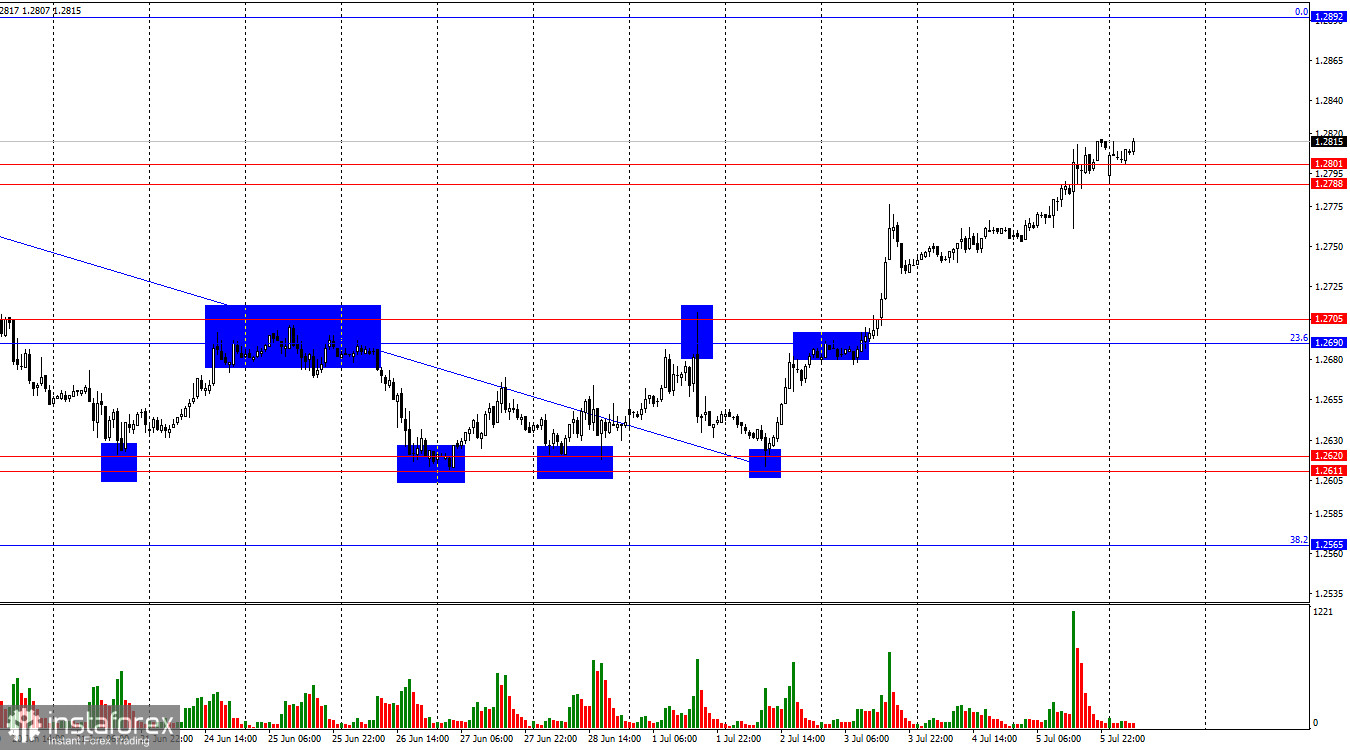

The wave situation remains unchanged. The last downward wave (which formed starting from June 12) managed to break the low of the previous wave, and the new upward wave (currently forming) has yet to reach the peak of the previous wave at 1.2859. Thus, the trend for the GBP/USD pair remains "bearish." I am cautious about conclusions regarding the "bearish" trend because bears still regularly show weakness, and the informational background often prevents their further attacks. Last week, they had to retreat due to news from the US. The "bearish" trend will officially be broken after the peak of the last upward wave from June 12 – 1.2858 – is surpassed.

The informational background on Friday only led to another retreat of the bears. I cannot say that the market wants to buy only the pound, but what else can it do if every new day brings more negative data from the US? Throughout last week, only one report (JOLTS) supported the dollar. All other data fell short of expectations, leading to the logical decline of the US currency. Today, Monday, there will be very few news events, which is unlikely to make traders active. If today closes below the zone of 1.2788–1.2801, it will indicate that the market is ready for a correction. The most logical target for the correction is the zone of 1.2690–1.2705.

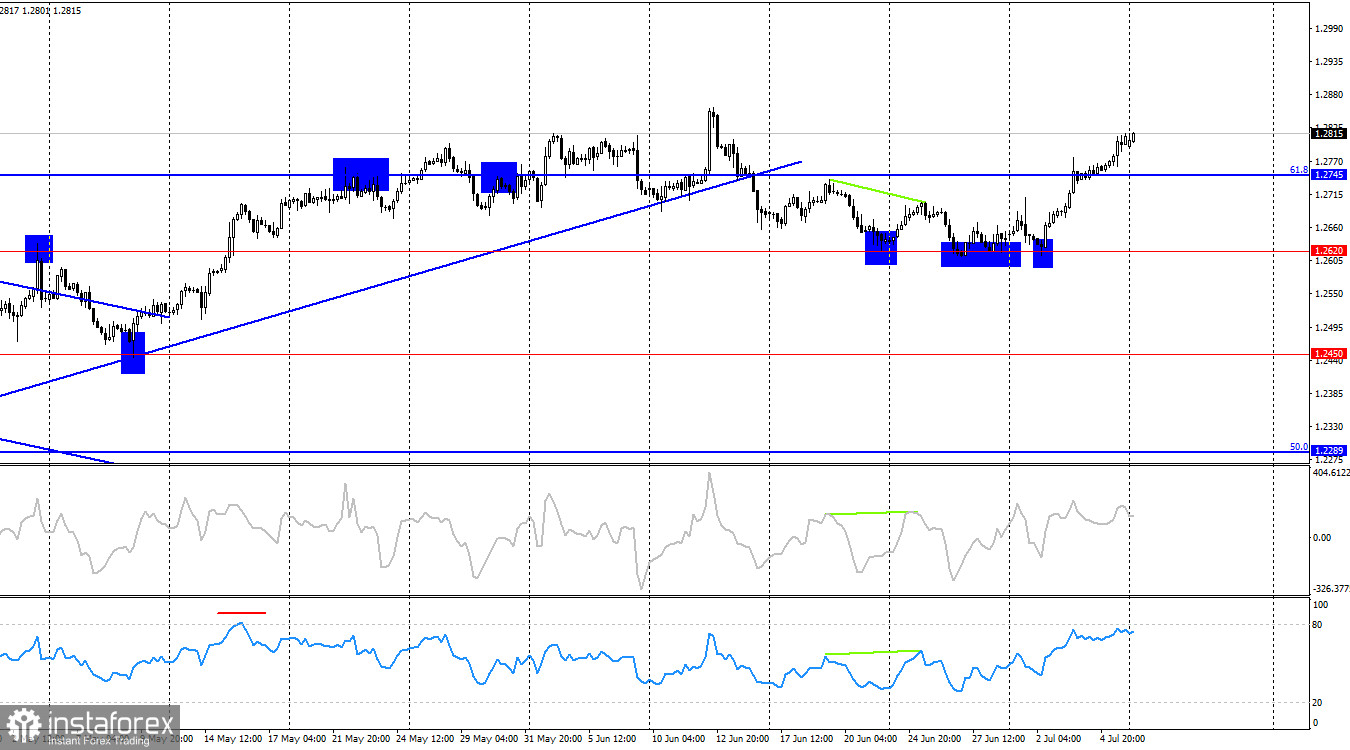

On the 4-hour chart, the pair turned in favor of the British currency after four rebounds from the level of 1.2620 and then consolidated above the corrective level of 61.8%–1.2745. The 4-hour chart shows no obstacles to further growth of the pound up to 1.3044. The bears have not been able to break even the simplest level. Currently, the pound has good graphical prospects.

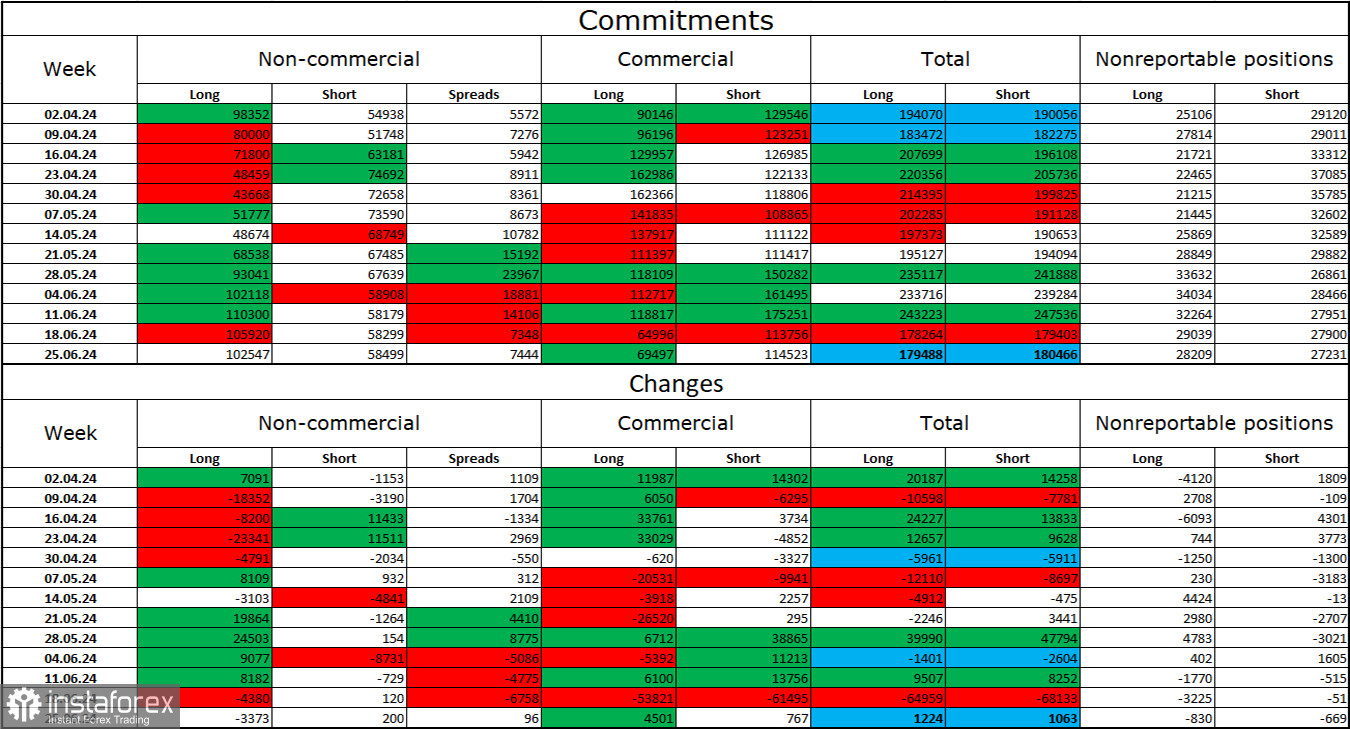

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" category of traders became slightly less "bullish" over the past reporting week. The number of long positions held by speculators decreased by 3373 units, while the number of short positions increased by 200. The bulls still have a solid advantage. The gap between the long and short positions is 44 thousand: 102 thousand against 58 thousand.

The pound still has prospects for decline. The graphical analysis provided several signals of the "bullish" trend breaking, and bulls cannot attack forever. Over the past three months, the number of long positions has grown from 98 thousand to 102 thousand, while the number of short positions has increased from 54 thousand to 58 thousand. Over time, major players will continue to get rid of long positions or increase short positions, as all possible factors for buying the British pound have already been worked out. However, it should be remembered that this is just a hypothesis. The graphical analysis still indicates the weakness of the bears, who cannot even "take" the level of 1.2620.

News Calendar for the US and the UK:

The economic events calendar on Monday needs to be more interesting. The informational background will not influence market sentiment today.

GBP/USD Forecast and Trading Tips:

Sales of the pound are possible today if it closes below the zone of 1.2788–1.2801 with a target of 1.2690–1.2705. Purchases could be considered on a rebound from the zone of 1.2611–1.2620 on the hourly chart with a target of 1.2690–1.2705. Then, if it closes above the zone of 1.2690–1.2705 with a target of 1.2788–1.2801. Both targets have been reached. It's advisable to hold off on new purchases at the beginning of the week.

Fibonacci levels are built between 1.2036–1.2892 on the hourly chart and 1.4248–1.0404 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română