FX.co ★ GBP/USD: Simple trading tips for beginner traders on July 4th (US session)

Relevance until

Relevance untilGBP/USD: Simple trading tips for beginner traders on July 4th (US session)

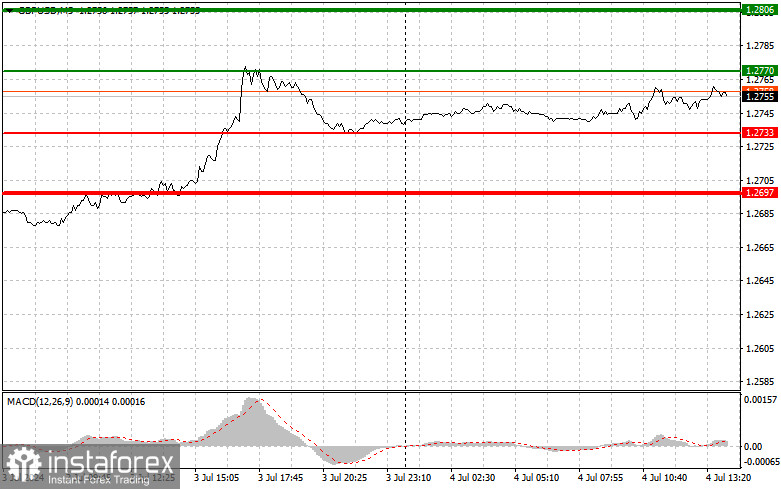

Analysis of Trades and Tips for Trading the British PoundTesting the price at 1.2751 coincided with the moment when the MACD indicator was starting to move upward from the zero mark, confirming the correct entry point for buying the pound. However, the pair did not experience significant growth. Low trading volume and low volatility in the second half of the day will likely result in trading within the channel, making strong price movements unlikely. Considering that there are no U.S. statistics today, it is better to trade from local highs and lows in opposite directions. As for the intraday strategy, I plan to act based on Scenario 2.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română