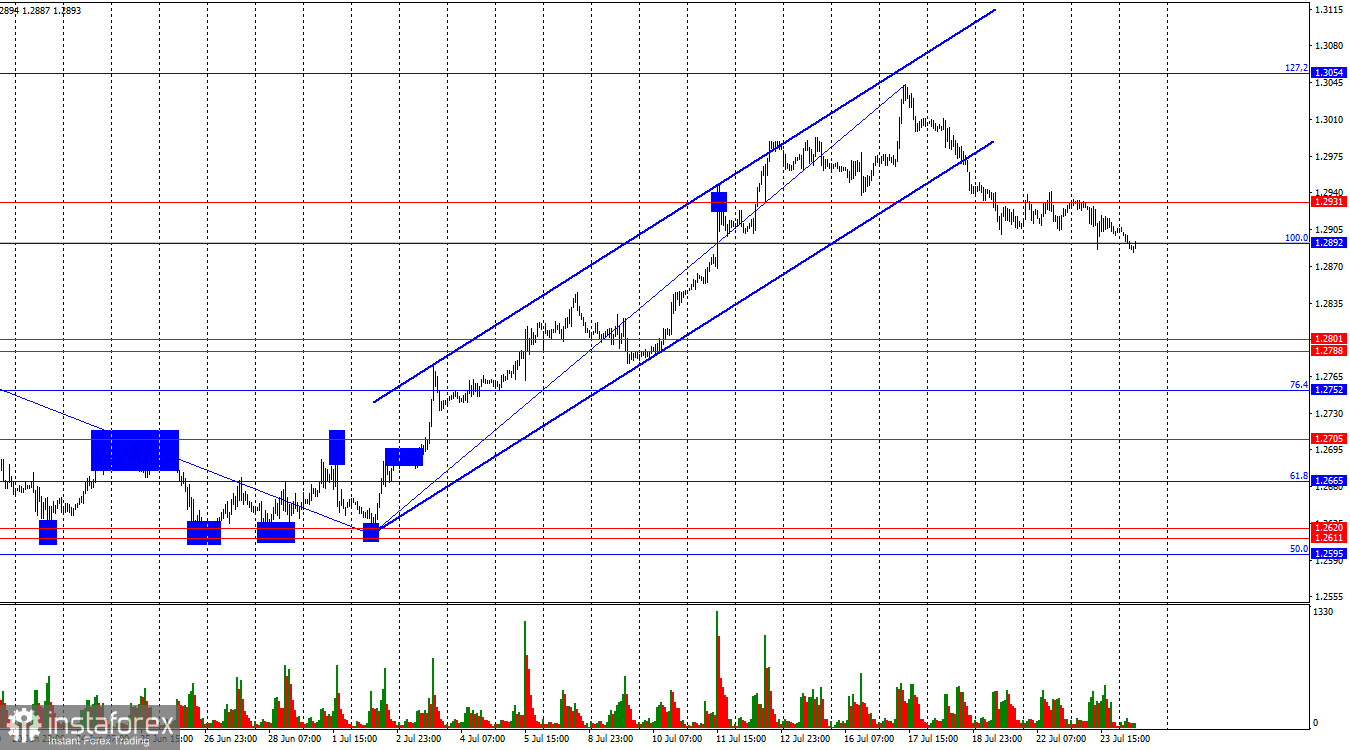

On the hourly chart, the GBP/USD pair remained within the support zone of 1.2892–1.2931 on Tuesday. Securing a position below this zone will likely result in further declines for the pound toward the next support zone of 1.2788–1.2801. Conversely, holding above the 1.2892–1.2931 zone will favor the bulls, potentially allowing the pound to resume its rise toward the 127.2% corrective level at 1.3054. On Wednesday morning, bears may struggle to close below 1.2892.

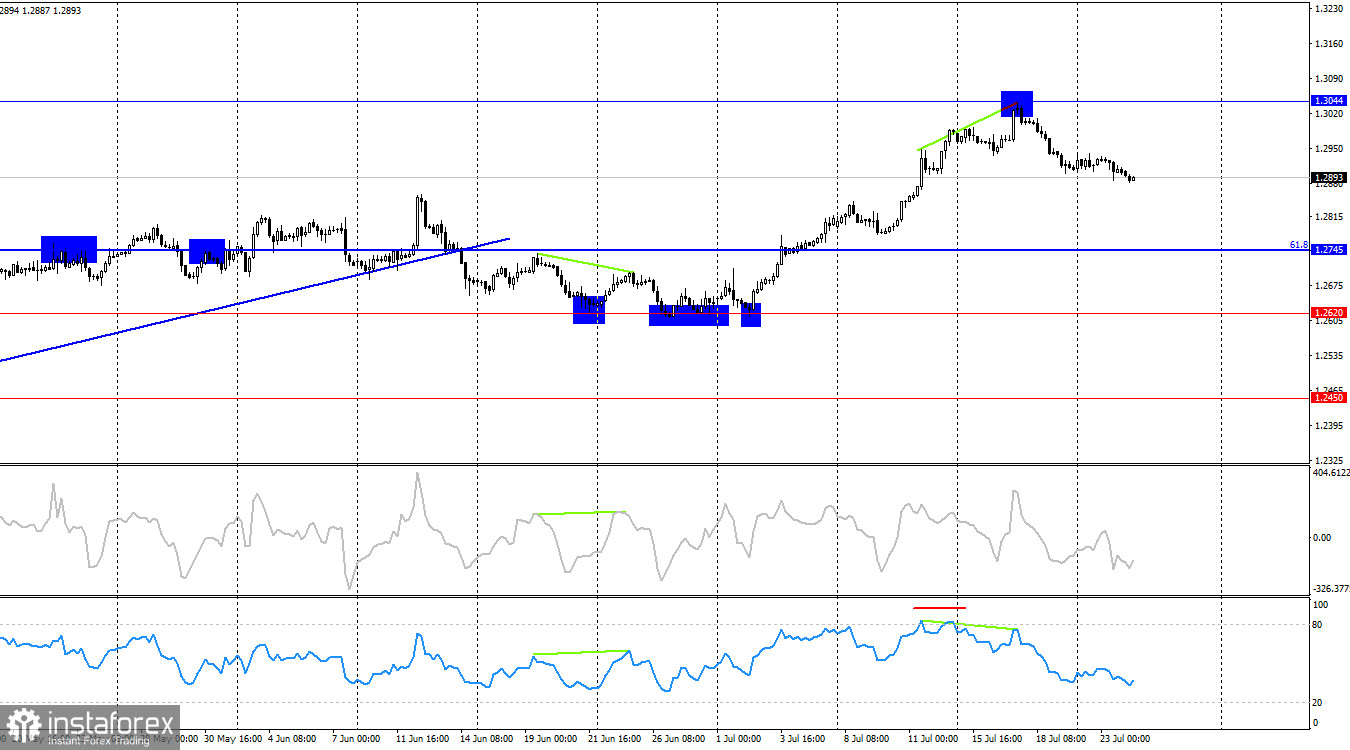

The wave situation changed last week. The last completed downward wave (starting from June 12) managed to break the low of the previous downward wave, while the last upward wave broke the high of the previous upward wave. Therefore, we are currently dealing with a bullish trend. The pound's rise may continue, but traders must form at least a corrective downward wave. A change to a bearish trend is not currently indicated from a wave perspective. For this to occur, the pair would need to break the last low from July 2. Whether the bears have the strength to reach this level remains a significant question.

The information backdrop on Tuesday provided no new opportunities for traders. The pound took another step toward a bearish trend, but current bearish intentions are quite fragile. Thus, closing below the 1.2892 level could lead to further declines, but today's business activity indices in the UK could exceed forecasts, allowing bulls to mount another attack. I do not expect a significant rise in the pound today, as forming a corrective wave—which I believe could end in the 1.2788–1.2801 zone—is a crucial factor.

On the 4-hour chart, the pair rebounded the 1.3044 level, forming a bearish divergence on the RSI indicator. Earlier, this indicator had entered the overbought zone. Thus, several sell signals were received on the higher time frame. The downtrend may continue toward the 61.8% corrective level at 1.2745. On the hourly chart, bears have closed below the trend channel, which also supports the continuation of the pair's decline.

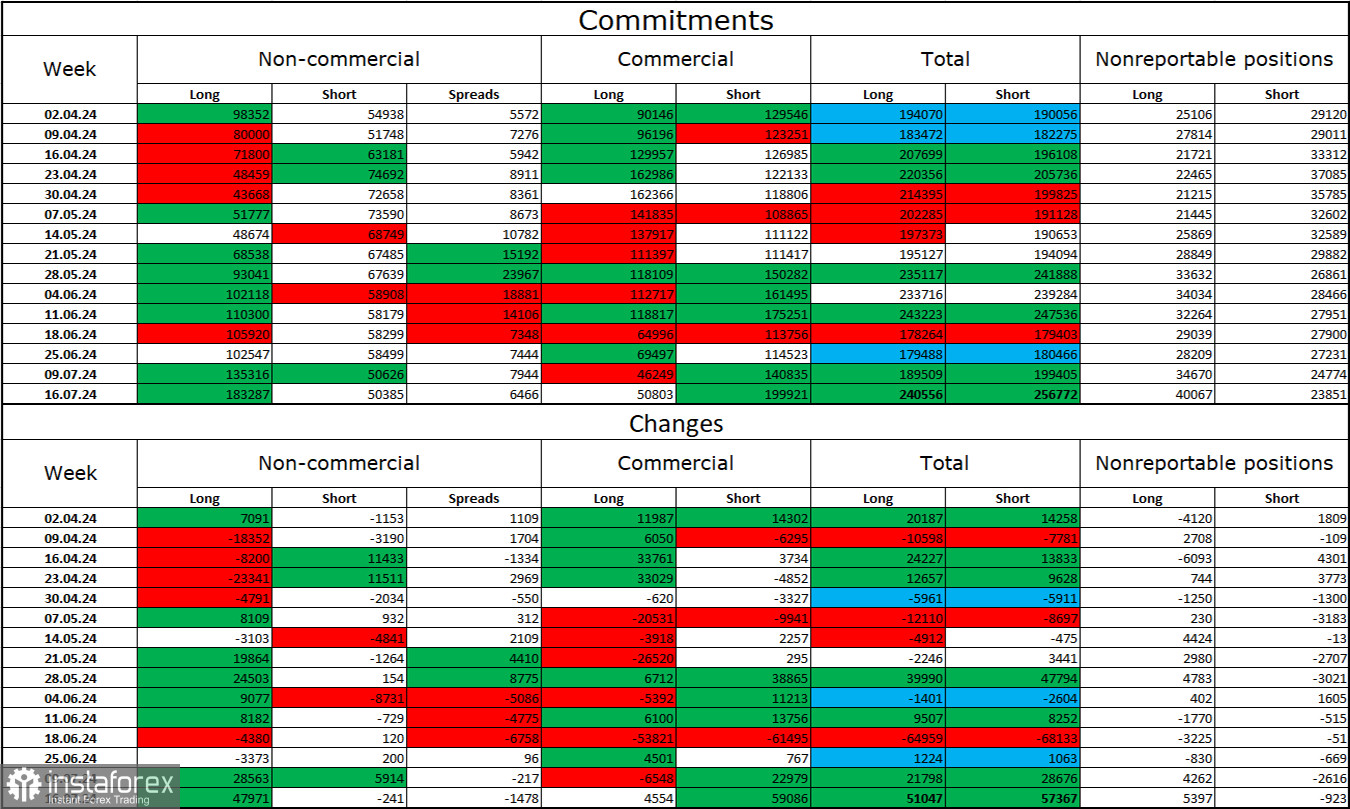

Commitments of Traders (COT) Report:

The sentiment among the "Non-commercial" category of traders became even more bullish last week. The number of long positions held by speculators increased by 47,971, while the number of short positions decreased by 241 units. Bulls still hold a solid advantage. The gap between long and short positions is now 133,000: 183,000 versus 50,000.

In my opinion, the pound still has the potential to fall, but the COT reports currently suggest otherwise. Over the last three months, the number of long positions increased from 98,000 to 183,000, while the number of short positions decreased from 54,000 to 50,000. I believe that over time, professional traders may start to shed long positions or increase short positions, as all potential factors for buying the British pound seem to have been factored in. However, this is just a hypothesis. Graphical analysis suggests a likely fall, but this does not negate the weakness of the bears, who have yet to take the 1.2620 level.

News Calendar for the UK and the USA:

- UK – Services PMI (08:30 UTC)

- UK – Manufacturing PMI (08:30 UTC)

- USA – Services PMI (13:45 UTC)

- USA – Manufacturing PMI (13:45 UTC)

On Wednesday, the economic event calendar includes several entries. The impact of the information background on market sentiment today may be moderate in strength.

Forecast for GBP/USD and Trading Tips:

Selling the pound was possible upon the rebound from the 1.3044 level on the 4-hour chart, with the target at the lower boundary of the ascending channel. These sales can now be maintained with the expectation of a close below the 1.2892–1.2931 zone on the hourly chart. The target in this case is the 1.2788–1.2801 zone. I do not consider purchases advisable in the next couple of days.

Fibonacci level grids are constructed from 1.2892–1.2298 on the hourly chart and from 1.4248–1.0404 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română