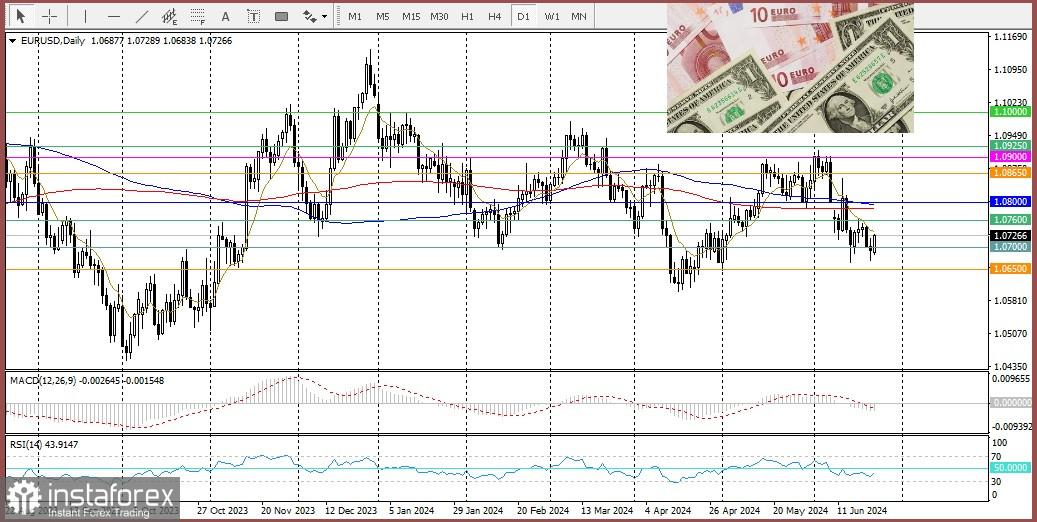

On the first trading day of the week, the EUR/USD pair is attempting to attract buyers despite the euro's strength being undermined by a combination of factors.

There is uncertainty surrounding the outcome of early elections in France, which increases concerns that the new government could worsen the financial situation in the Eurozone's second-largest economy. Additionally, Friday's business activity indices in the Eurozone indicate a sharp slowdown in business activity in June. Furthermore, today's economic indicators from Germany are negative. Alongside some USD purchases, these factors are putting pressure on the EUR/USD pair.

The US Dollar Index, which tracks the dollar's performance against a basket of currencies, despite today's correction, has risen to its highest level since May 9th following Friday's PMI index release, indicating that US business activity in June rose to a 26-month high. Such data confirm the patient approach of the Federal Reserve. However, signs of easing inflationary pressures keep September rate cuts on the agenda. Accordingly, this restrains dollar bulls from aggressive positions, thereby helping to limit further depreciation of the EUR/USD pair.

This week, to gauge insights into the Fed's rate cut path, attention should be paid to the PCE Price Index data, which will be released on Friday. These data will play an important role in influencing short-term dynamics in the US dollar, thereby giving a significant impulse to the EUR/USD pair.

Today, to capitalize on short-term opportunities in the absence of corresponding macroeconomic data from the US, attention should be focused on speeches by ECB officials and FOMC members.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română