EUR/USD

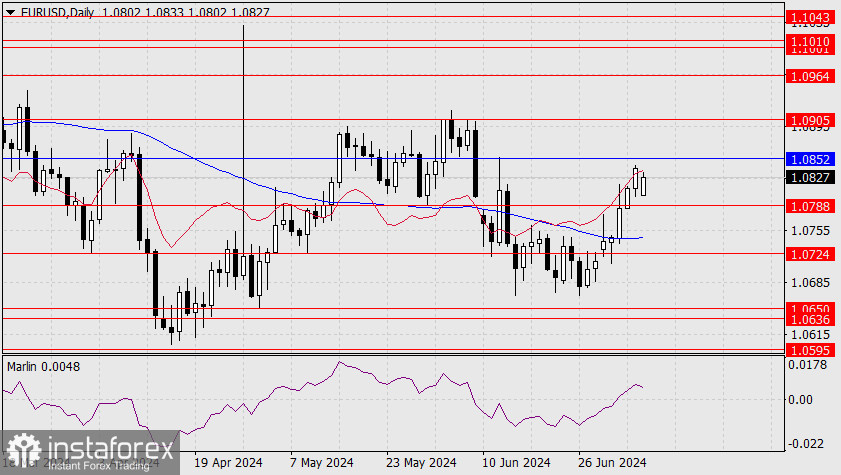

The euro ended last week by testing the resistance of the MACD indicator line on the weekly chart. Perhaps, the price is already on the way to climb above Friday's high of 1.0843. If the price closes the current gap, it will limit the growth by the same line, now slightly higher at the level of 1.0852. Overcoming the MACD line will allow the price to reach the upper boundary of the descending price channel around 1.0900/05, although the gap itself indicates that EUR/USD is tired of rising.

As a result of the second round of parliamentary elections in France, the majority of votes went to the "New Popular Front" left-wing coalition (182 seats), with Macron's centrist alliance in second place (168 seats), and Marine Le Pen's coalition "National Rally" in third (143 seats). The remaining groups distributed another 84 seats. In the end, it seems that everyone is satisfied, and these elections no longer affect the markets.

On the daily chart, the price is showing progress above the MACD line but below the balance line. This situation also indicates market fatigue and a high likelihood of the price moving in a sideways trend in the short-term. The range may be limited to levels 1.0788-1.0852.

On the 4-hour chart, the Marlin oscillator is heading downwards, but so far this is a reaction to the market opening the day with a gap. Marlin may not even leave the positive territory. In order to work on the pair's rise, the price must consolidate above 1.0852, and in preparation for a decline, the euro must consolidate below 1.0788.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română