Inflation in the United States was expected to decrease from 3.3% to 3.1%, which in itself convinced the market of the imminent start of monetary policy easing by the Federal Reserve. However, US consumer inflation eased to 3.0% in June. As a result, the dollar immediately started to lose its positions quite significantly. The market is now convinced of two Fed rate cuts by the end of the year. The first rate cut is expected in September, and the second in December. These forecasts and expectations are quite justified. So, locally, the market is entering a phase where the USD stays lower. Of course, there will be pauses and minor pullbacks along this path. Something similar was observed yesterday, closer to the end of the U.S. trading session. Most likely, the pullback will continue today, and the market will try to settle slightly below current values. After that, the pair could move towards the dollar's decline.

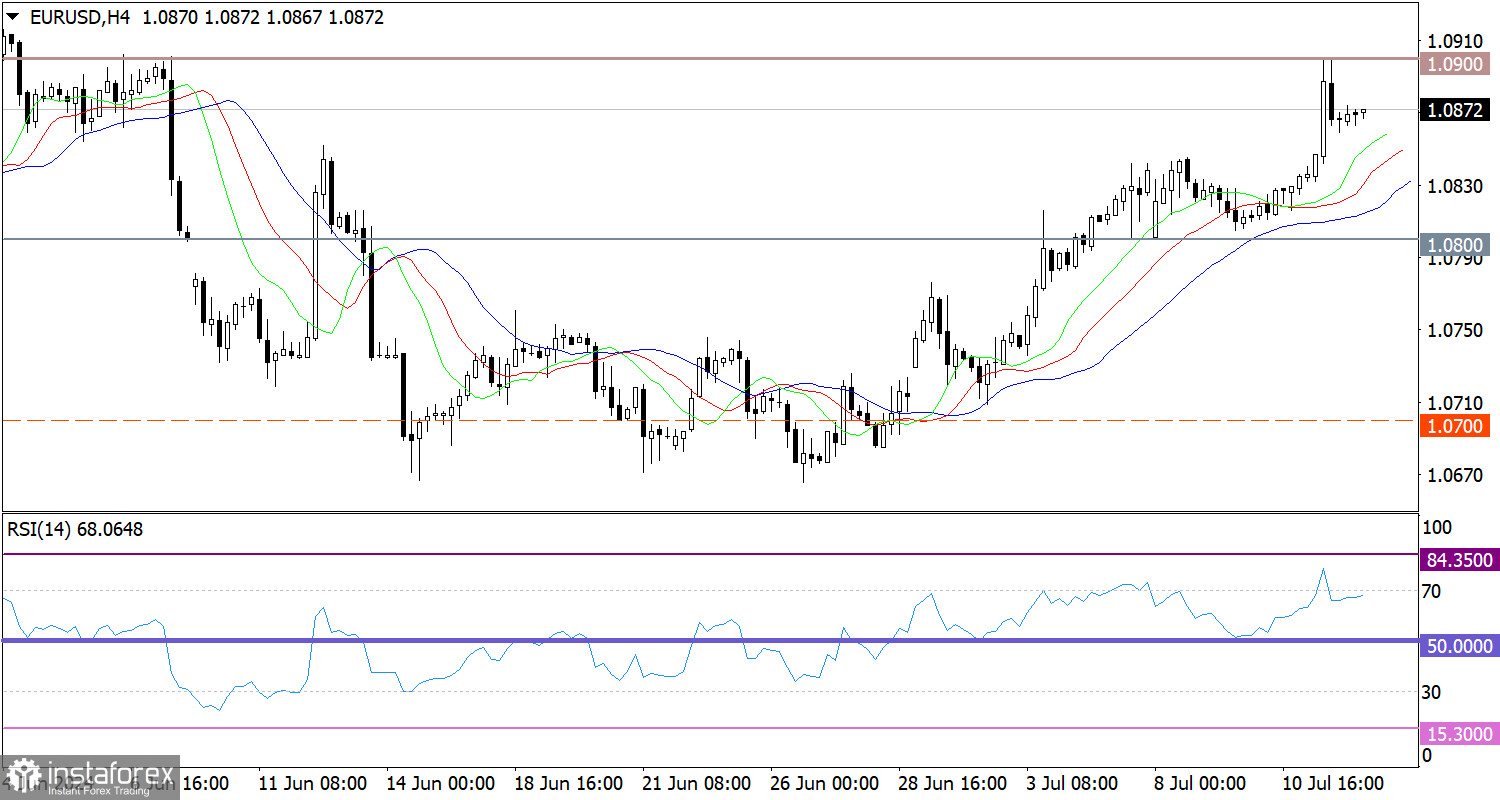

During speculative growth, EUR/USD almost reached the level of 1.0900, and the volume of long positions decreased. As a result, the market experienced a minor pullback, which can be considered a process of regrouping trading forces.

On the 4-hour chart, the RSI locally ended up in the overbought zone when it reached the resistance level of 1.0900.

On the same chart, the Alligator's MAs are headed upwards, which reflects the quote's movement.

Outlook

To start a new wave of growth, the price must settle above the 1.0900 level. Otherwise, the current pullback may linger in the market.

In terms of complex indicator analysis, a pullback is likely in the short term. Indicators signal an upward cycle in the intraday period.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română