The dollar continued to lose ground on Friday, but once the U.S. session opened, a slight rebound began. This was due to the Producer Price Index, which showed that the headline PPI increased from 2.4% to 2.6%, coming in above the expected 2.3% growth. Based on these data, there is a risk that the current slowdown in inflation in the United States may be temporary, and it could start rising again at any moment. This, of course, could alter the pace of the Federal Reserve's monetary policy easing.

Today, the market will primarily focus on the Eurozone industrial production report, where the rate of decline is expected to slow from -3.0% to -2.0%. This could potentially push the euro to rise to Friday's highs.

However, the influence of political factors has sharply increased. After the failed assassination attempt on Donald Trump, the presidential race in the United States has taken on an unpredictable turn. Due to the uncontrollable nature of political risks, investors will clearly try to minimize them by any means. And the only way to do this is by reducing dollar assets. Therefore, the main news from now on will be domestic political news from the U.S..

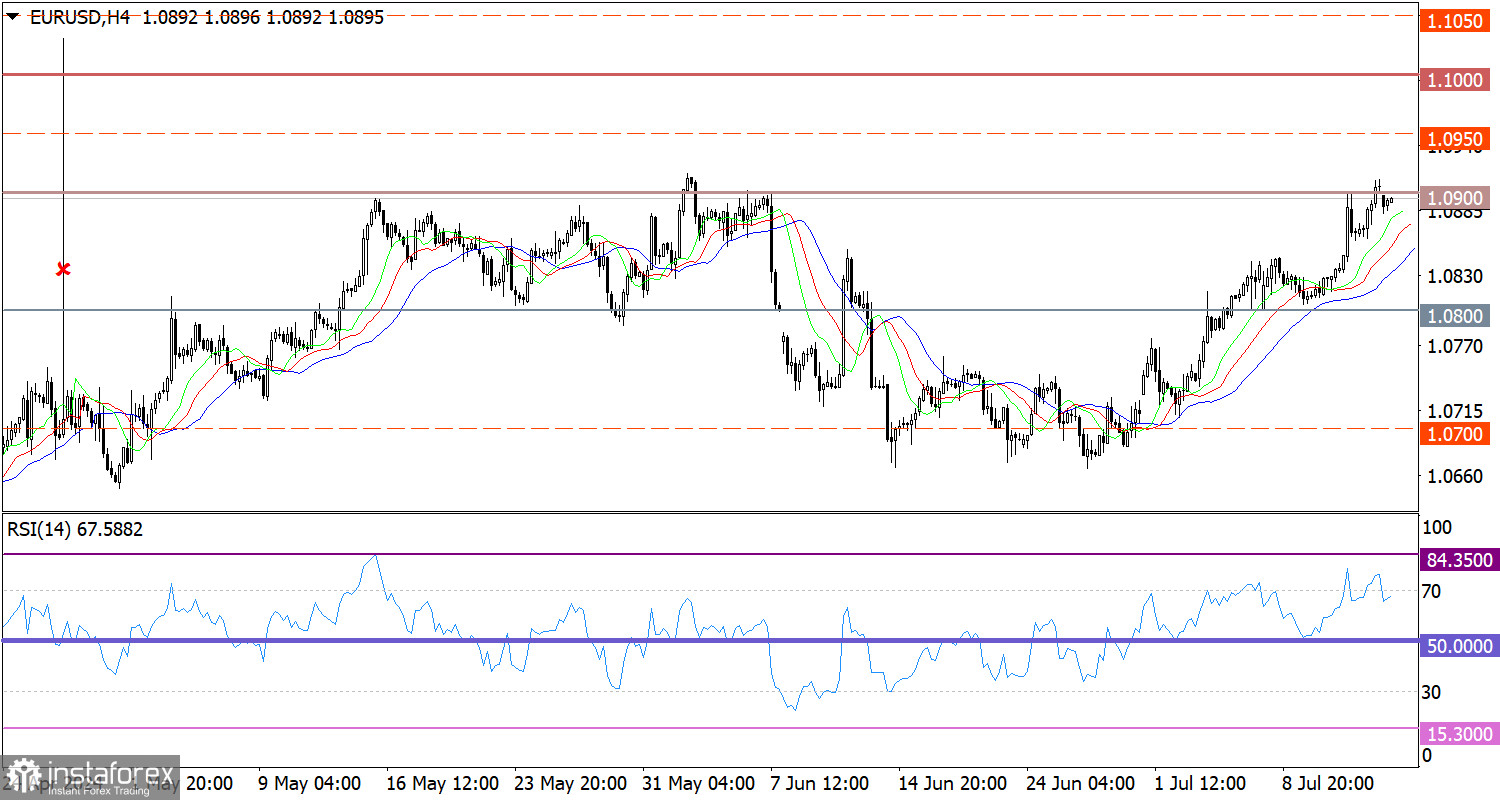

EUR/USD closed last week above the 1.0900 level, thus reflecting bullish sentiment among traders.

On the 4-hour chart, the RSI technical indicator is hovering in the upper area, which suggests that the euro may rise further.

On the same chart, the Alligator's MAs are headed upwards, which reflects the quote's movement.

Outlook

Keeping the price above the level of 1.0900 may lead to an increase in the volume of long positions. In this scenario, the euro could move towards the resistance level of 1.1000. As for the alternative scenario, based on signs of overbought conditions in the short-term, coupled with the resistance level of 1.0900, the price could remain stagnant or even retreat.

The complex indicator analysis unveiled that in the short-term and intraday periods, indicators are providing an upward signal.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română