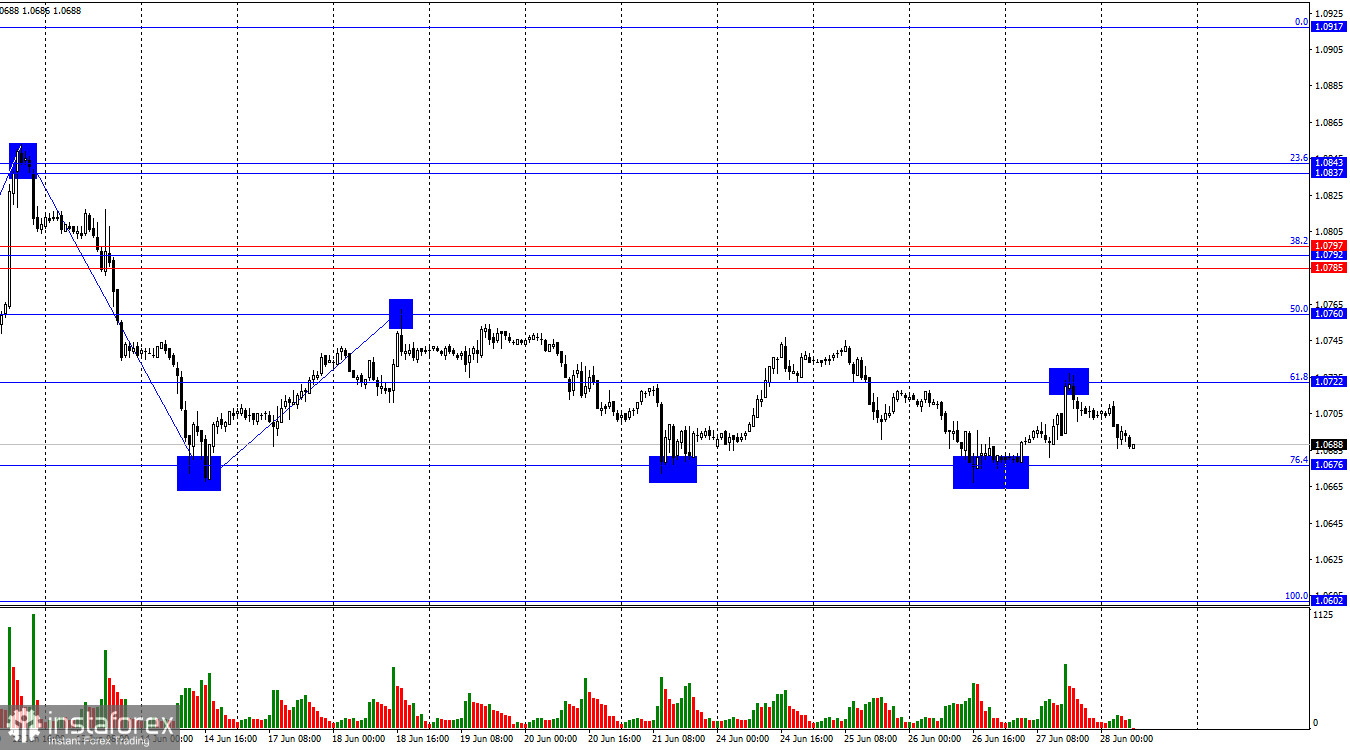

The wave situation remains clear. The last completed upward wave was very weak and failed to break the peak of the previous wave. The last downward wave (which may still be incomplete) failed to break the low of the previous wave. Thus, the "bearish" trend persists, but the first sign of a trend change to "bullish" may appear in the near future. This sign would break the peak of the last upward wave from June 18. If this does not happen, I expect a break of the 1.0676 level and a further decline in the euro.

The information background on Thursday worked against the bears and bulls for the US dollar. The US GDP in the first quarter showed an increase of 1.4%. Although this figure met traders' expectations, it is still worth noting the significant slowdown in the US economy's growth rate compared to last year's third quarter. The US economy is slowing down against the backdrop of the Federal Reserve's "hawkish" policy, which is unlikely to become less "strict" in the near future. At the same time, the high FOMC rate is good news for the dollar, which can continue to strengthen in the foreign exchange market. The GDP report had a localized negative impact on the dollar. Still, the Fed's monetary policy, which caused the slowdown in economic growth, will have a long-term positive impact on the US currency.

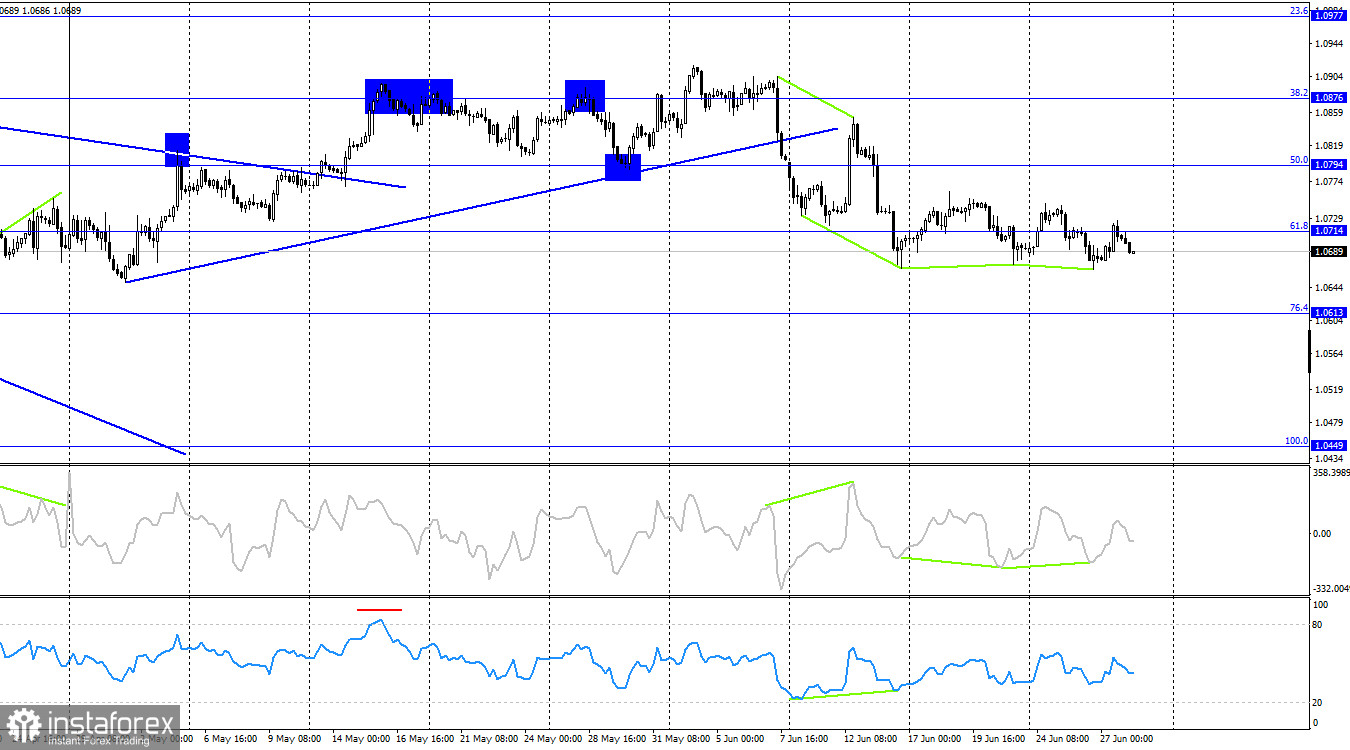

On the 4-hour chart, the pair made a new reversal in favor of the euro after forming a "bullish" divergence in the CCI indicator, followed by another upward reversal after forming another "bullish" divergence. A week ago, the 4-hour chart showed a close below the trendline, which changed traders' sentiment to "bearish." Thus, any "bullish" divergences signal a correction. Without consolidation below the 1.0676 level, corrections may recur.

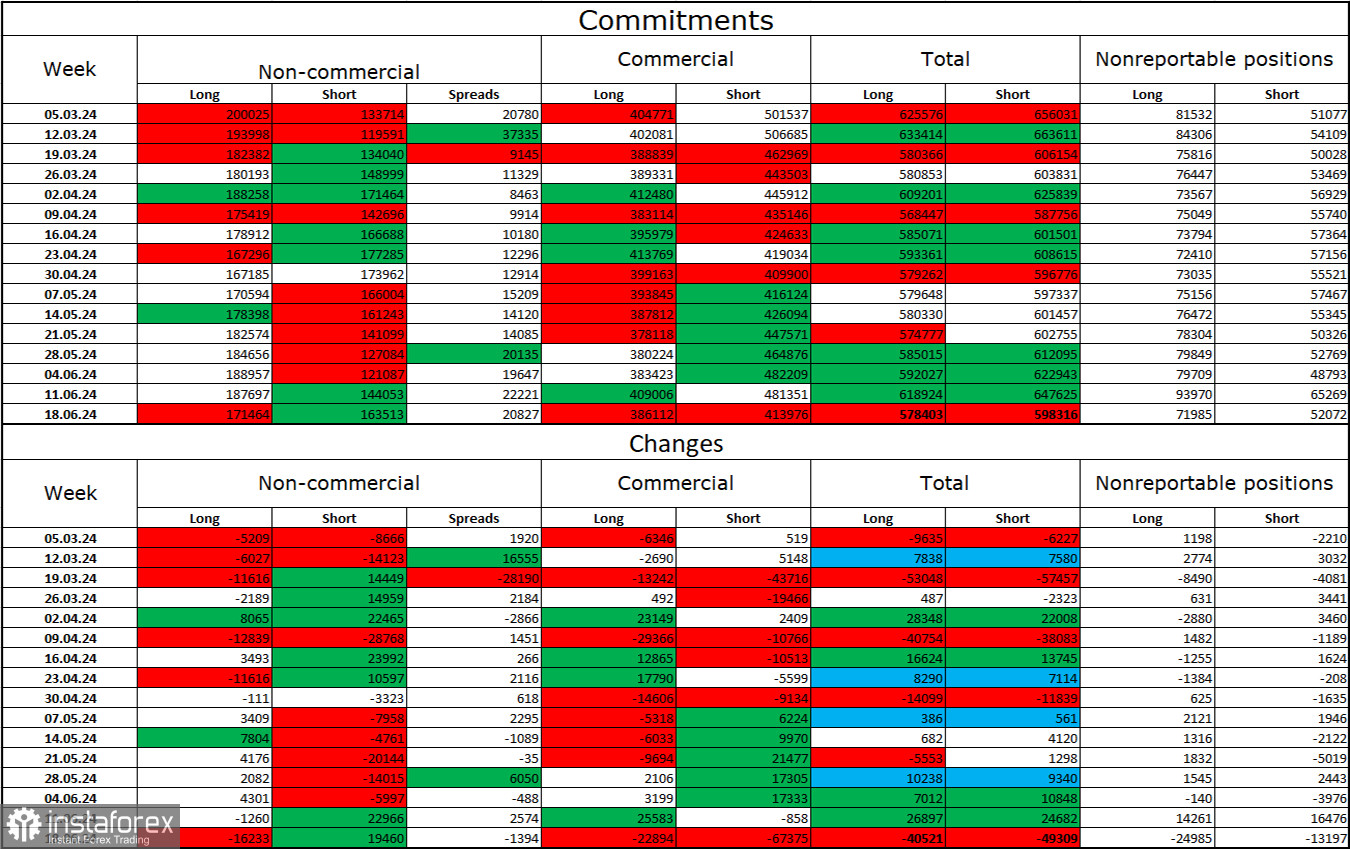

Commitments of Traders (COT) Report:

During the last reporting week, speculators closed 16,233 long positions and opened 19,460 short positions. The sentiment of the "Non-commercial" group turned "bearish" several weeks ago and is currently only getting stronger. The total number of long positions held by speculators now stands at 171 thousand, while short positions amount to 163 thousand. The gap continues to narrow.

The situation will continue to shift in favor of the bears. I don't see any long-term reasons to buy the euro since the ECB has begun easing monetary policy, which will reduce the yields on bank deposits and government bonds. In America, yields will remain high for at least several months, making the dollar more attractive to investors. The potential for the euro to decline is significant, even according to the COT reports. If the "bullish" sentiment among major players persists and the euro is falling, where will the euro be when the sentiment turns "bearish"?

News Calendar for the US and the Eurozone:

Eurozone – Unemployment Rate in Germany (07:55 UTC).

US – Core Personal Consumption Expenditures Price Index (12:30 UTC).

US – Personal Income and Outlays (12:30 UTC).

US – University of Michigan Consumer Sentiment Index (14:00 UTC).

On June 28th, the economic calendar includes three interesting entries in the US. The impact of the information background on traders' sentiment today could be moderate, especially in the second half of the day.

Forecast for EUR/USD and trading tips:

Yesterday, sales of the pair were possible on the hourly chart, rebounding from the level of 1.0722 and targeting 1.0676. Consolidation below this level will allow maintaining sales with a target of 1.0602. Purchases of the euro were possible on the hourly chart, rebounding from the level of 1.0676 and targeting 1.0722. This target was achieved. New purchases can be considered on a new rebound from 1.0676.

Fibonacci levels grids are built from 1.0602 to 1.0917 on the hourly chart and from 1.0450 to 1.1139 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română