And the last shall be first. What is currently happening in the US stock market can only be described as a redistribution of investment portfolio structures. For most of the year, the top-10 companies in the S&P 500 outperformed the broader stock index by 1.5-2.0 times, while other issuers did not grow by even 5%. In July, it was time for a reassessment.

The hallmark of 2024 has become the slogan: American stocks will continue to rise no matter what news comes in. In the first quarter, the US economy delivered pleasant surprises, and the S&P 500 confidently moved north, hoping its strength would increase corporate earnings. Mid-year, investors' attention shifted to rumors of an imminent easing of Federal Reserve monetary policy. The news was bad, yet the broad stock index continued to rise on expectations that an economic slowdown would push the central bank to cut rates.

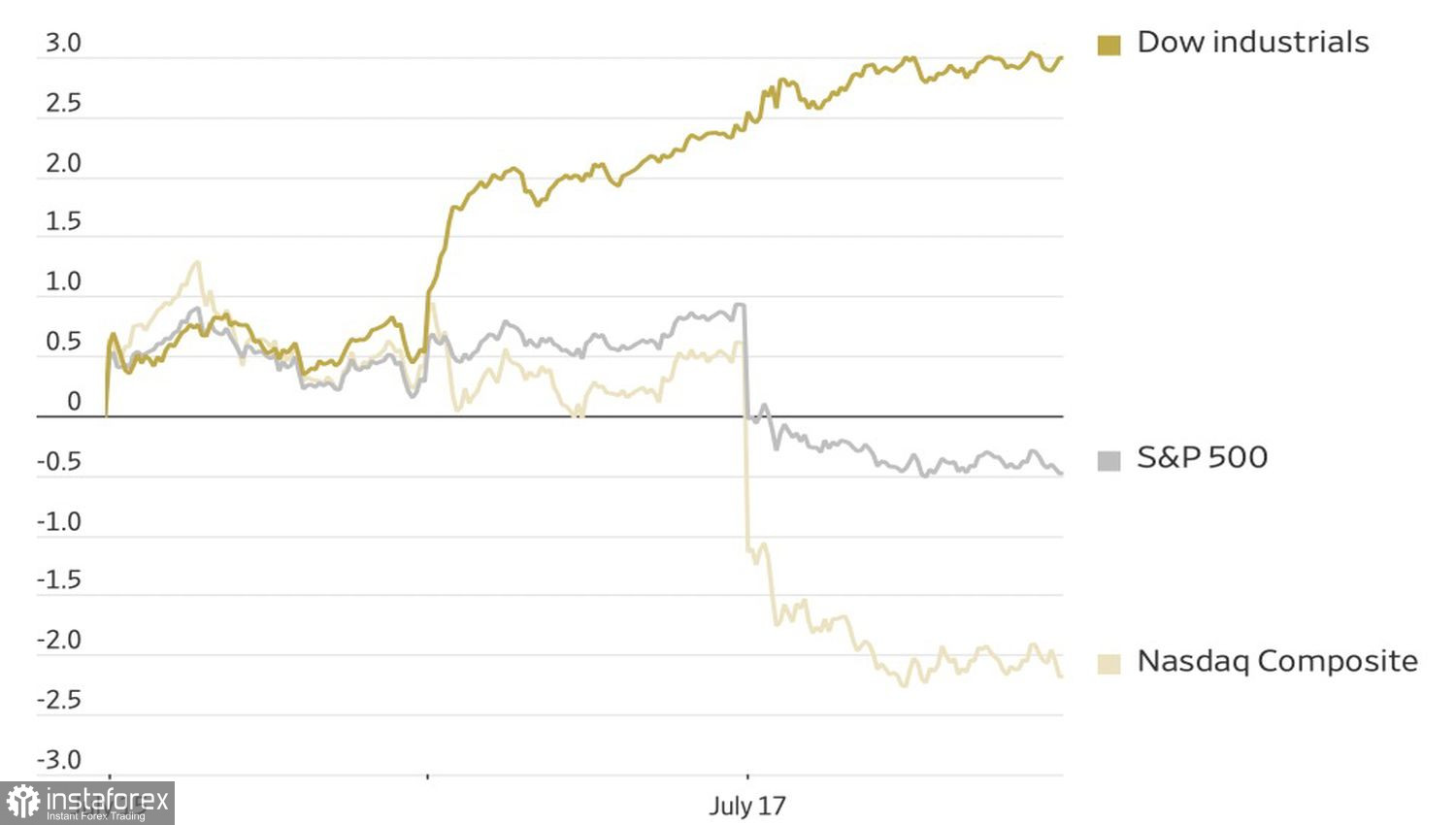

Do not be afraid of the correction of the US stock market. Other securities will benefit from monetary expansion. Not the ones that were actively bought in the first half of 2024. There is a change in the structure of the portfolio. A typical example is the first increase in the Dow Jones index since 1999 against the background of a fall in the S&P 500 by 1% or more.

Dynamics of US stock indices

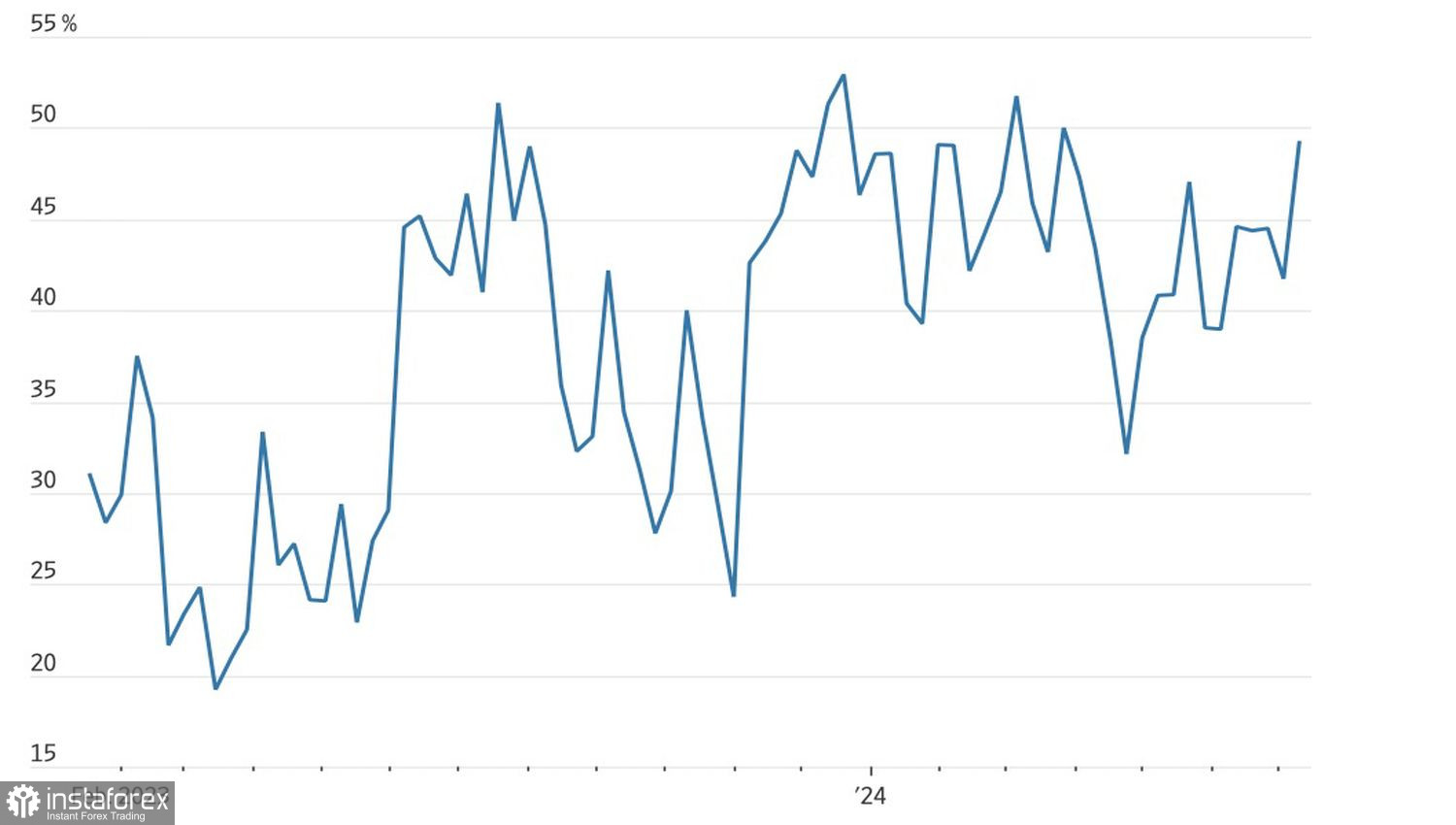

The following factors indicate that the equity market remains fundamentally strong. First, the share of optimists among respondents in the American Association of Individual Investors survey increased to 49%. For 35 of the last 36 weeks, this indicator has been above its historical average. Second, US equity funds recently recorded the largest weekly inflow in a year, and BlackRock said that its iShares ETF raised $150 billion in January-June, twice as much as in the same period in 2023.

Finally, the S&P 500 rally is being promoted by Trump trading. The Republican intends to raise import tariffs, which will slow down the economies of China, the Eurozone, and other countries. This will bring back the theme of American exceptionalism to the markets and accelerate capital inflows into North America. He is focused on reducing fiscal stimulus, which will boost US GDP, contribute to corporate earnings growth, and increase stock prices..

Dynamics of the share of optimists in the US stock market

Alas, there are pitfalls in everything. Donald Trump's statement that Taiwan should pay for its security and that the US is like an insurance organization caused NVIDIA and other tech giants' stocks to plummet, leading to a decline in the S&P 500. Taiwan's difficulties threaten chip manufacturers. It's no surprise that stocks are being offloaded.

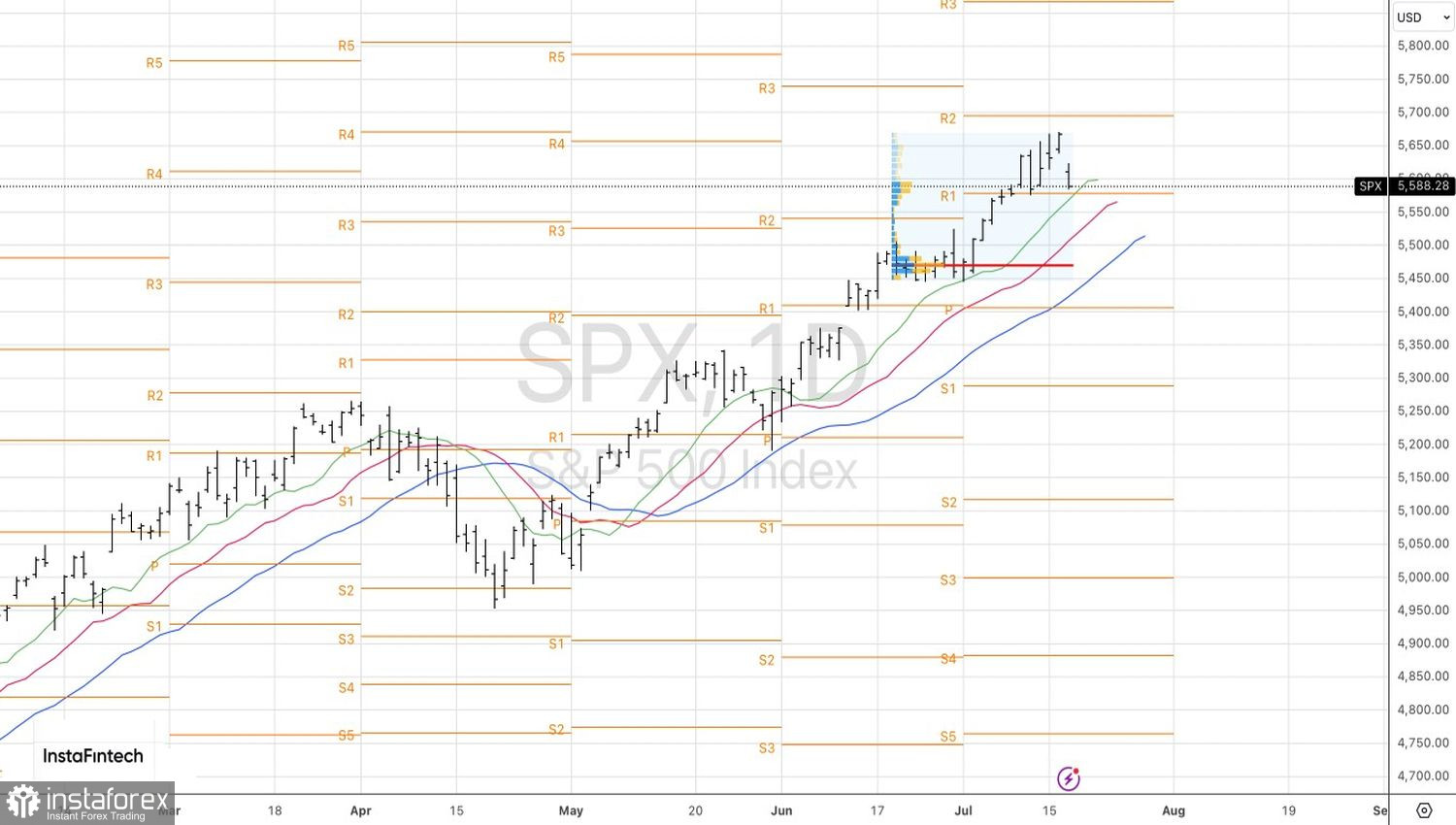

Technically, on the daily chart, after reaching the first of two previously set targets at 5650 and 5800, the S&P 500 returns to the ascending trend. This pullback risks gaining momentum if it breaks the support at 5577. Nevertheless, a rebound from the pivot level at 5530 and the fair value at 5473 will be a basis for purchases.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română