EUR/USD experienced low volatility for most of the day. We constantly mention this aspect because we consider it essential. If there are no movements in the market, what is the point of opening trades, and how can one expect to make a profit? Yesterday, the pair did turn down around its previous local high. Now we can expect it to fall back to the Murray level "-1/8" - 1.0681. Let us remind you that globally, the pair is not in a downtrend but in a sideways trend. The 24-hour timeframe clearly shows that in recent months, most of the trades have taken place between the levels of 1.0650 and 1.1000. The price briefly left this range twice. Therefore, we don't expect the euro to start a sharp upward movement. It failed to break through the last local high, the last medium-term high, so the global downward trend gradually continues. The euro will gradually fall but it will continue to show very weak movements. However, this is precisely what the volatility indicator tells us right now.

We do not understand how the euro can rise in the long term if the European Central Bank has started easing monetary policy and has begun increasing the negative gap from the Federal Reserve in terms of the rate. The euro's rise under such fundamental conditions simply contradicts all types of analysis. Of course, the market can move in a certain way, and market makers and other big players are not obliged to consider the monetary policy of the ECB or the Fed. But a completely different logic works here. If the ECB rate falls and the Fed rate does not, the financial conditions in the US are simply better than in the Eurozone. Investors can place money in bank deposits at a more favorable rate and buy government bonds with higher yields. Therefore, it is not even about the market makers who can move the market in any direction. It's about global economic processes and capital flows.

As for the macroeconomic and fundamental background, the absence of important reports were recorded in the first two days of the week, but there was a speech by Fed Chief Jerome Powell in Congress. We would not draw conclusions about Powell's statements right now because we believe that it is necessary to wait for the second speech, which will take place today. The crux of the matter will not be what Powell says but how he responds to the congressmen's questions. Therefore, we will make conclusions in the next article. However, looking ahead, it is extremely difficult to expect Powell to soften his rhetoric at this time. This could be expected if the next US inflation report shows a significant slowdown. But this report will be released on Thursday, so Powell will not have grounds to change his rhetoric to a more dovish one. The current level of inflation still does not allow for the first rate cut to be expected in September or October, at best in December.

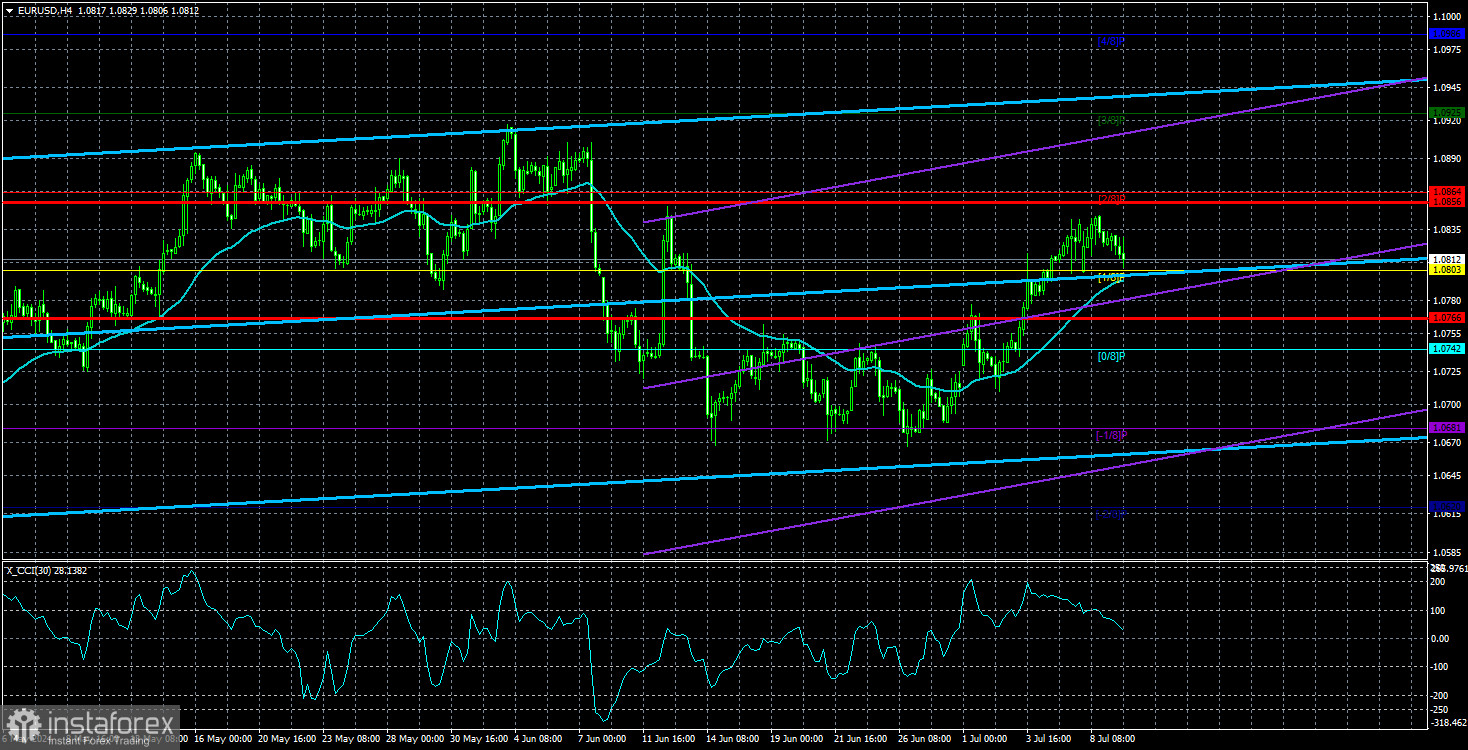

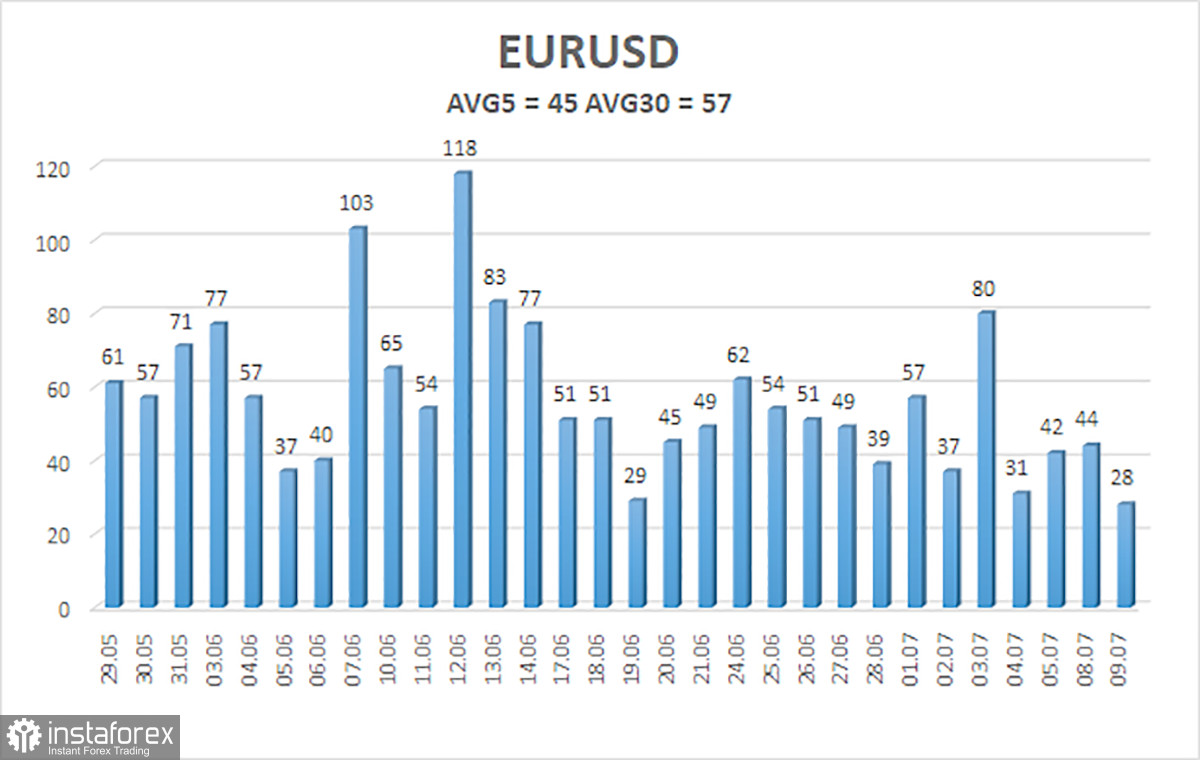

The average volatility of the EUR/USD pair over the last five trading days as of July 10 is 45 pips, which is considered a low value. We expect the pair to move between 1.0766 and 1.0856 on Wednesday. The higher linear regression channel is directed upwards, but the global downward trend remains intact. The CCI indicator entered the oversold area, but it has already been more than compensated by the bullish correction.

Nearest support levels:

S1 - 1.0803

S2 - 1.0742

S3 - 1.0681

Nearest resistance levels:

R1 - 1.0864

R2 - 1.0925

R3 - 1.0986

Trading Recommendations:

EUR/USD maintains a global downtrend, while it continues to rise on the 4-hour timeframe. In previous reviews, we said that we expect a continuation of the global downtrend. However, at this time we can't deny that the euro is rising again due to comprehensible reasons. Unfortunately, both the market and macro data are against the dollar at the moment. We believe that the euro can't start a new global trend right now when the ECB eases its monetary policy, so most likely the pair will continue to fluctuate between the levels of 1.0650 and 1.1000. Traders may opt for short positions in the upper part of this range and after the price consolidates below the moving average. Targets are around the 1.0681 level.

Explanation of the chart:

- Linear Regression Channels – Helps determine the current trend. If both are directed in the same direction, it means the trend is currently strong.

- Moving Average Line (settings 20.0, smoothed) – Determines the short-term trend and the direction in which trading should currently be conducted.

- Murray Levels – Target levels for movements and corrections.

- Volatility Levels (red lines) – The probable price channel in which the pair will spend the next day, based on current volatility indicators.

- CCI Indicator – Its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is imminent.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română