Silence is a sign of consent. But what exactly is Andrew Bailey agreeing to, having been silent about the repo rate for 10 weeks? This marks the longest period of silence in his four-year service at the helm of the Bank of England. Is he agreeing that the BoE's monetary policy should be eased in August because consumer prices have been at the 2% target for two months now? Or does he agree that it is the wrong time to rush into monetary expansion on the back of the rapid rise in wages and core inflation?

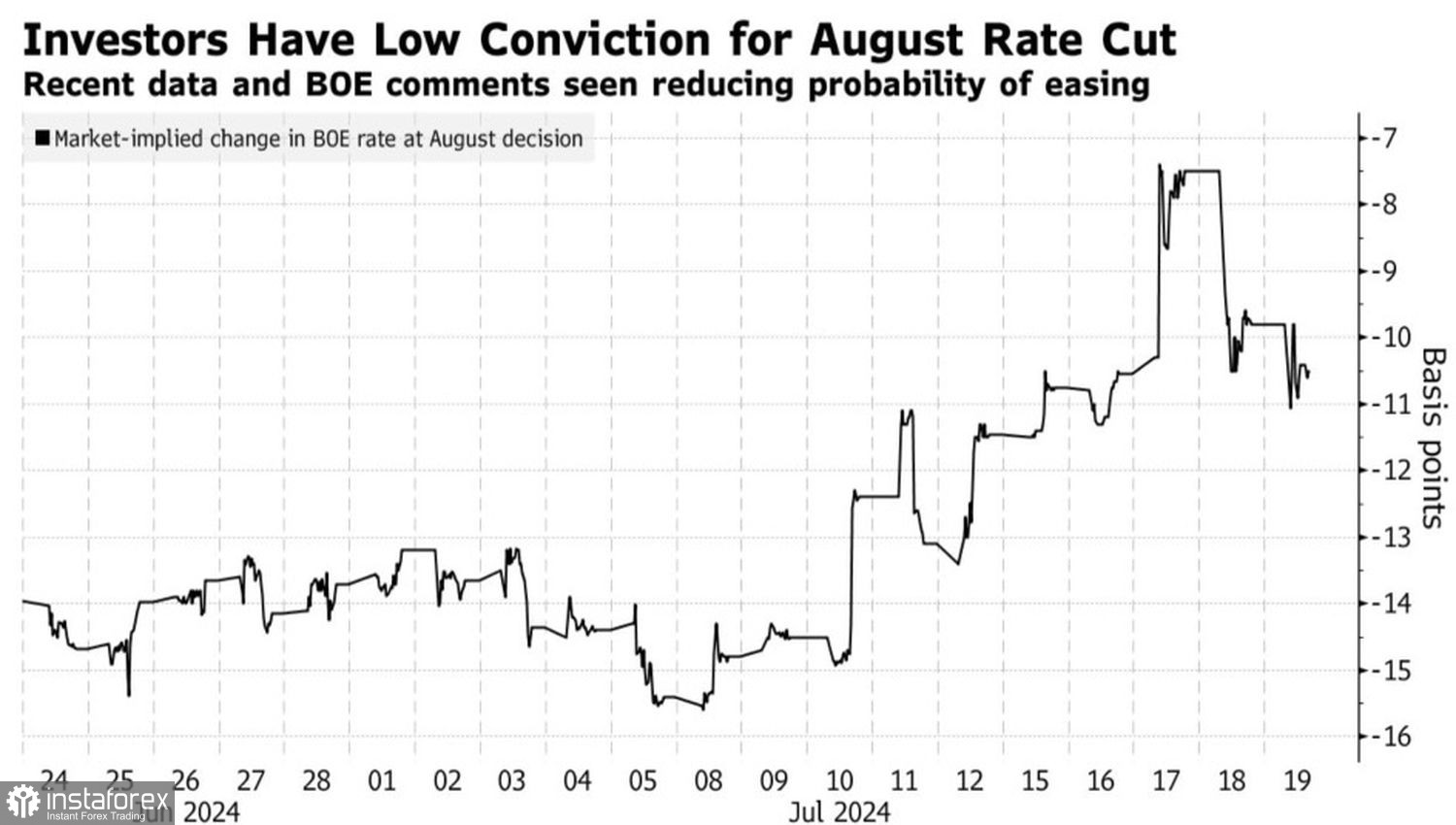

Markets estimate about a 40% probability of a rate cut at the Bank of England's August meeting. So, Andrew Bailey's comments could help investors clarify the situation. However, there is another perspective. Previous speeches by the BoE governor have often misled rather than clarified. That's why some think it's better when he stays silent. This allowed GBP/USD to move confidently upward until a cyber outage and related chaos in airports, the banking system, and financial markets forced the pound sterling to retreat.

Dynamics of expected rate cut in August

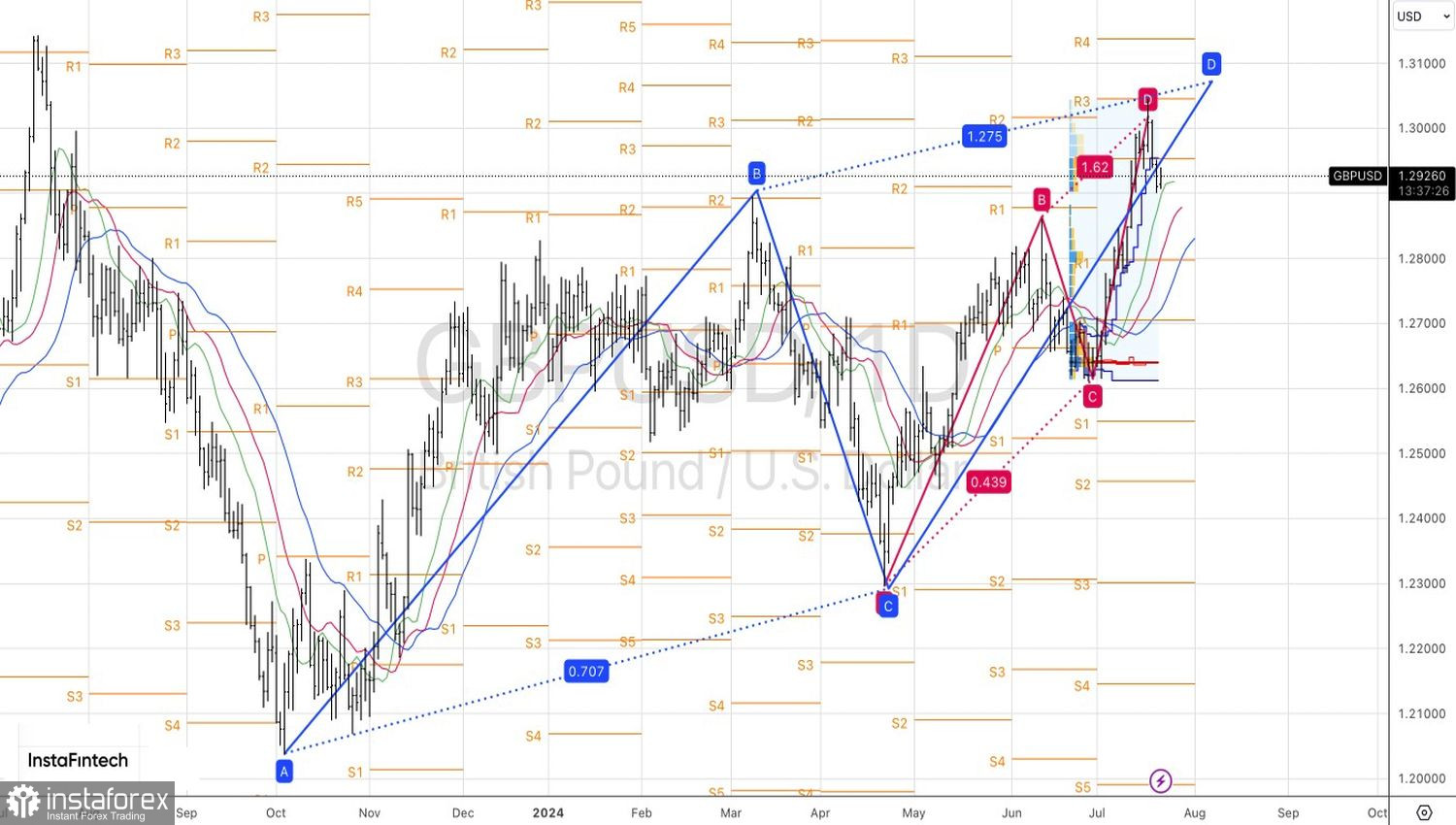

The passivity of the Bank of England is one of the main drivers of sterling's success in 2024. Other advantages for the GBP/USD bulls include the acceleration of the UK's economic growth and the Labour Party's victory in the parliamentary elections. As a result, the country could have the most stable government in at least five years. Besides, a decline in GDP growth divergence with the US allows banks and investment companies to forecast further strengthening of the British pound. JP Morgan, for example, believes it will rise to $1.35 by March 2025, while Goldman Sachs pinpoints this level in the long term.

Speculators are also in the game. By the week ending July 16, hedge funds and asset managers had increased net longs on sterling to the highest level since 2007. It is not surprising that global cyber outages, related corrections in American stock indices, and worsening global risk appetite enabled traders to close long positions on GBP/USD and triggered a GBP/USD pullback.

Dynamics of speculative positions on GBP/USD

It can't be said that the outlook for the pound is cloudless. A 1.2% month-on-month decline in retail sales in June, three times worse than Bloomberg experts had predicted, indicates excessive optimism about the UK economy. According to the IMF, the Labour Party needs to boost GDP to 2.6% in 2025-2026 to stabilize public debt by 2028-2029 without additional tax hikes or budget cuts. This is an extremely challenging task.

Technically, on the daily GBP/USD's chart, a logical pullback followed after the price reached the 161.8% target level on the minor ABCD pattern. A return of the price above the pivot level of 1.2955, or a rebound from the support levels at 1.288 and 1.2815 will form the basis for long positions on sterling against the US dollar.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română