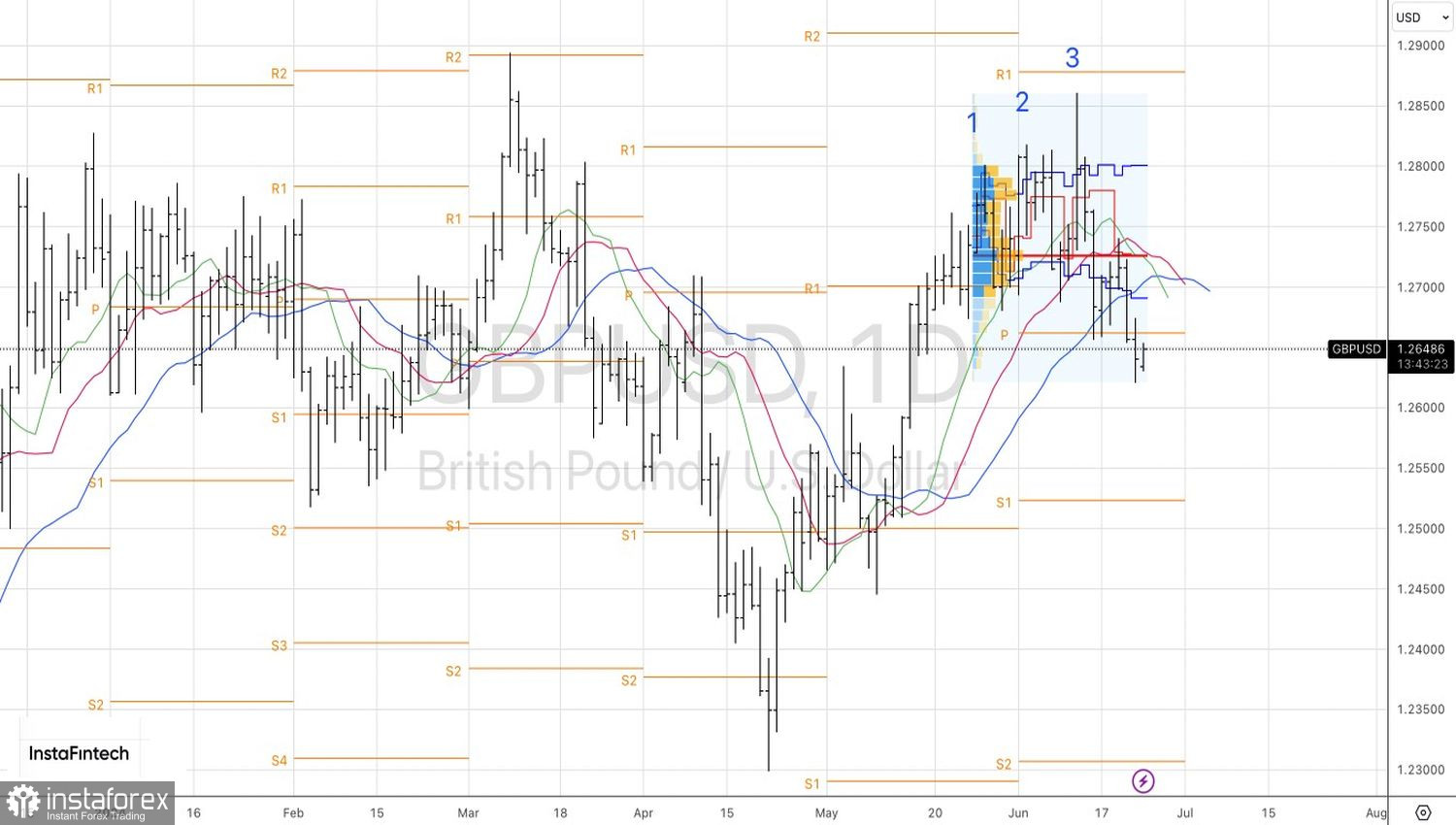

Those who sow the seeds are not always the ones who reap the harvest. The Conservatives did everything possible to slow inflation to 2%, but the Bank of England intends to lower rates in August. This opinion emerged among investors after the central bank meeting concluded in June. The likelihood of a rate cut at the next meeting increased from 32% to 50%, causing GBP/USD quotes to plummet.

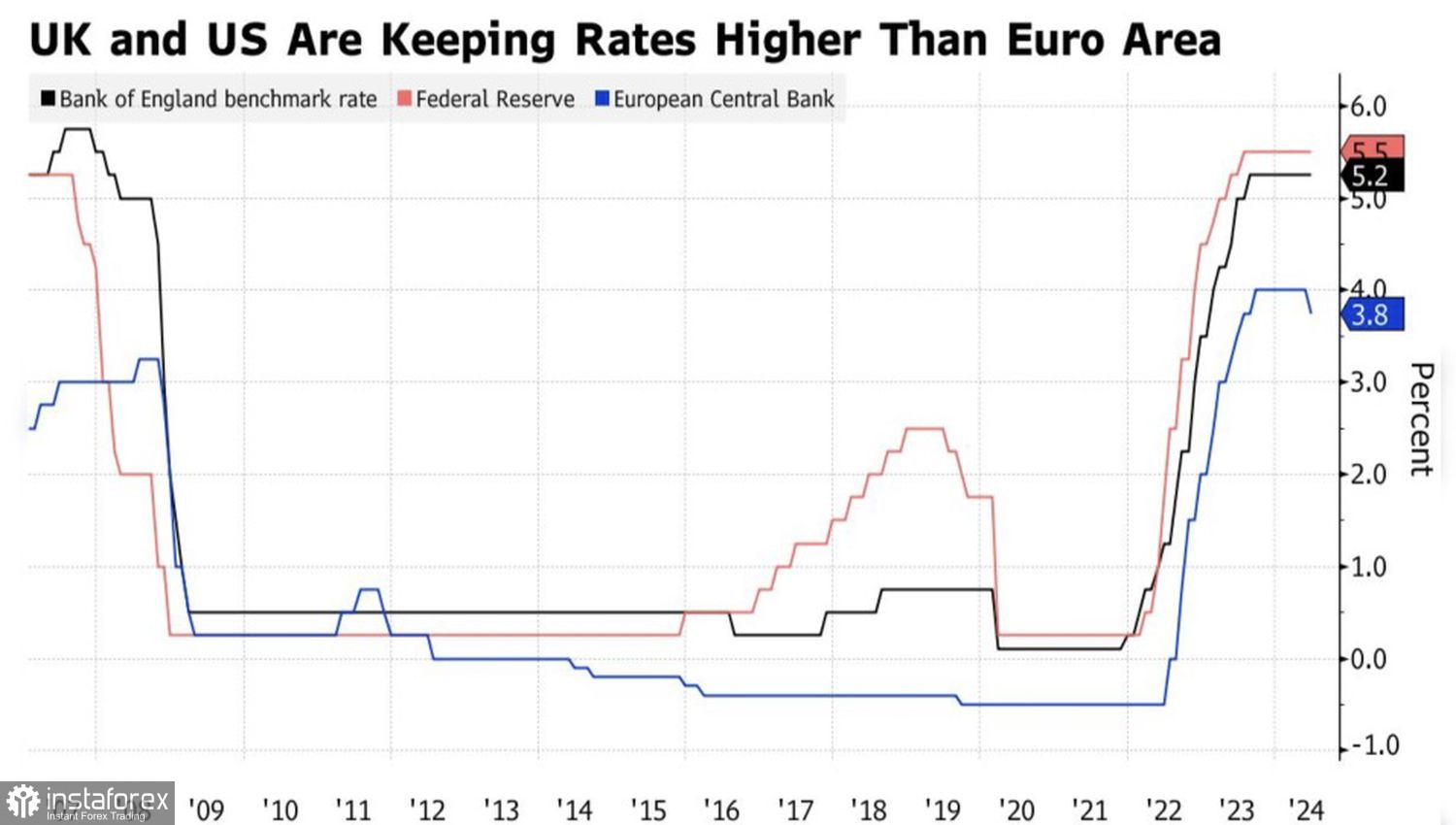

The BoE has kept its main interest rate at a 16-year high of 5.25%, in what it described as a "finely balanced" decision. Two out of nine MPC members voted to ease monetary policy. However, by August, three more could join them, including BoE Governor Andrew Bailey, and borrowing costs will finally go down.

Dynamics of the BoE's rate

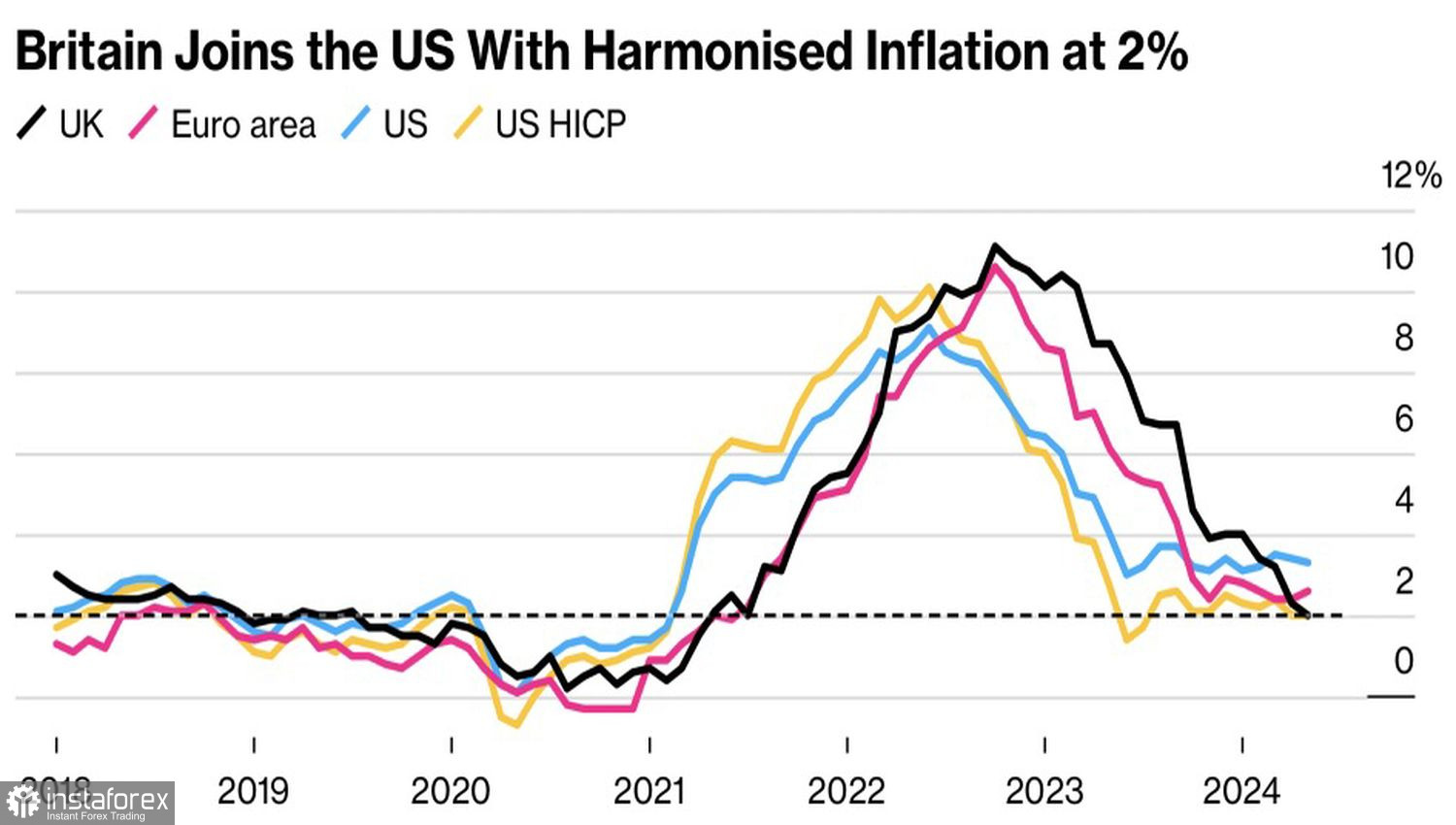

According to Bailey, the good news is that inflation has returned to the 2% target. However, the central bank wants to ensure that it remains near this mark, so it has decided to keep the rate unchanged at the current level of 5.25%.

Indeed, the United Kingdom's overall inflation rate fell to 2% year-on-year in May, allowing the BoE to be the first among the leading central banks in the world to declare victory over inflation. Nevertheless, prices for services remain very high. The 5.7% level is not a satisfying achievement.

Inflation in Britain, the Eurozone, and the US

The chances of a rate cut in August do look high. The policy of hawkish cuts is popular among central banks. Rates can be reduced, but no signal should be given that they will fall even further. This is how the European Central Bank operates, forcing markets to guess when exactly the second step will be taken after the first cut in June. The BoE could go down the same path.

The UK economy is showing mixed signals. While retail sales in May marked the best performance since January at 2.9%, according to Pantheon Macroeconomics, which suggests GDP expansion of 0.4% in the second quarter, business activity is not as smooth. In June, the purchasing managers' index fell to its lowest level since November. Most likely, companies were scared by the uncertainty associated with the parliamentary elections. For the first time since 2010, the Labour Party could return to power in the country.

On the contrary, the US PMIs data came out better than expected. The widening divergence in economic growth between the US and the UK pushed GBP/USD to its lowest level in five weeks. Will it be able to find the bottom?

Technically, on the GBP/USD daily chart, the 1-2-3 reversal pattern is being implemented. A decline below the moving averages indicates that the bears are in control. If in the near future the bulls cannot push the pair back above 1.2665, short positions formed from 1.2715 should be raised. The cluster of pivot levels near 1.25 serves as the target point.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română