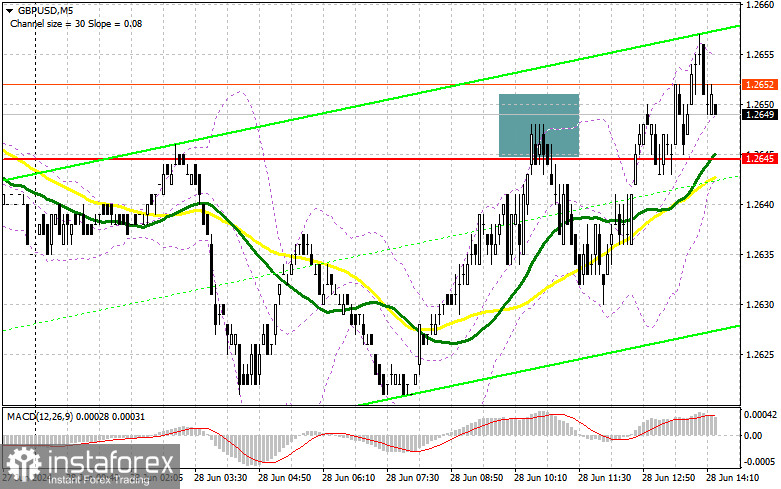

In my morning forecast, I highlighted the 1.2645 level and planned to make market entry decisions based on it. Let's look at the 5-minute chart and analyze what happened there. The rise and formation of a false breakout at this level provided an excellent entry point for selling the pound, resulting in a 15-point decline. However, it did not lead to a larger downward movement. The technical picture was not revised for the second half of the day.

To open long positions on GBP/USD:

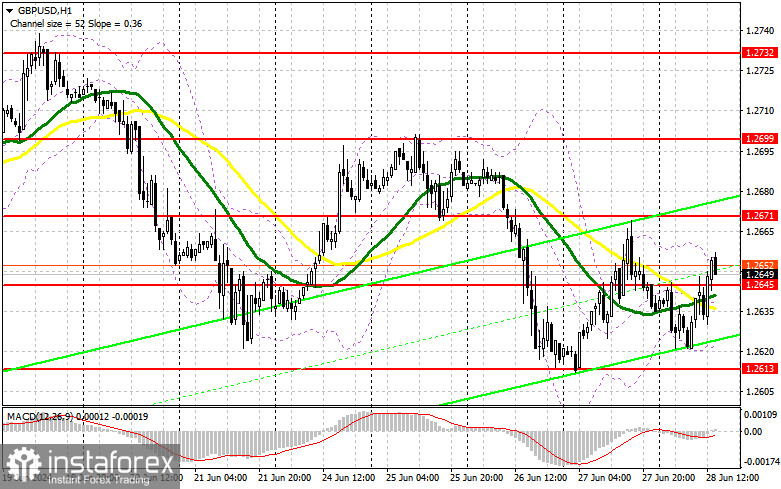

Let's see how the pair reacts to the US statistics and then make any decisions about entering the market. Expected data includes the core personal consumption expenditures index, US household spending and income levels changes, consumer sentiment indices from the University of Michigan, and inflation expectations. Statements from American politicians will be a separate part. With very good statistics and further pair decline, I expect buyers to emerge around the new support level of 1.2613, formed in the middle of this week. Only the formation of a false breakout there will provide an entry point for long positions aiming for a new wave of growth to the 1.2645 level, where trading is currently conducted. A breakout and retest from top to bottom of this range will be a suitable condition for buying, targeting the 1.2671 level. The farthest target will be the 1.2699 area, where I plan to take profits. With a GBP/USD decline and a lack of bullish activity at 1.2613 in the second half of the day, pound buyers will lose all initiative, returning the market to a bearish character. This will also lead to a decline; the next support renewal will be at 1.2583. Only the formation of a false breakout will be a suitable condition for opening long positions. I plan to buy GBP/USD immediately on a rebound from the 1.2550 low, aiming for a correction of 30-35 points within the day.

To open short positions on GBP/USD:

Sellers can re-enter the market at any moment, so strong data from the US will be sufficient. However, it should be understood that the data must indicate increasing price pressure, not a decrease. In the event of a bullish reaction to the reports, only the formation of a false breakout around the resistance of 1.2671 will be a suitable option for opening short positions aiming for a decline towards the support at 1.2645. A breakout and retest from bottom to top will trigger stop orders and pave the way to 1.2613 - the monthly low. The farthest target will be the 1.2583 area, where I will take profits. Testing this level will strengthen the bearish nature of the market. With GBP/USD growth and lack of activity at 1.2671 in the second half of the day, buyers will have chances for a larger correction at the end of the month. In this case, I will postpone sales until a false breakout at the 1.2700 level. If there is no downward movement, I will sell GBP/USD immediately on a rebound from 1.2732, but only expecting a downward correction of 30-35 points within the day.

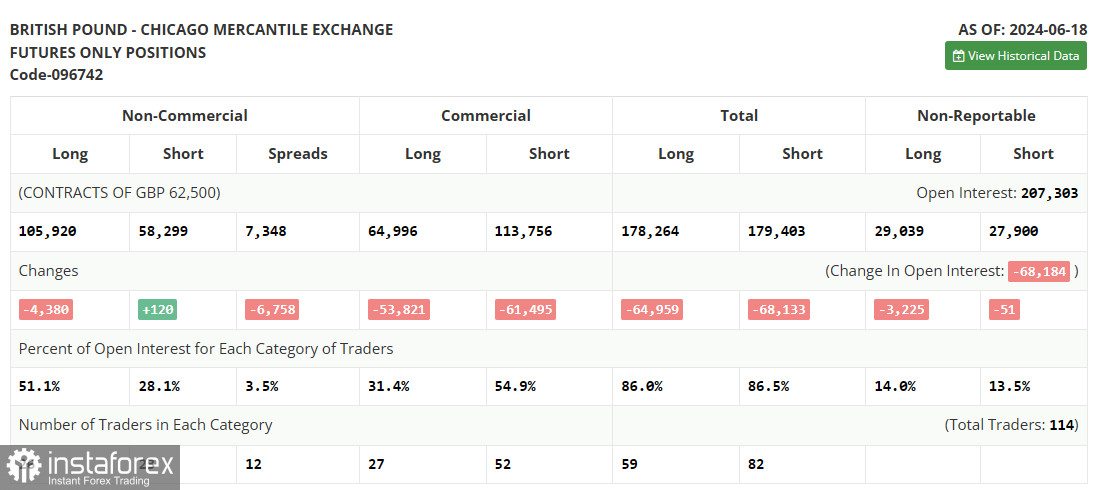

The COT report (Commitment of Traders) for June 18 showed an increase in short positions and a slight decrease in long positions. The outcomes of the Bank of England meeting, where it was announced that rates in the UK could be cut as early as August this year, though not a revelation for traders, still influenced market dynamics, leading to a sharp reduction in long positions. An even more significant difference lies in the policies and actions of the Federal Reserve, which recently left interest rates unchanged, signaling only one possible rate cut this year. This maintains demand for the US dollar and plays in its favor. The latest COT report states that non-commercial long positions fell by 4,380 to 105,920, while non-commercial short positions increased by 120 to 58,299. As a result, the spread between long and short positions dropped by 6,785.

Indicator Signals:

Moving Averages

Trading is conducted around the 30 and 50-day moving averages, indicating a sideways market.

Note: The author considers the period and prices of the moving averages on the H1 hourly chart and differs from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands

In the event of a decline, the lower boundary of the indicator, around 1.2625, will act as support.

Indicator Descriptions:

- Moving average (defines the current trend by smoothing out volatility and noise). Period – 50. Marked in yellow on the chart.

- Moving average (defines the current trend by smoothing out volatility and noise). Period – 30. Marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence – convergence/divergence of moving averages). Fast EMA – period 12. Slow EMA – period 26. SMA – period 9.

- Bollinger Bands. Period – 20.

- Non-commercial traders – speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between non-commercial traders' short and long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română