Analysis of Trades and Tips for Trading the EuroDue to the low market volatility, the levels I identified were not tested. The data on the German Consumer Price Index fully matched economists' forecasts, and the euro did not react, which was expected. The absence of other statistics from the Eurozone also played its part. However, the second half of the day might be quite different.We are expecting June data on the Consumer Price Index, the Core Consumer Price Index excluding food and energy prices, weekly initial jobless claims in the US, and a speech by FOMC member Raphael Bostic. Well, if the last two fundamental events do not help us, then the inflation data can make a lot of noise – especially if they differ from economists' forecasts.The growth of inflation in the United States is higher than expected – the growth of the dollar and the fall of the euro. If inflation falls towards the Fed's target level, the dollar will weaken, and the euro will rise. I plan to act based on Scenario #1 despite the MACD indicator readings for intraday strategy, as I expect strong directional movement following the statistics release.

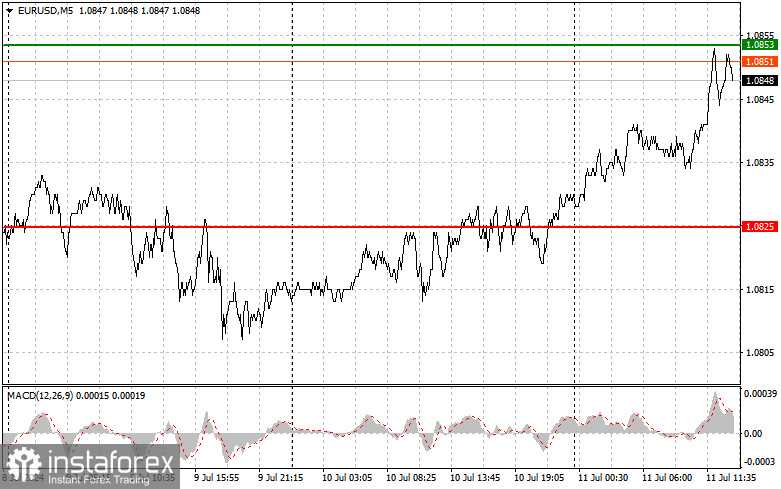

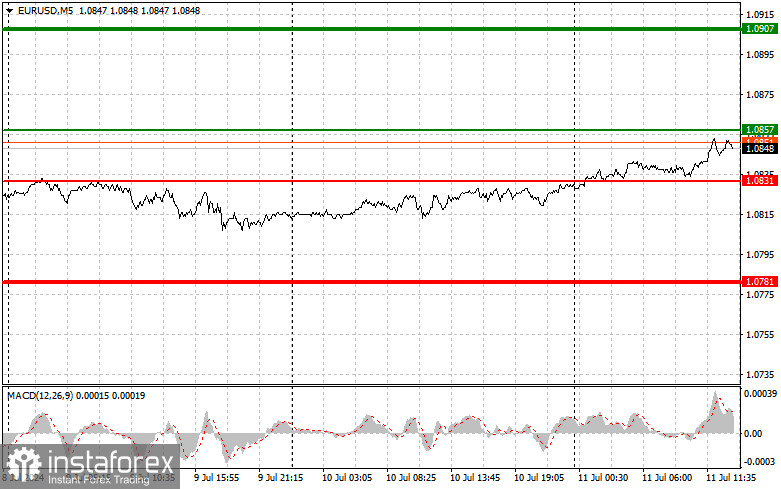

Buy signal Scenario No. 1: today I plan to buy euros when the price reaches 1.0857 (the green line on the chart) in order to grow to the level of 1.0907. At 1.0907, I will exit the market, as well as sell euros in the opposite direction, counting on a movement of 30-35 points from the entry point. A strong upward movement in the euro can be expected after weak US inflation data. Important! Before buying, ensure that the MACD indicator is above the zero mark and starting its upward movement.Scenario #2: I also plan to buy the euro today in the event of two consecutive tests of the 1.0831 price when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. Expect growth to the opposite levels of 1.0857 and 1.0907.Sell SignalScenario #1: I will sell the euro after it reaches the 1.0831 level (red line on the chart). The target will be 1.0781, where I plan to exit the market and buy the euro in the opposite direction, expecting a movement of 20-25 points from the level. Pressure on the pair will return if there is a failed attempt to break the daily high and news of rising US inflation. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just starting its downward movement.Scenario #2: I also plan to sell the euro today if the price of 1.0857 is tested twice consecutively when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward market reversal. Expect a decline to the opposite levels of 1.0831 and 1.0781.

Chart Key:

- Thin green line – entry price for buying the trading instrument.

- Thick green line – anticipated price for placing Take Profit or manually fixing profits, as further growth above this level is unlikely.

- Thin red line – entry price for selling the trading instrument.

- Thick red line – anticipated price for placing Take Profit or manually fixing profits, as further decline below this level is unlikely.

- MACD Indicator – It is important to consider overbought and oversold areas when entering the market.

Important Advice for Beginner Forex Traders:

- Be very cautious when making market entry decisions. It is best to stay out of the market before releasing important fundamental reports to avoid getting caught in sharp price fluctuations.

- If you decide to trade during news releases, always set stop orders to minimize losses. You can quickly lose your entire deposit without stop orders, especially if you don't use money management and trade large volumes.

- Remember that you need a clear trading plan, like the one presented above, for successful trading. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for an intraday trader.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română