EUR/USD

Ahead of the release of the US inflation data, stock indexes suddenly showed solid gains, with the S&P 500 gaining more than 1%. Oil and gold also increased in price. However, yields on US government bonds remained almost unchanged, which holds us back from making premature conclusions. Media reports suddenly started expressing opinions about inflation decreasing as if it were an almost accomplished fact, despite Federal Reserve Chief Jerome Powell's hawkish tone during his speeches before Congress. There is a possibility that a surprise is being prepared for imprudent investors.

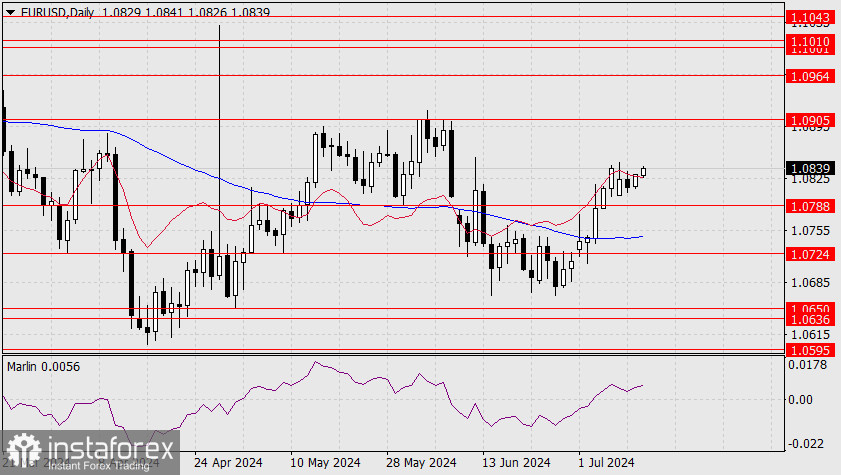

Currently, the euro is above the balance indicator line. In addition, the Marlin oscillator, being in the positive area, has turned upward. The price remains below the recent high from July 8th, so even now, the euro remains in a sideways trend. As before, we expect worse data from the US CPI (above the forecasted 3.1% y/y for the overall index) and counter-dollar currencies to show weakness.

On the 4-hour chart, the price is rising above the indicator lines, but the Marlin oscillator is growing much slower than the price, trying to stay in the downward trend territory. A sign of a price reversal will be its consolidation below the MACD line (1.0803). Next, the euro will struggle with the support at 1.0788. An alternative scenario suggests that the price will rise to the target level of 1.0905.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română