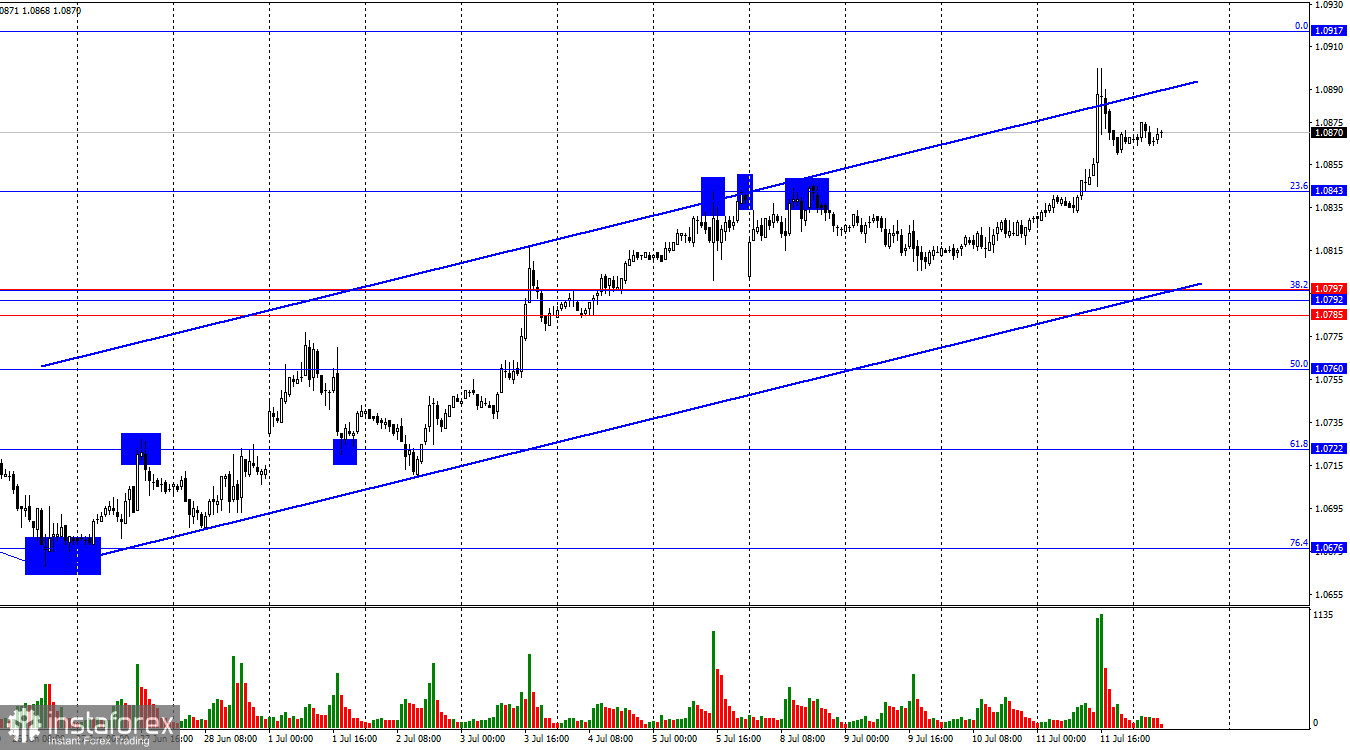

The EUR/USD pair consolidated above the corrective level of 23.6%-1.0843 on Thursday and continues to rise towards the corrective level of 0.0%-1.0917. Yesterday, the US dollar took another "blow of fate" in the form of an inflation report, which became the main reason for the bears' new retreat. The ascending trend channel signals a "bullish" trend in the market.

The situation with the waves has become more complex. The new upward wave broke the peak of the previous wave and continues to form, while the last completed downward wave failed to break the low of the previous wave. Thus, there were two signs of a trend change from "bearish" to "bullish." Last week, the bulls received support from an important informational background, which led to a confident rise in the pair. This week, only one inflation report in the US clearly pointed to the fall of the dollar, but it was enough for a new rise in the pair.

The informational background on Thursday once again did not give the bears a single chance. US inflation slowed more than traders expected, which served as the basis for new sales of the dollar. In my opinion, besides this report, nothing else this week pushed traders to sell the US currency. Some experts believe that Jerome Powell softened his rhetoric regarding monetary policy, but I don't think that's the case. Powell once again said the sacramental phrase that the Fed is ready to start easing policy, but more data is needed to ensure inflation is moving steadily toward 2%. We have been hearing this phrase every month since January. All this time, inflation in America has been in the range of 3.0-3.7%, so every time Powell talks about being ready to ease, but "inflation must be on the path to 2%." We did not hear anything new this week. Nevertheless, the market has figured out everything it needs by itself. Now it is confident in a rate cut in September.

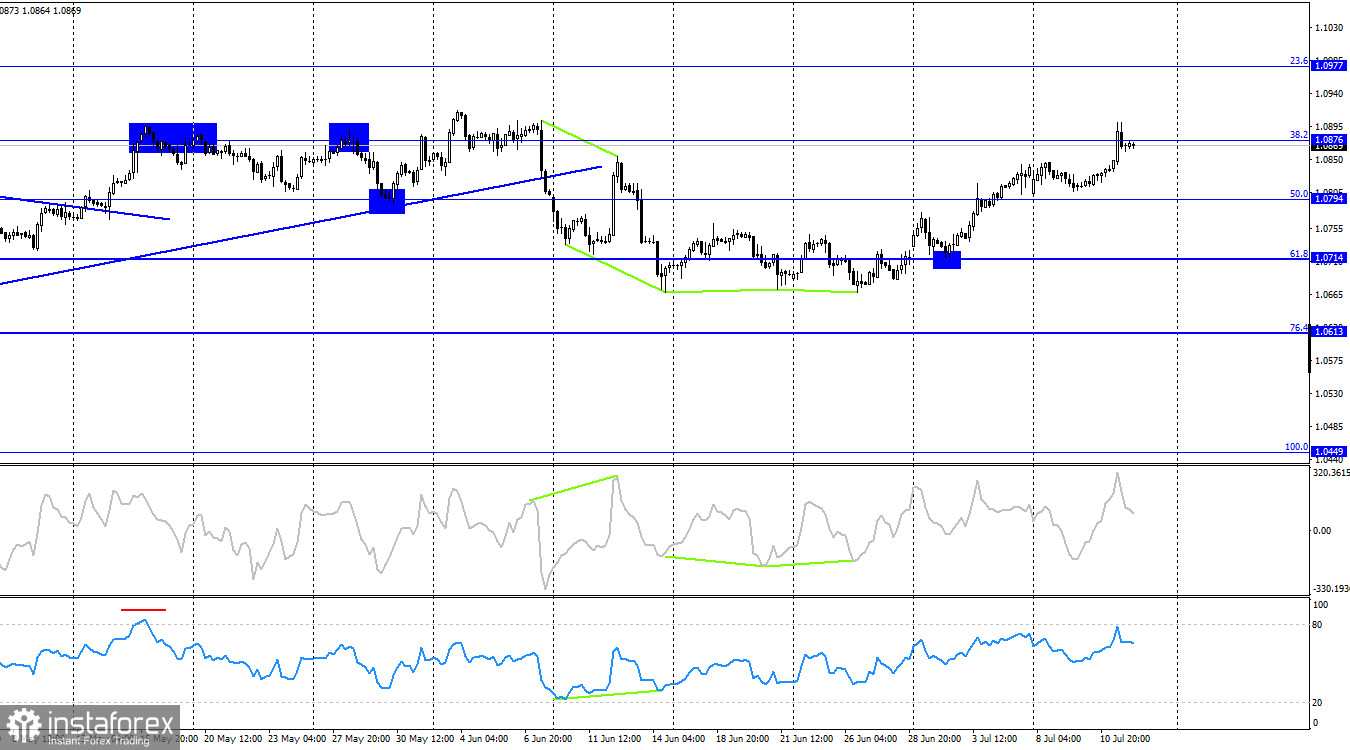

On the 4-hour chart, the pair performed a new reversal in favor of the euro after forming a new "bullish" divergence with the CCI indicator and rebounding from the corrective level of 61.8%-1.0714. Later, the pair consolidated above the Fibonacci level of 50.0%-1.0794 and reached the corrective level of 38.2%-1.0876. A rebound from this level will favor the US currency and some decline towards 1.0794. Closing above 1.0876 will increase the likelihood of continued growth towards the next Fibonacci level of 23.6%-1.0977. No emerging divergences are observed in any of the indicators today.

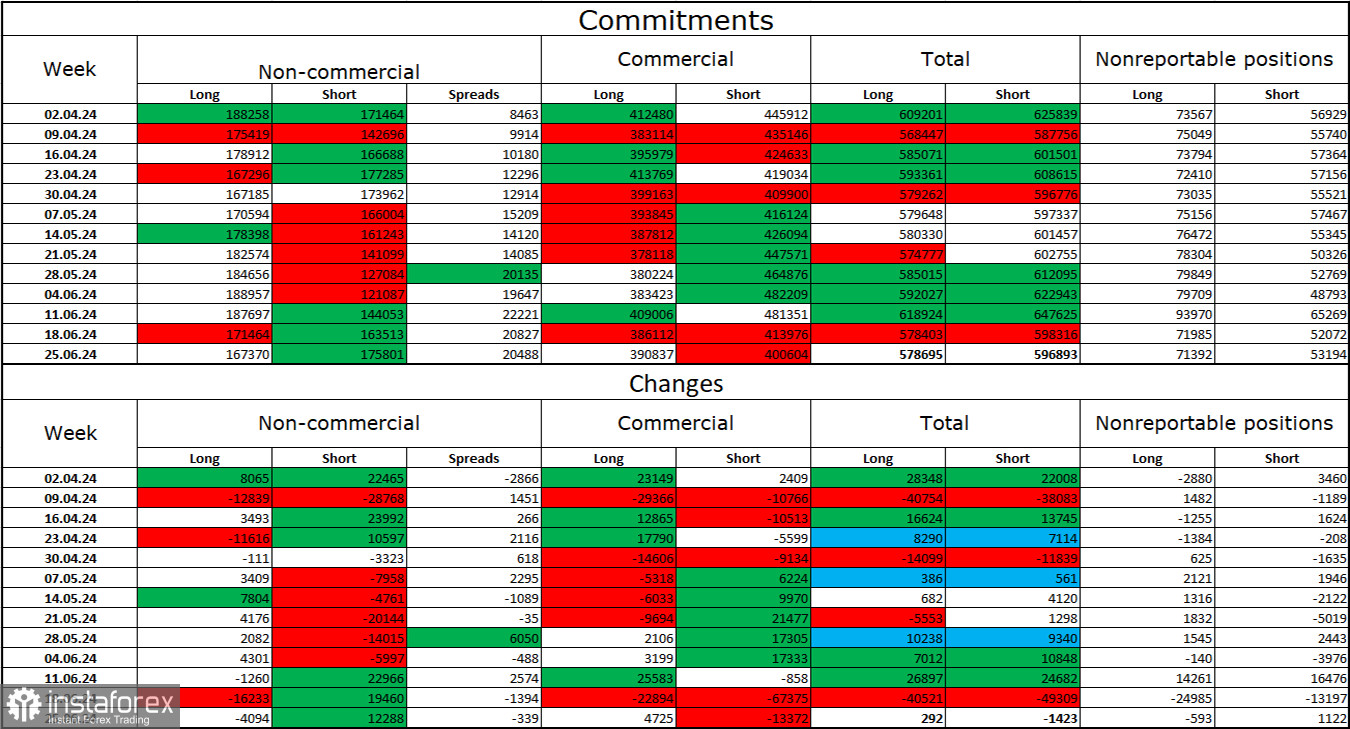

Commitments of Traders (COT) Report:

During the last reporting week, speculators closed 4,094 long positions and opened 12,288 short positions. The sentiment of the "Non-commercial" group turned bearish a few weeks ago and is currently intensifying. The total number of long positions held by speculators now stands at 167,000, while the number of short positions is at 175,000.

I still believe that the situation will continue to shift in favor of the bears. I do not see long-term reasons to buy the euro, as the ECB has begun easing monetary policy, which will lower the yields of bank deposits and government bonds. In America, they will remain at high levels for at least several more months, making the dollar more attractive to investors. The potential for a decline in the euro is substantial even according to the COT reports. The number of short contracts among professional players is increasing.

News Calendar for the US and the Eurozone:

USA – Producer Price Index (12:30 UTC).

USA – University of Michigan Consumer Sentiment Index (14:00 UTC).

The economic events calendar for July 12 includes two not very significant entries. The influence of the informational background on trader sentiment today might be weak.

Forecast for EUR/USD and trading advice:

Selling the pair is possible today upon a rebound from the level of 1.0917 on the hourly chart with a target of 1.0843. Buying was possible when closing above 1.0843 with a target of 1.0917. These trades can still be kept open, but the likelihood of a correction is higher today. Unless the US reports again disappoint the bears.

Fibonacci levels are constructed from 1.0602 to 1.0917 on the hourly chart and from 1.0450 to 1.1139 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română