It seems that the Democratic Party has quickly settled on a candidate for the presidency of the United States, and corporate media are reporting the possibility of Kamala Harris being appointed within the next few days, a month before the party convention. This reduces the risks of political uncertainty and is the reason for the dollar's growth. If these rumors are confirmed, which could happen any day now, the US dollar will receive an even more significant boost.

At the same time, investors today might focus not only on political news but also on macroeconomic data. This concerns preliminary estimates of business activity indices. However, these are likely to have a minor impact. Both Europe and US indices are expected to show growth. Only a significant deviation of the actual data from expectations would affect the current situation.

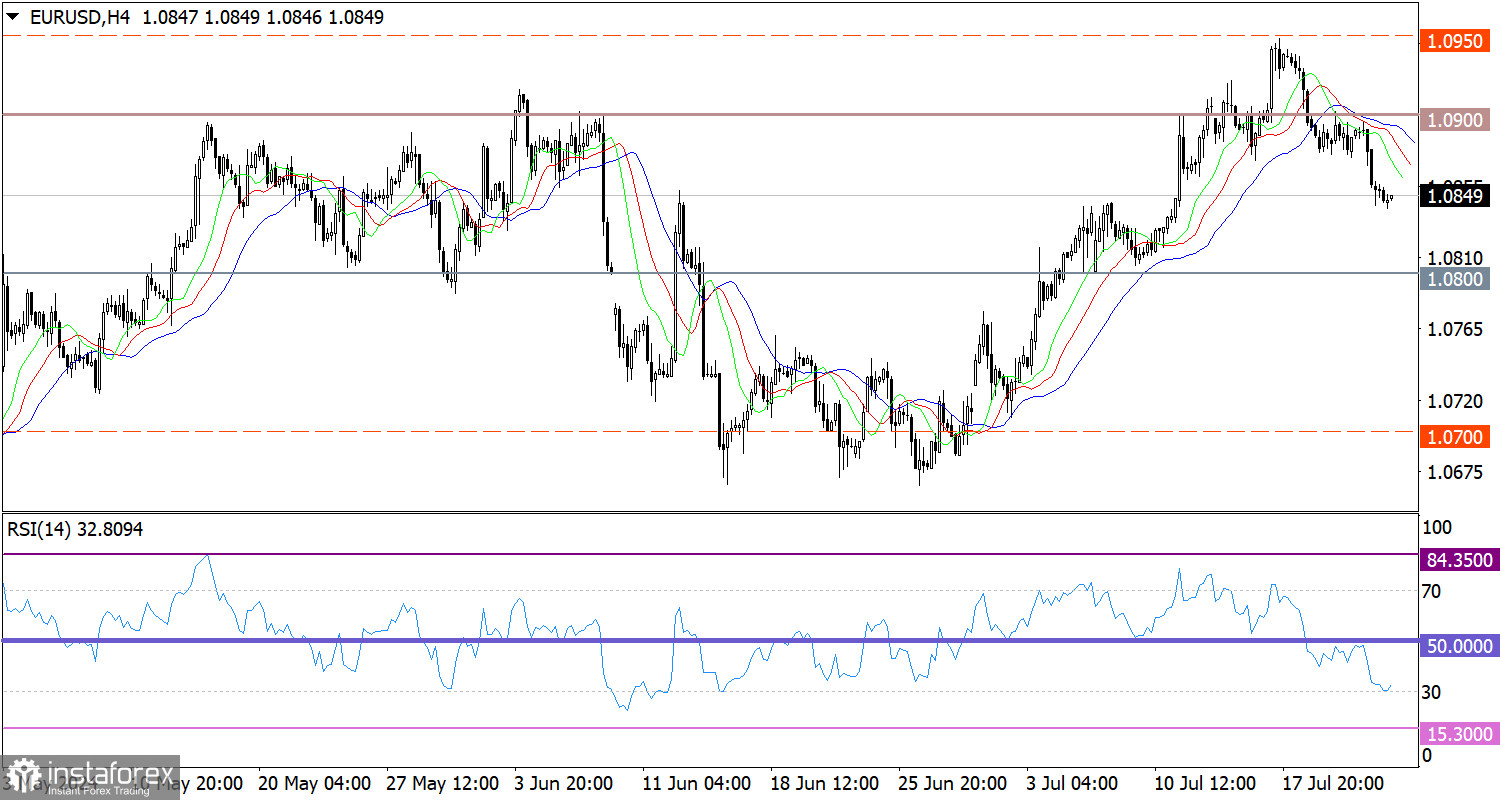

After stalling for a brief period, the volume of short positions on the euro increased. As a result, the corrective move from the lower area of the psychological level 1.0950/1.1000 has been extended.

On the 4-hour chart, the RSI indicator hovers in the lower area as it reaches the oversold level.

During the same time frame, the Alligator's MAs are headed downwards, aligning with the corrective cycle's direction.

Outlook

Considering the scenario of the subsequent development of the corrective cycle, a move toward the 1.0800 level is a logical step. However, signs of the euro being oversold in the short-term periods may complicate this task.

Complex indicator analysis points to a correction in the short-term and intraday time frames.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română