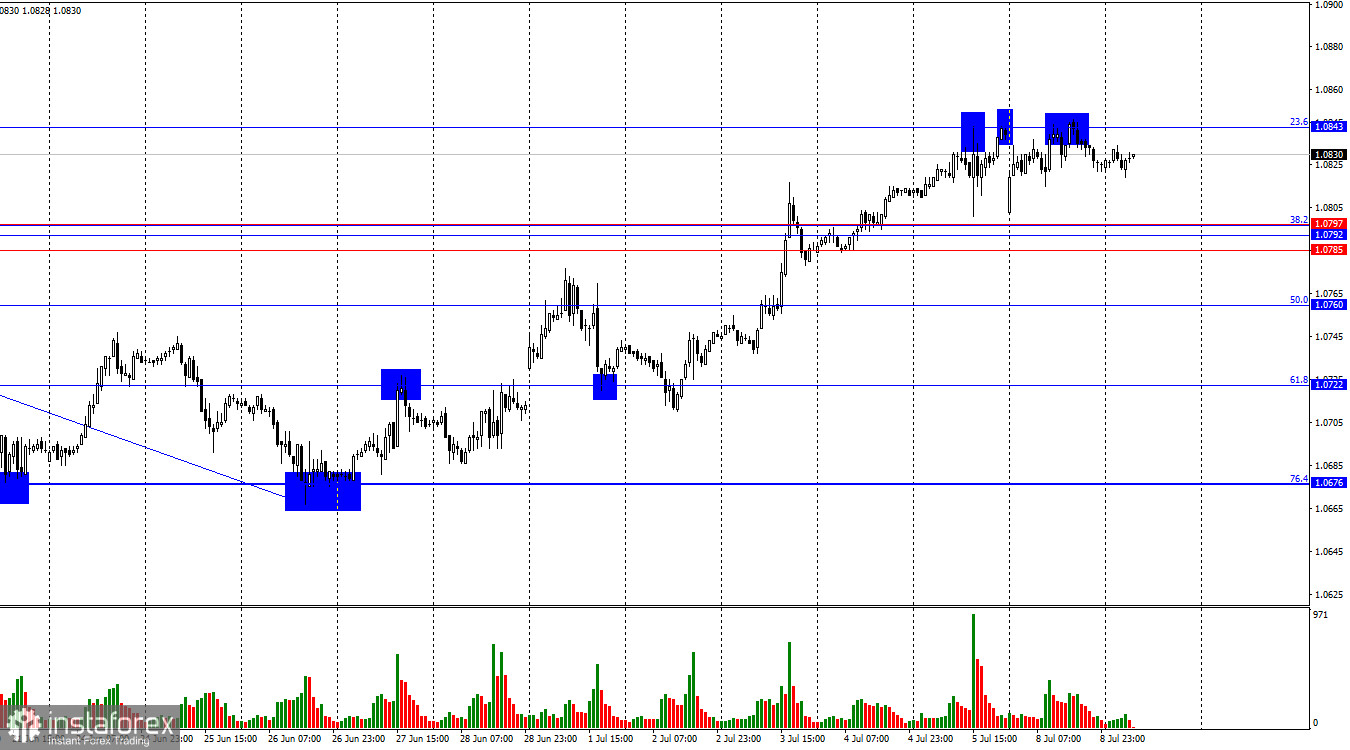

On Monday, the EUR/USD pair tested the 1.0843 level for the third time and performed a new rebound from this level. Thus, today, we might observe a decline in quotes towards the support zone of 1.0785–1.0797. Consolidation of the pair above the 1.0843 level (which is possible even after three rebounds) will allow traders to expect continued growth towards the next Fibonacci level of 0.0%.

The wave situation has become more complex. The new upward wave broke the peak of the previous wave and continued to form, while the last completed downward wave did not manage to break the low of the previous wave. Therefore, two signs of a trend change from "bearish" to "bullish" were obtained. Last week, the bulls received support from an important news background, which led to the pair's confident growth. From the 1.0843 level, one can expect a corrective, "bearish" wave to form.

There was no news background on Monday, and without economic data, the market decided to focus on politics for the second consecutive Monday. I'm not strong in political intricacies, but many expected a victory from Marine Le Pen's party in France. They feared her ultra-right views. As the second round of parliamentary elections showed, these fears were not realized, activating the euro bulls. It's good that the 1.0843 level was strong; otherwise, the European currency could have grown even more. I'm not against further growth of the euro, but it would look strange considering the ECB's easing of monetary policy. Thus, a decline in the euro, even within the framework of a corrective wave, is likely this week. Certainly, Jerome Powell or the US inflation report could spoil the whole picture. No one is immune to that.

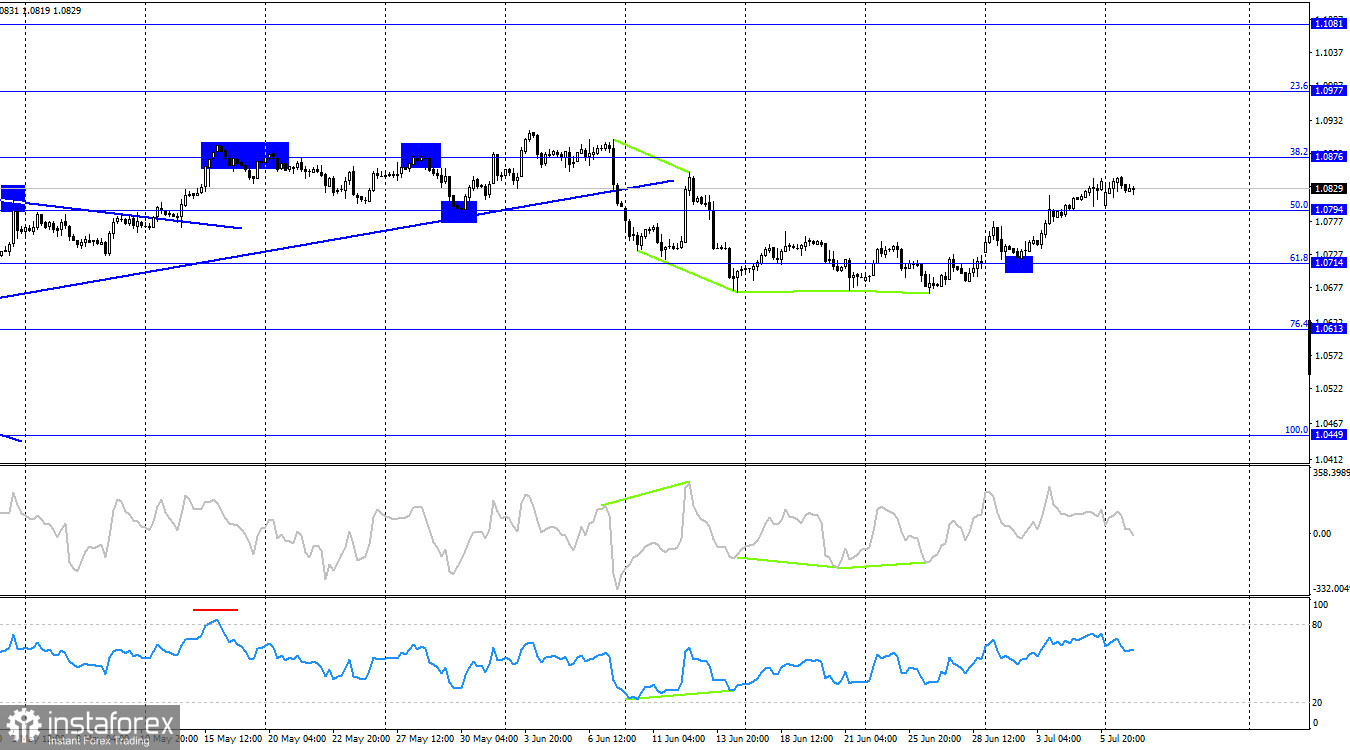

On the 4-hour chart, the pair reversed in favor of the euro after forming a new "bullish" divergence with the CCI indicator and rebounding from the corrective level of 61.8%–1.0714. Later, the pair consolidated above the Fibonacci level of 50.0%–1.0794, which allows us to expect continued growth towards the next corrective level of 38.2%–1.0876. There are no impending divergences in any indicator today.

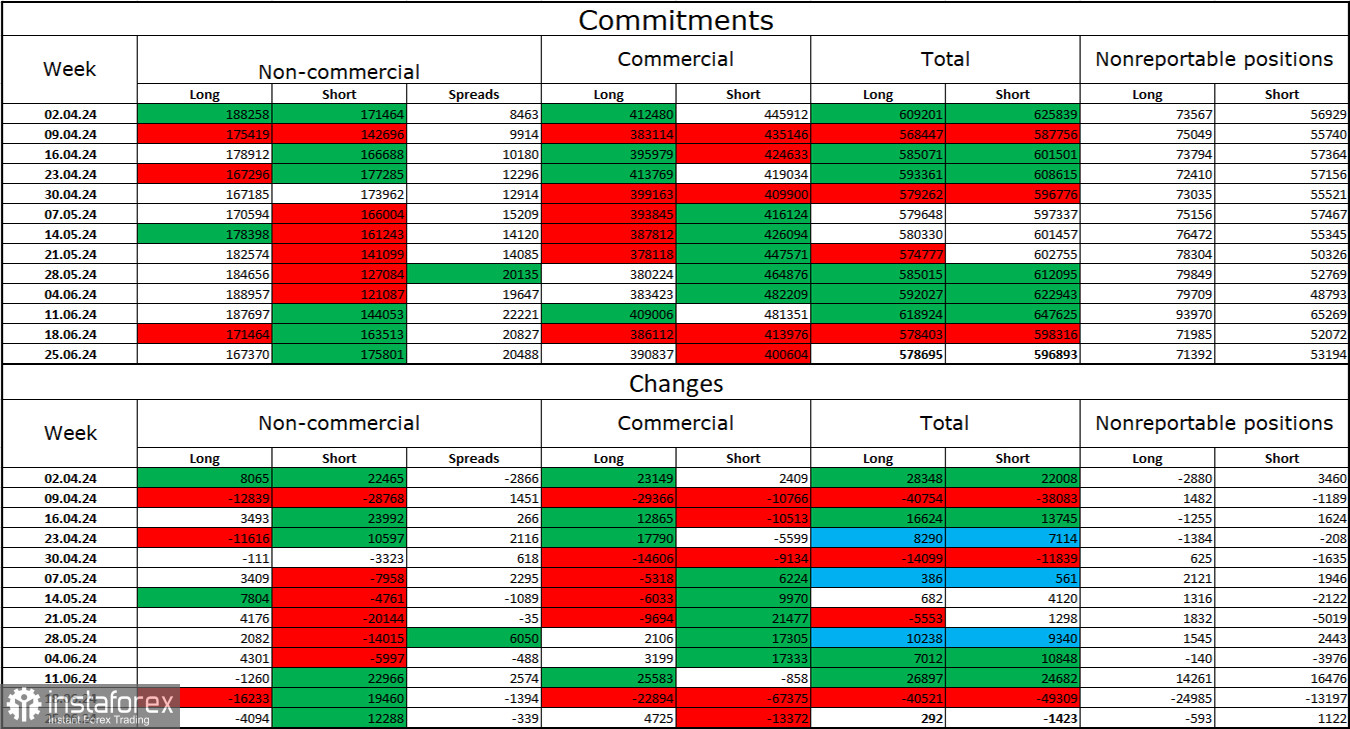

Commitments of Traders (COT) Report:

During the last reporting week, speculators closed 4,094 long positions and opened 12,288 short positions. The sentiment of the "Non-commercial" group changed to "bearish" a few weeks ago and is currently strengthening. The total number of long positions held by speculators now stands at 167,000, while short positions total 175,000.

The situation will continue to change in favor of the bears. I do not see long-term reasons to buy the euro, as the ECB has started to ease monetary policy, which will reduce the yield on bank deposits and government bonds. In America, yields will remain high for at least a few months, making the dollar more attractive to investors. The potential for a decline in the euro is quite significant, even according to the COT reports. Currently, the number of Short contracts among professional players is growing.

News Calendar for the US and Eurozone:

USA – Speech by Federal Reserve Chairman Jerome Powell (14:00 UTC).

On July 9, the economic events calendar contains only one important entry. The influence of the news background on market sentiment today may be strong, but mainly in the second half of the day.

Forecast for EUR/USD and Trading Advice:

Sales of the pair are possible upon a rebound on the hourly chart from the 1.0843 level, targeting the zone of 1.0785–1.0797. New sales – upon closing below this zone with targets of 1.0760 and 1.0722. The euro is not immortal and omnipotent; it cannot grow constantly. Upon closing above the mentioned zone, purchases were possible with a target of 1.0843. This target was achieved. New purchases – upon a rebound from the 1.0785–1.0797 zone targeting 1.0843. Or upon closing above 1.0843 with a target of 1.0917.

The Fibonacci levels are built between 1.0602–1.0917 on the hourly chart and between 1.0450–1.1139 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română