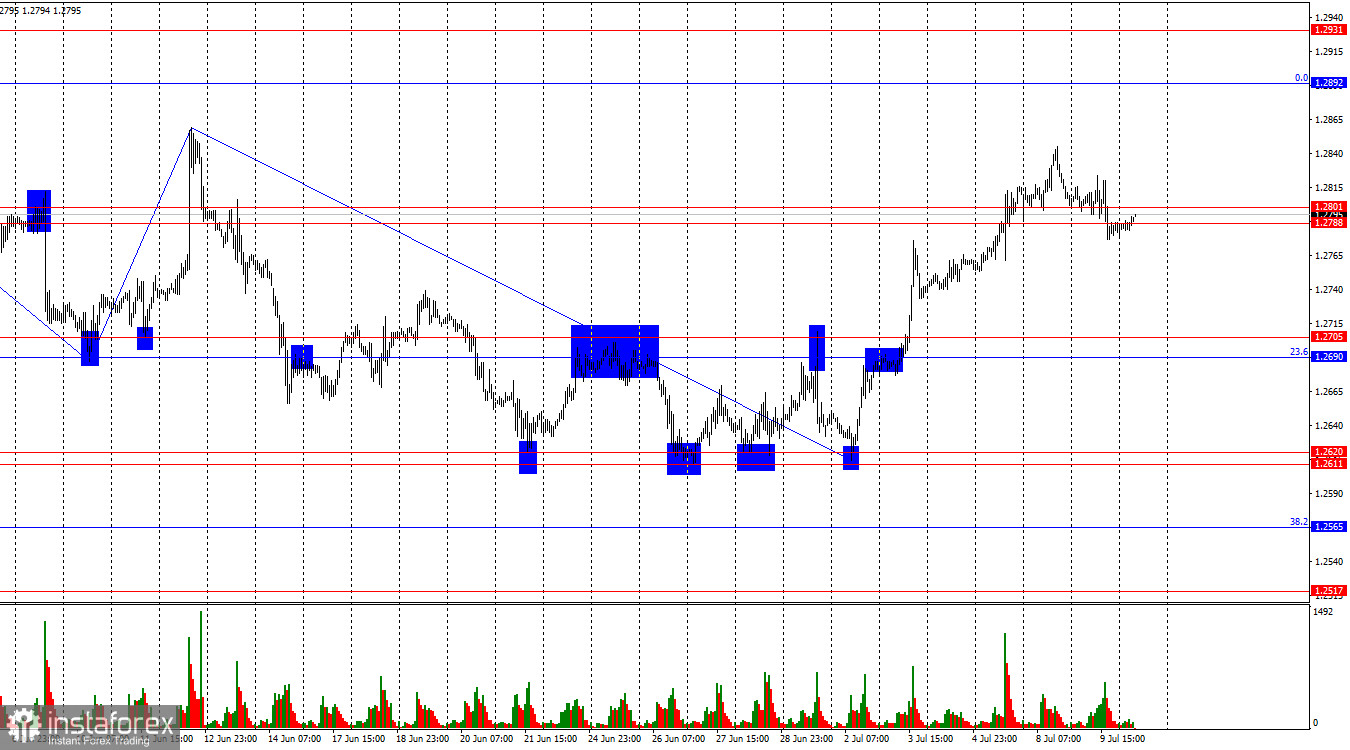

On the hourly chart, on Tuesday, the GBP/USD pair managed to secure itself below the support zone of 1.2788–1.2801, allowing it to continue falling towards the support zone of 1.2690–1.2705. Securing quotes above the zone of 1.2788–1.2801 will again favor the pound and resume growth towards the corrective level of 0.0%–1.2892.

The wave situation remains unchanged. The last downward wave (which has been forming since June 12) managed to break the low of the previous wave, while the new upward wave (currently forming) has yet to reach the peak of the previous wave at 1.2859. Therefore, the trend for the GBP/USD pair remains "bearish." I am cautious about concluding the "bearish" trend, as bears still regularly show weakness, and the informational background often makes their further attacks impossible. Last week, they had to retreat due to news from the US. The "bearish" trend will officially be broken after the peak of the last upward wave from June 12 – 1.2859 – is breached.

The informational background on Tuesday needed to be stronger; it was practically absent. Jerome Powell's speech offered nothing new to the market or the dollar. The decline observed throughout the day cannot be directly linked to the FOMC President's speech. Thus, the first half of the current week was uneventful, as evidenced by trader activity. Today, Powell will give a second speech in Congress, but before a different committee. Since the text of his speech is available on the Fed's website, I expect it to remain the same during the second speech. Therefore, traders should focus on the upcoming US inflation report and GDP data from the UK.

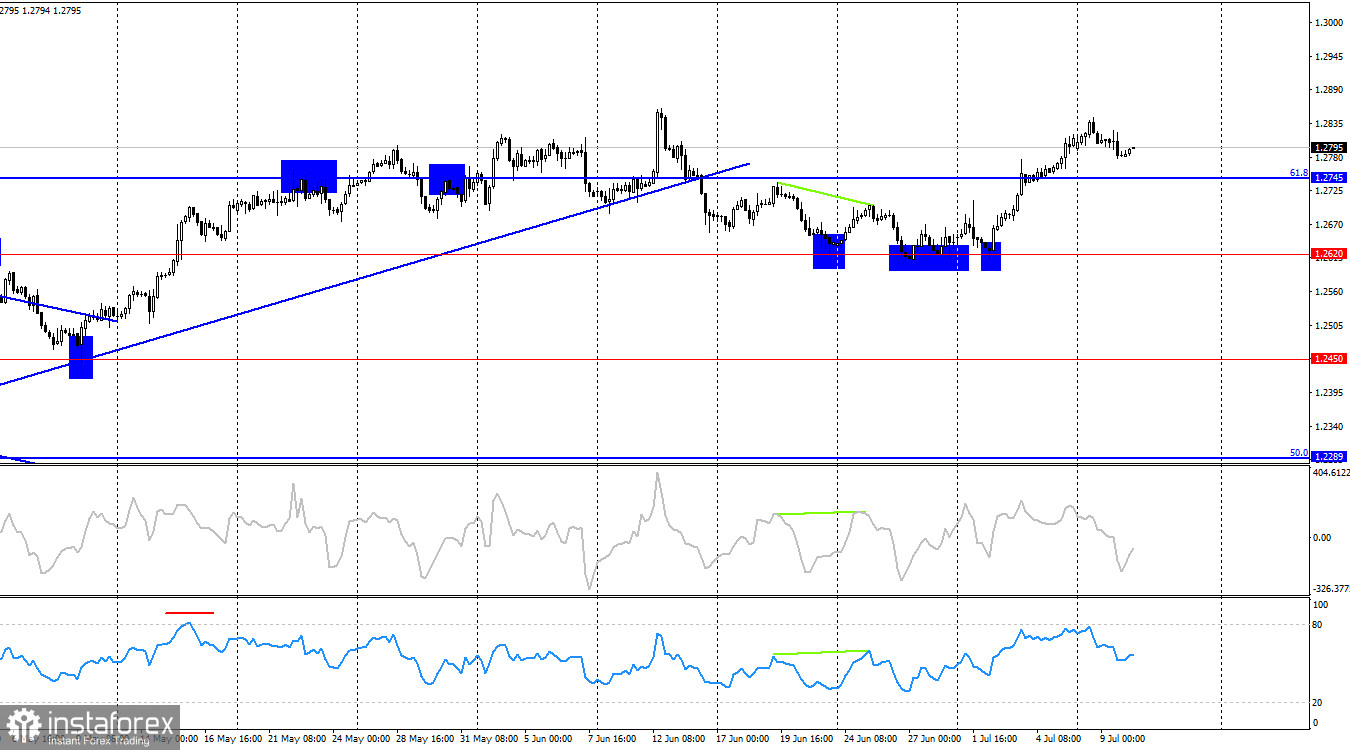

On the 4-hour chart, the pair favored the British currency after four bounces off the level of 1.2620, followed by securing above the corrective level of 61.8%–1.2745. The 4-hour chart shows no obstacles to further growth of the pound up to the level of 1.3044. Bears couldn't even break through the simplest level. At this time, the pound has good graphical growth prospects.

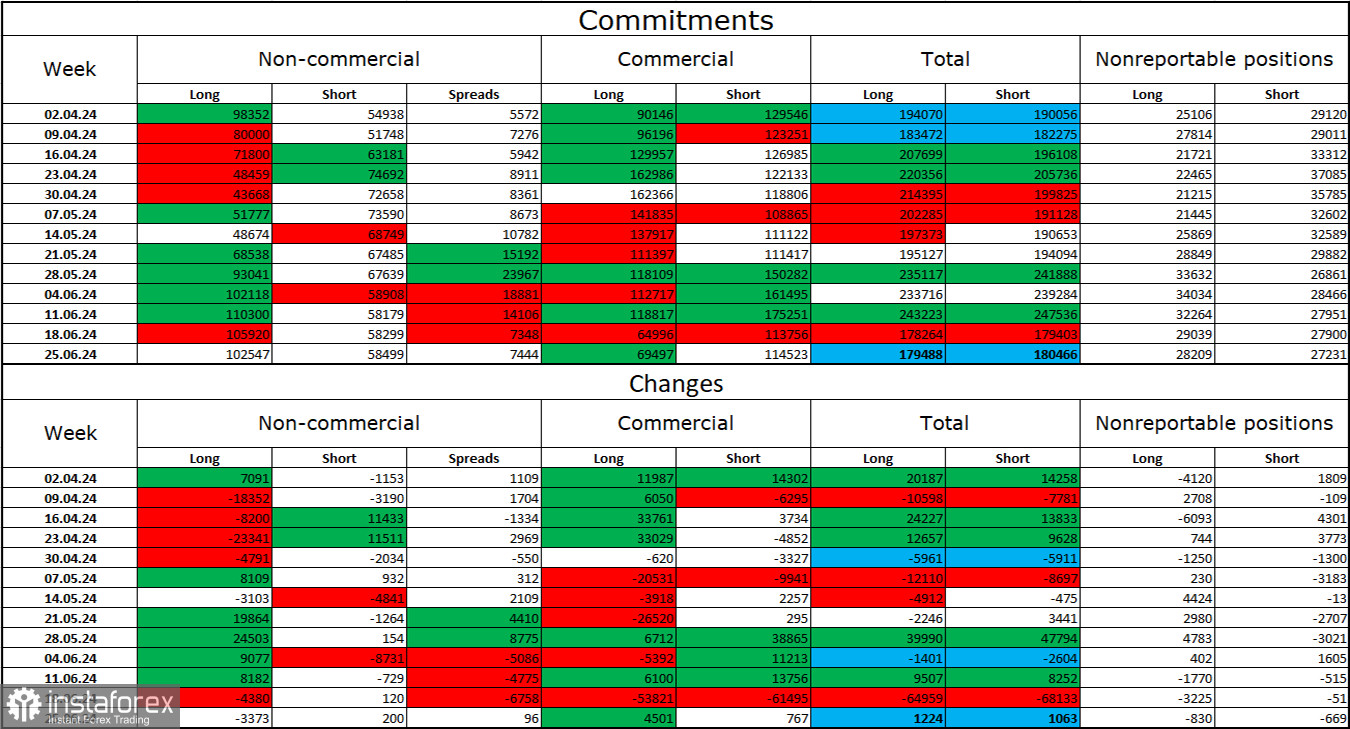

Commitments of Traders (COT) Report

The sentiment of the "Non-commercial" trader category became slightly less "bullish" over the last reporting week. The number of long positions held by speculators decreased by 3,373 units, while the number of short positions increased by 200. Bulls still have a solid advantage. The gap between long and short positions is 44,000: 102,000 against 58,000.

The pound still has prospects for a decline. The graphical analysis has already issued several signals of a broken "bullish" trend, and bulls cannot keep attacking forever. Over the last three months, the number of long positions has increased from 98,000 to 102,000, and the number of short positions from 54,000 to 58,000. Over time, large players will continue to dispose of long positions or increase short positions, as all possible factors for buying the British pound have already been accounted for. However, it should be remembered that this is merely an assumption. The graphical analysis still indicates the weakness of bears, who can't even "take" the level of 1.2620.

News Calendar for the US and UK:

- USA – Speech by Fed President Jerome Powell (14-00 UTC).

The economic events calendar contains only one entry on Wednesday. Unless Powell makes unexpected statements, the informational background's impact on market sentiment today might be weak or absent.

Forecast for GBP/USD and Trader Tips:

Selling the pound was possible when closing below the zone of 1.2788–1.2801, targeting 1.2690–1.2705. Buying could have been considered after rebounding from the zone of 1.2611–1.2620 on the hourly chart, targeting 1.2690–1.2705. Then, after closing above the zone of 1.2690–1.2705, targeting 1.2788–1.2801. Both targets have been reached. New buys are possible when securing above the zone of 1.2788–1.2801, targeting 1.2892.

Fibonacci level grids are built on 1.2036–1.2892 on the hourly chart and 1.4248–1.0404 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română