Without any economic or political news, the market has literally come to a standstill. Today's situation is somewhat similar, as aside from the secondary housing market data, the economic calendar is almost empty. Moreover, housing reports have a feeble impact. However, according to multiple statements, US President Joe Biden may address the nation today. He is expected to officiallyendorse Kamala Harris as the Democratic Party candidate. It seems that the incumbent vice president will be the one to challenge Donald Trump. The key point here is that the Democratic Party has quickly settled on its candidate, which significantly reduces political risks. This could potentially support the dollar.

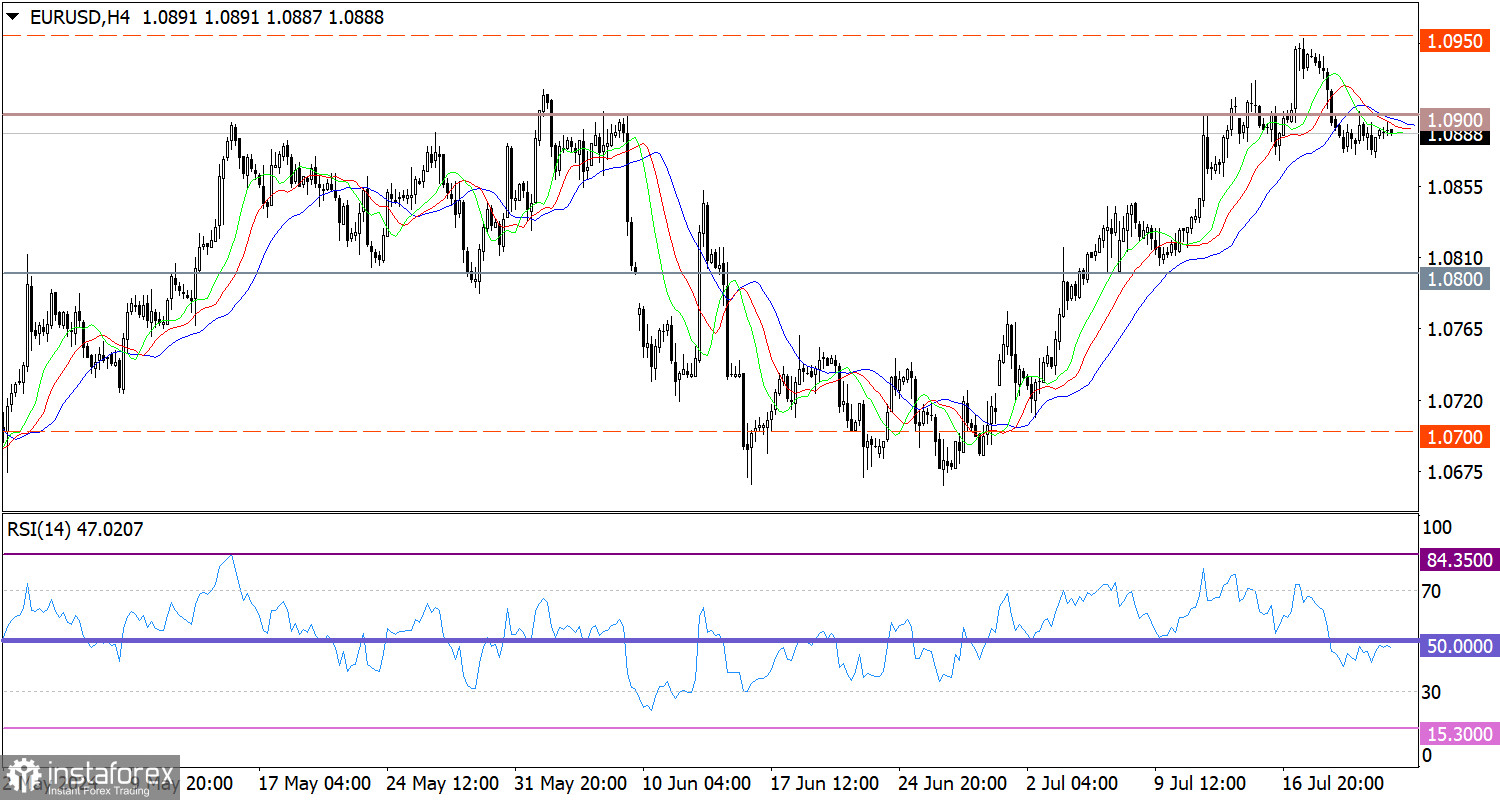

The EUR/USD pair has stalled just below the 1.0900 level, while the corrective cycle from the lower range of the psychological level of 1.0950/1.1000 remains intact.

On the 4-hour chart, the RSI indicator is moving in the lower area, indicating an increase in the volume of short positions on the euro.

As for the Alligator indicator in the same time frame, the lines are intertwined, meaning that the upward cycle is slowing down.

Outlook

To support the bearish bias, the quote must settle below the 1.0860 level. In this scenario, the euro could move towards the 1.0800 level. The bullish scenario will come into play if the price returns above the 1.0900 level.

Complex indicator analysis suggests a correction in the short-term and intraday time frames.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română