It should be remembered how it all started. Last week, Nonfarm Payrolls reports, unemployment, ISM and ADP indices turned out to be weaker than traders' expectations. Well, the dollar has fallen. This week, the first important report on American inflation finally finished off the dollar. And today, on Friday, not a single report has yet been published, and the US currency has already managed to collapse by another 25 points. In my opinion, we are already talking about a collapse. When we observe a collapse, we are not talking about the information background, its clear analysis, and appropriate reaction. The market is now just getting rid of the dollar almost in a panic.

And in my opinion, there is no reason to panic. Moreover, most market participants now expect the Fed to cut the rate in September (the probability of this reaching 85%), and, meanwhile, the ECB (whose currency is growing nonstop) began to lower the rate last month. This fact caused a restrained fall in the euro currency, and the fact of a future Fed rate cut caused the collapse of the American one.

I am not a supporter of the point of view that the dollar is falling undeservedly, but I also do not support its collapse. I believe that the current information background is much more even than the market draws it for us on the charts. In the current circumstances, I believe that a graphic picture is a more important tool than an information background. Since the market is trading impulsively, it is the graphics and technical analysis that will show us when the mood starts to change. And, in my humble opinion, this moment will not be associated with another report or performance.

I would also like to note separately that Jerome Powell has not softened his rhetoric in Congress this week. Some traders and analysts found "dovish" hints in Powell's words, but in fact, the Fed's PREP still depends only on the inflation rate. If inflation rises by the end of July and August (which cannot be completely excluded), then in September the regulator will again postpone the first easing.

Conclusion:

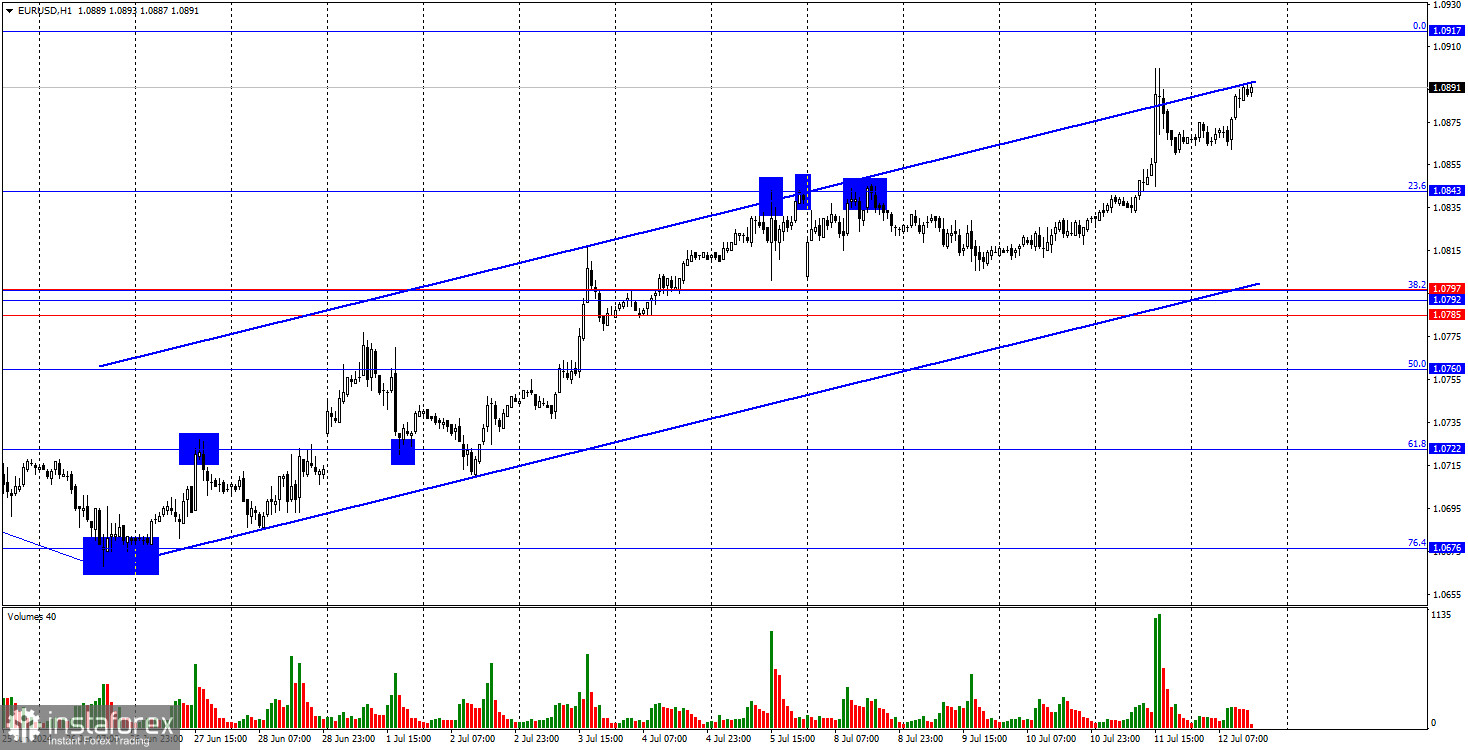

The trend for the EUR/USD pair changed to bullish last week and continues this week. As I said above, I don't think the dollar should have fallen that much in the last two weeks. Therefore, I expect a fairly strong pullback downwards. You can now focus on the upward trend channel on the hourly chart. It is he who has the best chance to show when the "bullish" fuse runs out. And it can run out today, Monday, or next Friday. We can see that there has not been any news yet today, and the dollar continues to fall.

Thus, I consider it impractical to buy a pair at peaks. Of course, the euro may rise to the level of 1.1500, but I still do not see how the bulls can continue their attacks. I expect a rebound from the upper line of the channel on the hourly chart and a fall to the support zone of 1.0785–1.0797. Next, everything will depend on the price behavior near the lower line of the channel.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română