Analysis of Trades and Tips for Trading the British Pound

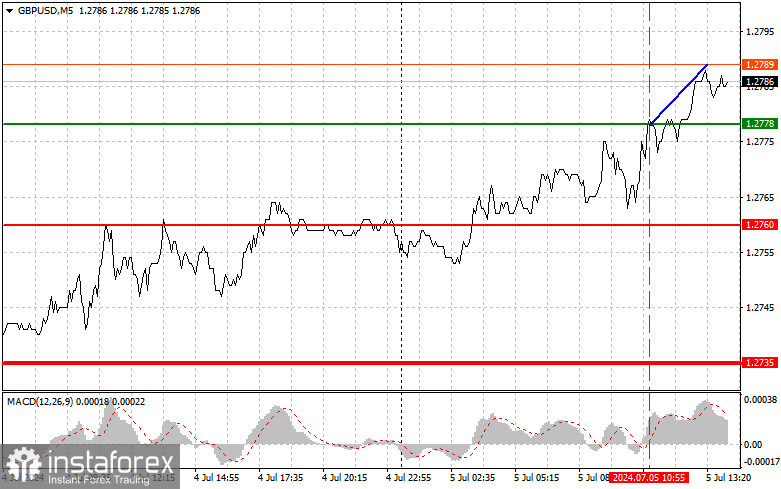

The test of the 1.2778 price level coincided with the moment when the MACD indicator started moving up from the zero mark, confirming a correct entry point for buying the pound. However, the pair did not experience significant growth. Low trading volume and low volatility ahead of the second half of the day, along with a lack of UK statistics, played their part. During the American session, the unemployment rate and changes in average hourly earnings are expected. Still, traders will be much more interested in the dynamics of non-farm payroll employment in the US. If the data exceeds forecasts, the pound could face certain problems as everyone would start buying the US dollar. Weak statistics would increase pressure on the dollar and boost GBP/USD. As for the intraday strategy, I plan to act based on Scenario No. 1, despite the MACD indicator readings, as I expect strong and directed movement after the reports.

Buy Signal

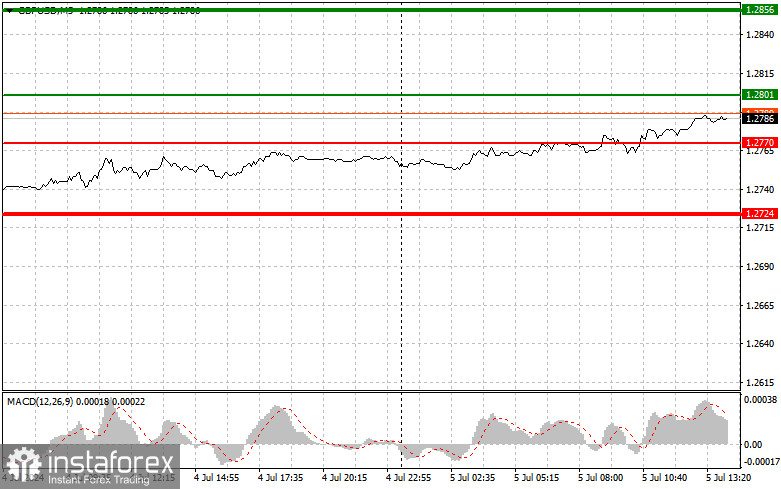

Scenario No. 1: Today, I plan to buy the pound upon reaching the entry point around 1.2801 (green line on the chart) with a target of 1.2856 (thicker green line on the chart). Around 1.2856, I will exit the purchases and open sales in the opposite direction (expecting a 30-35 point movement in the opposite direction from the level). Pound growth today can only be expected after breaking the daily high and weak US labor market data. Important: Before buying, ensure the MACD indicator is above zero and start moving upward from it.

Scenario No. 2: I also plan to buy the pound today in case of two consecutive tests of the 1.2770 price, with the MACD indicator in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. Growth can be expected to the opposite levels of 1.2801 and 1.2856.

Sell Signal

Scenario No. 1: Today, I plan to sell the pound after the 1.2770 (red line on the chart) is updated, leading to a rapid decline in the pair. The key target for sellers will be the 1.2724 level, where I will exit sales and immediately open purchases in the opposite direction (expecting a 20-25 point movement in the opposite direction from the level). After a failed consolidation around the daily high and strong US statistics, sellers will show themselves. Important: Before selling, ensure the MACD indicator is below the zero mark and just starting its decline from it.

Scenario No. 2: I also plan to sell the pound today in case of two consecutive tests of the 1.2801 price, with the MACD indicator in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline can be expected to the opposite levels of 1.2770 and 1.2724.

Chart Explanation:

- Thin green line – entry price to buy the trading instrument.

- Thick green line – estimated price where you can set Take Profit or manually lock in profits, as further growth above this level is unlikely.

- Thin red line – entry price to sell the trading instrument.

- Thick red line – estimated price where you can set Take Profit or manually lock in profits, as further decline below this level is unlikely.

- MACD Indicator – it is important to use overbought and oversold zones when entering the market.

Important: Beginner forex traders must carefully decide about entering the market. It is best to stay out of the market before releasing significant fundamental reports to avoid being caught in sharp price fluctuations. If you decide to trade during news releases, always set stop-loss orders to minimize losses. You can quickly lose your entire deposit without setting stop-loss orders, especially if you do not use money management and trade in large volumes.

And remember, successful trading requires a clear plan, like the example above. Spontaneous trading decisions based on the current market situation are initially a losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română