Although the dollar has somewhat declined, it has only moved to the lower boundary of a narrow range in which the market has been in for over a week. Given the fact that the economic calendar is relatively empty, the most likely scenario for today is a reversal towards the upper boundary. Meanwhile, European Central Bank officials have recently started talking about the possibility of lowering interest rates twice more before the end of the year. If this topic develops further with similar statements from key representatives of the ECB, some changes will take place in the market, and the dollar may show a sharp rise. Therefore, the pair has the chance to break out of the stagnant phase.

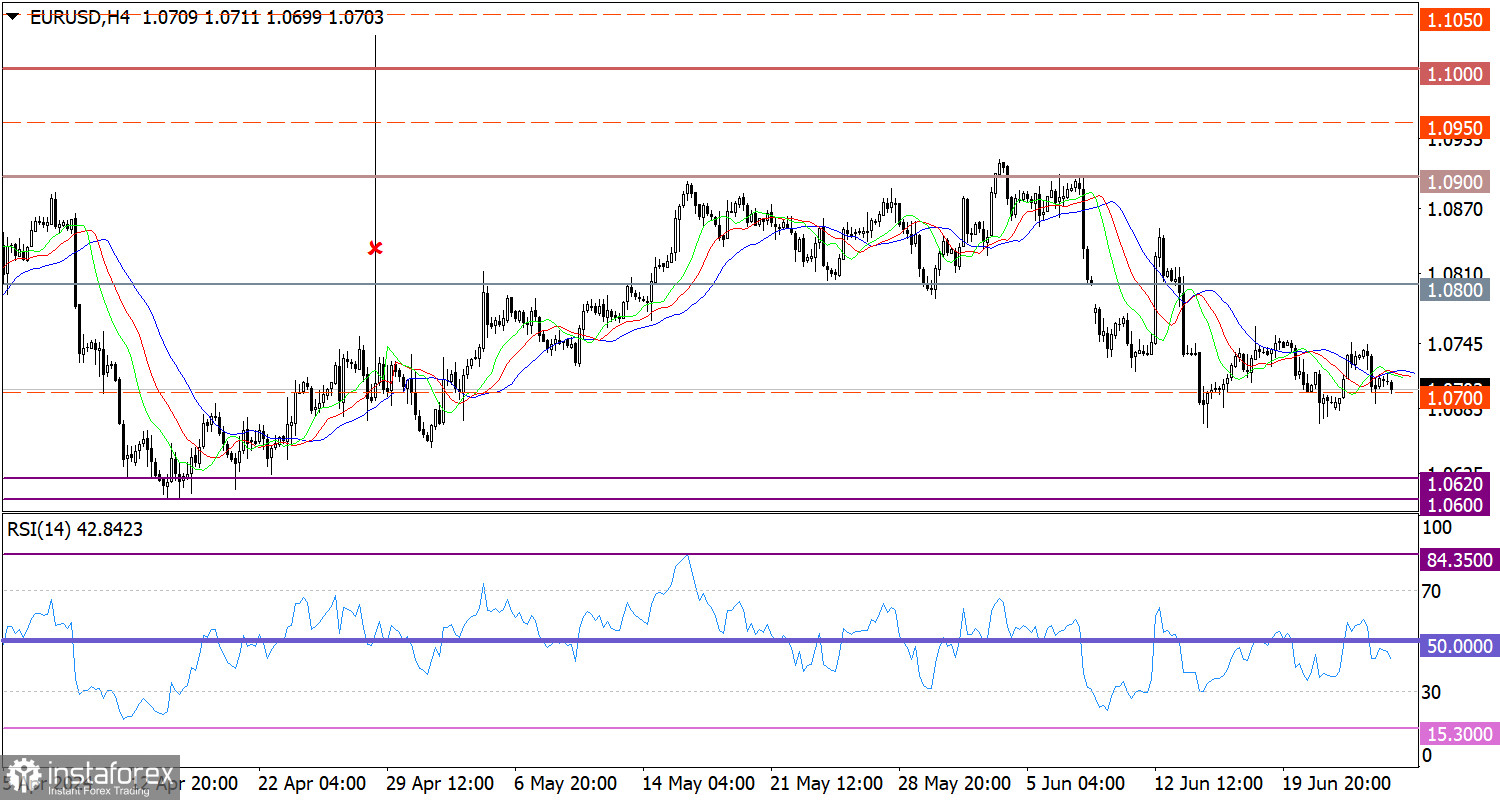

The dynamics of EUR/USD are quite low, indicating a stagnant phase. The value of 1.0700 serves as a boundary, and the price has been hovering this mark for several days.

On the 4-hour chart, the RSI technical indicator is moving in the lower area of 30/50, which points to the bearish sentiment.

Meanwhile, the Alligator's MAs are intertwined in the 4-hour chart, which points to the stagnant phase.

Outlook

Based on recent fluctuations, we can assume that the 1.0670/1.0750 values may serve as the boundaries of this temporary phase. The most suitable strategy would be the method of outgoing momentum with the price consolidating beyond the established boundaries on the intraday period.

Complex indicator analysis shows unstable readings due to the sideways movement in the short- and intraday periods.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română