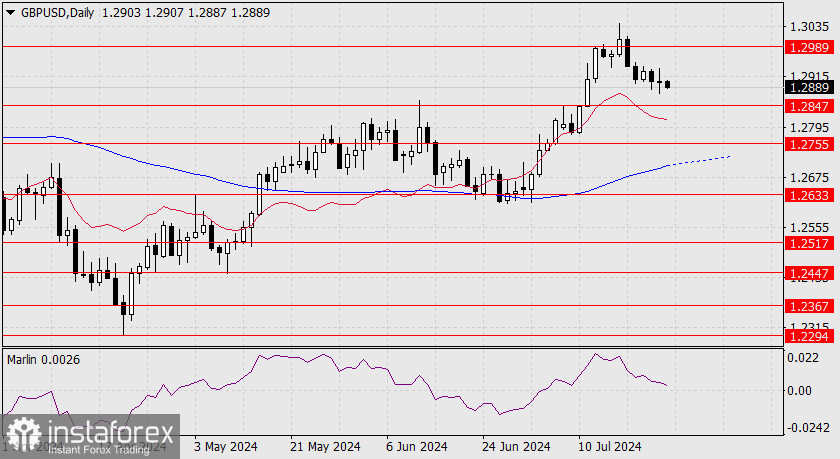

However, today, strong data from the US could push European currencies lower. GDP for the second quarter is expected to grow from 1.4% to 2.0%, and June orders for durable goods might show an increase of 0.3%. We expect the pound to fall towards the target level of 1.2755 by the start of next week.

On the 4-hour chart, yesterday's weak convergence also helped the pound remain within the consolidation range. We are now seeing anoher breakout from this consolidation, which will likely be the final one. The Marlin oscillator briefly moved into bullish territory yesterday, which appears to be a false move. The first target for the pound is 1.2847.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română