Today, the GBP/USD pair is going ahead with its corrective decline from the one-year high of 1.3045, reached earlier this week.

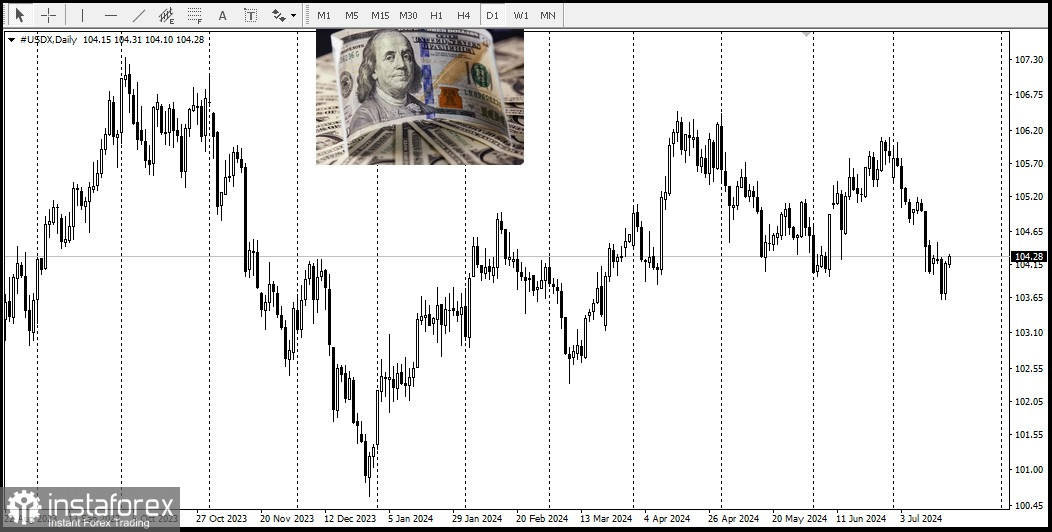

The pound sterling remains depressed for the second day in a row as the US dollar continues to recover.

Concerns over a renewed trade war between the US and China, as well as ongoing geopolitical tensions, are curbing investors' appetite for riskier assets. So, the risk aversion enabled a sudden fall in US stocks, including in Asian markets, which helped the safe-haven dollar consolidate its recovery from a nearly four-month low. Accordingly, this acts as a headwind for the GBP/USD pair.

However, expectations of a September rate cut by the Federal Reserve could keep dollar bulls from an aggressive stance, thereby providing some support for the pound sterling.

On the part of market participants, there is a 100% likelihood that the US central bank will begin a cycle of rate cuts in September. That scenario was bolstered by US initial jobless claims data released on Thursday, which pointed to a weakening labor market. In the context of declining inflation, there are fundamental arguments for the Federal Reserve to begin cutting borrowing costs.

Conversely, following yesterday's higher-than-expected UK CPI, investors are underestimating the possibility of a rate cut by the Bank of England.

In addition, higher-than-estimated UK GDP growth of 0.4% in May could provide support to the British pound and also help limit losses in the GBP/USD pair.

To assess new trading opportunities, it makes sense to wait for the New York session and the remarks of influential FOMC members, which will encourage demand for the US dollar, opening up short-term trading opportunities.

Meanwhile, spot GBP/USD seems to be ready for losses.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română