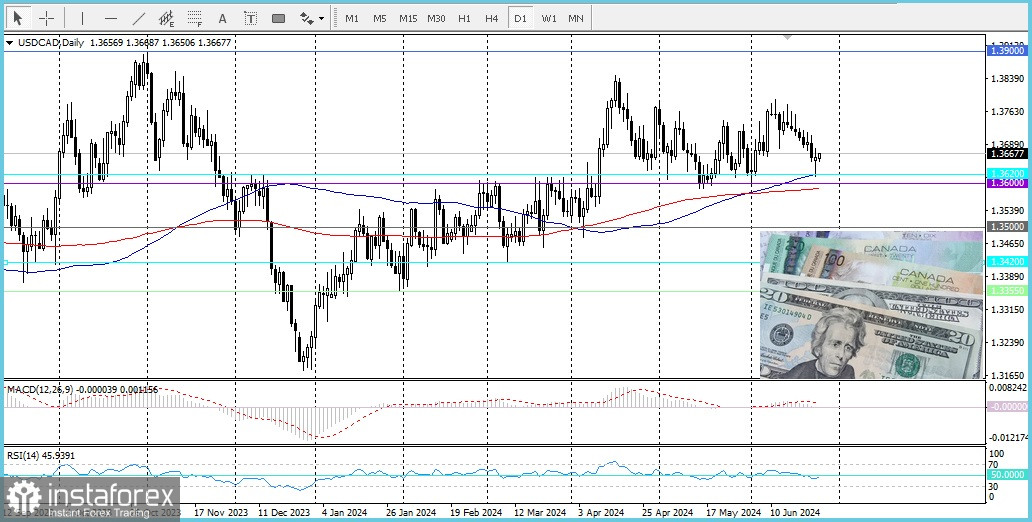

Today, the USD/CAD pair, attempting to attract buyers, is fluctuating within a narrow range amid a mixed fundamental situation. Ahead of key US macroeconomic data, the fundamental backdrop calls for caution among aggressive traders.

Final GDP data for the US for the first quarter will be published on Thursday, followed by the PCE Price Index on Friday. PCE is considered the preferred inflation indicator of the Federal Reserve System and plays a key role in influencing market expectations regarding future policy decisions. In turn, this will stimulate demand for the US dollar and give a significant boost to the USD/CAD pair.But uncertainty about the likely timing of the start of the Fed's rate cut cycle is preventing the US dollar from attracting buyers. Recent hawkish comments from influential FOMC members suggest that the US Central Bank is in no hurry to reduce borrowing costs in the near future. Nevertheless, signs of easing inflationary pressures in the US maintain hopes for a September rate cut by the Fed and constrain the US dollar's exchange rate.At the same time, the sharp increase in consumer inflation in Canada in May forced investors to abandon hopes for a rate cut by the Bank of Canada in July. Moreover, rising crude oil prices are strengthening the Canadian dollar, which is linked to commodities. Consequently, this may further contribute to limiting the USD/CAD pair. Therefore, any attempt at positive movement is more likely to attract new sellers at higher levels and risks failing fairly quickly.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română