Markets are prone to repeating their mistakes. At the beginning of the year, they expected the Federal Reserve to cut interest rates at 6-7 meetings in 2024. In practice, strong US economic data shattered these hopes, setting the stage for the US dollar's uptrend. After the June employment and inflation statistics, investors have revised their forecasts, now anticipating three rounds of monetary easing —in September, November, and December. Isn't that too much on the back of the current uncertainty?

Labor market cooling and disinflation are strong arguments in favor of easing the Fed's monetary policy. However, what is the evidence that stubborn inflation has been eventually defeated? In fact, Donald Trump's policies are pro-inflationary. Tariffs will disrupt supply chains, fiscal stimuli will encourage domestic consumption, and a weak dollar policy will raise import prices. As a result, the central bank will have to tighten the reins, acting more slowly than markets expect. This will promote strength in the USD index, just as it happened in the first half of the year.

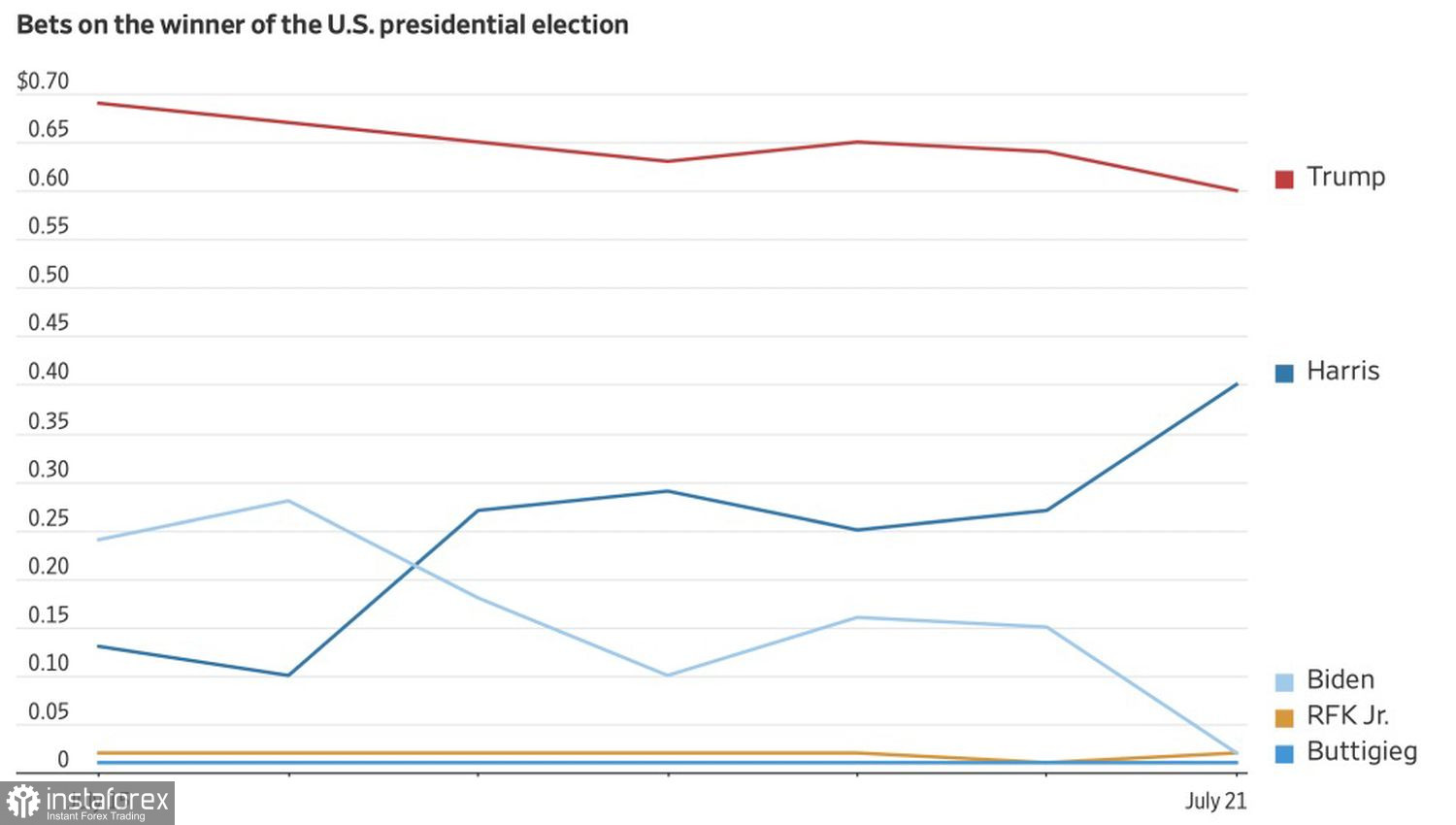

Presidential candidates' ratings

Let's not forget that Donald Trump's policies will bring chaos to financial markets. He will likely exert political pressure on the Federal Reserve, as he did during his previous term. Forex traders will start discussing currency interventions. A new round of trade wars is also not good news for risky assets. In such conditions, safe-haven currencies, especially the US dollar, will thrive.

The combination of new import tariffs and stimulating fiscal policies is a strong argument for the separation of economies. US GDP will click into gear, while in China, the export-oriented eurozone, and other regions, it will slow down. This will bring back the theme of American protectionist rhetoric to the markets and push the EUR/USD pair down.

Thus, the re-evaluation of market expectations for the federal funds rate, divergence in economic growth between the US and other countries, and high demand for the US dollar as a safe-haven asset will contribute to the fall of EUR/USD. On the other side is investors' belief in Fed monetary expansion which drives the currency pair upward. However, for now, Trump's trade policy is winning. This is proven by the sliding yield spread of US Treasuries.

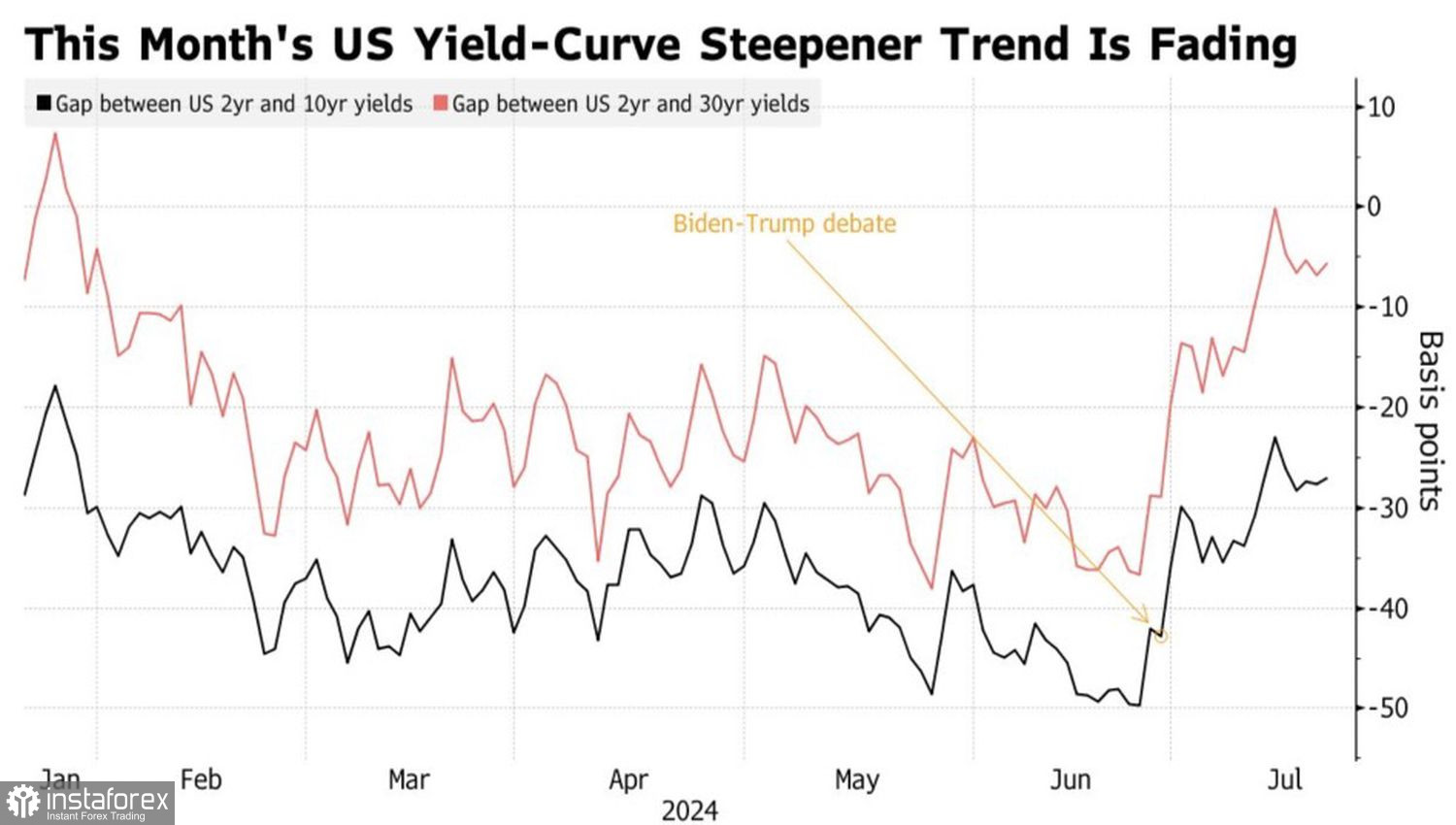

Dynamics of US Treasury yield spread

If investors gave priority to the Federal Reserve's monetary policy, the indicator would fall, primarily due to the decline in short-term Treasury yields. As it rises, preference is given to the Trump trade. The ongoing dynamic may remain until the November elections, posing risks of a euro reversal against the US dollar.

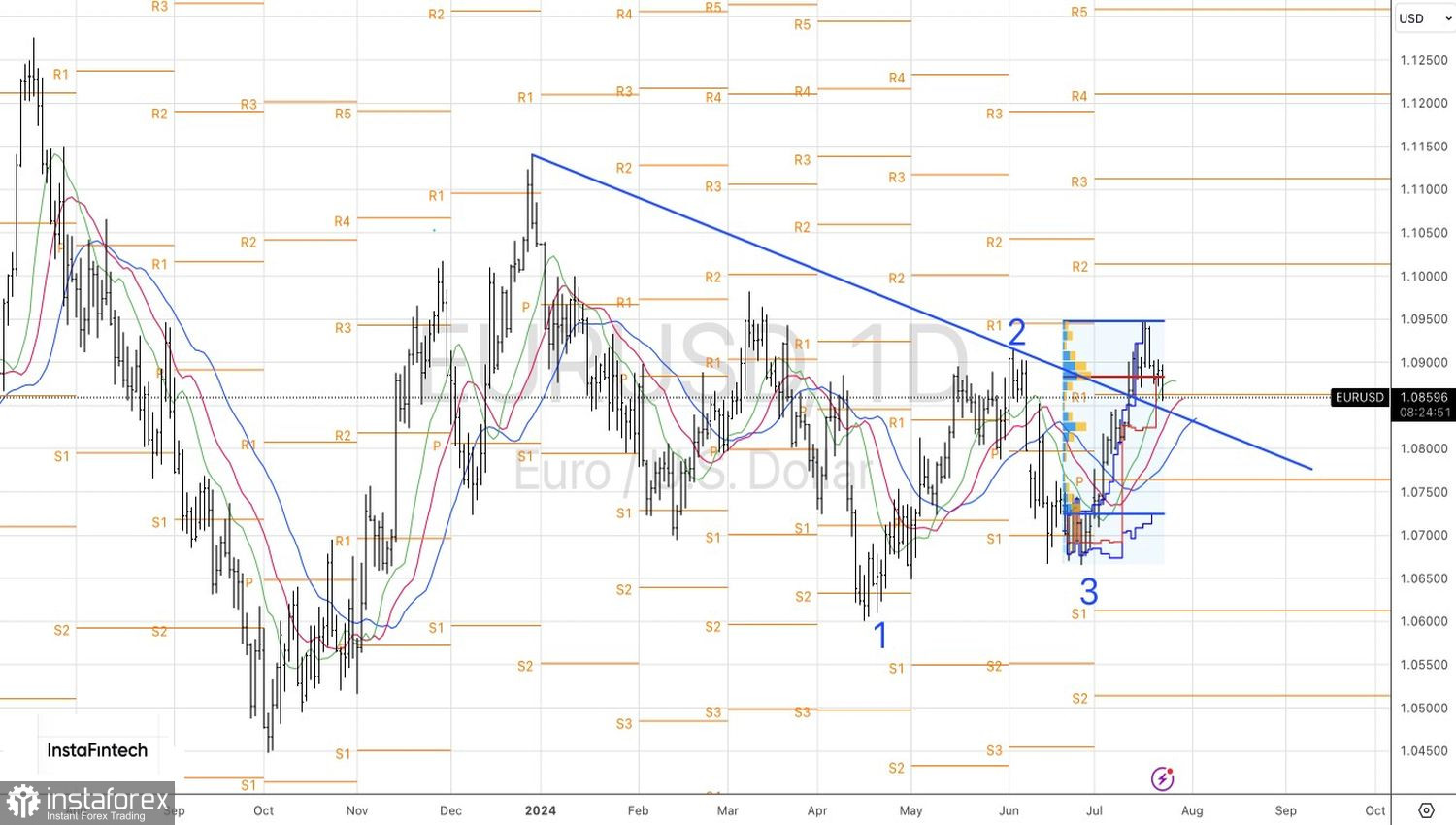

Technical analysis

Technically, on the daily EUR/USD chart, the bears made an attempt to organize a pullback. A rebound from the trend line near 1.083 would be a reason to buy. Conversely, with a confident break of this line from top to bottom, traders have to take into account the risks of a nosedive. So, traders will have the reason to sell the instrument.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română