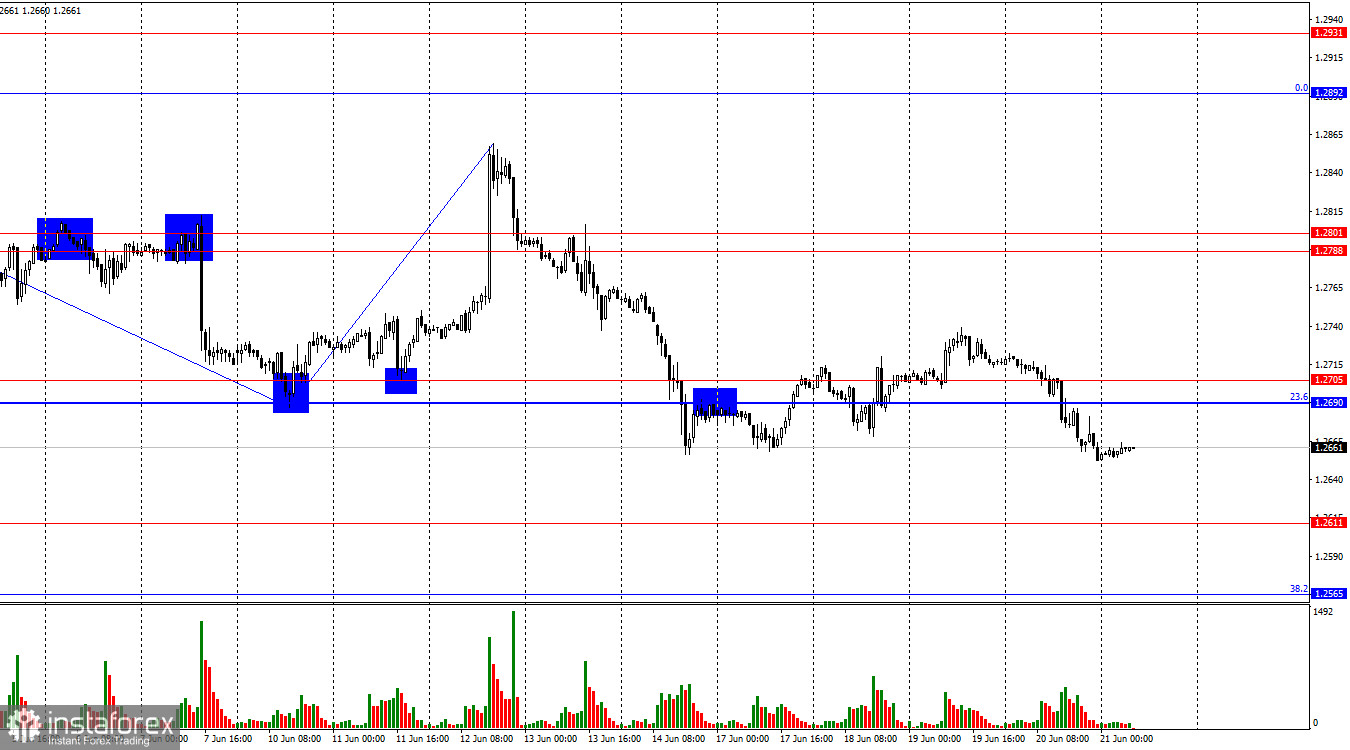

On the hourly chart the GBP/USD pair continued its decline on Thursday and once again broke below the support zone of 1.2690–1.2705. Thus the bears made a second attempt to reverse the trend in their favor. The decline in quotes may continue in the near future towards the levels of 1.2611 and 1.2565. Consolidation of the pair's rate above the 1.2690–1.2705 zone will again indicate the bears' weakness and the bulls may start attacking with a target of 1.2788.

The wave situation changed last Friday. The last upward wave broke the peak from June 4 and the new downward wave managed to break the low of the wave from June 10. Thus the trend for the GBP/USD pair has turned "bearish." Conclusions about the start of a "bearish" trend should be made cautiously as the bulls have not yet completely left the market. The emerging advantage of the bears can be easily broken. The current upward wave may be corrective after which a new downward wave will form maintaining the "bearish" trend. However the bears' advantage in the market at this time (if it exists at all) is very weak.

The informational background on Thursday was extremely important for the pound but the market showed little interest in the Bank of England's decisions. The regulator decided to keep the rate at a 15-year high of 5.25%. Some traders expected a rate cut this month but the Bank of England did not take such a step. The press release stated that core inflation in the UK is at a high level which does not yet allow for the start of monetary policy easing. Additionally British policymakers fear that the consumer price index may accelerate in the second half of the year making a rate cut impossible and impractical. Only two out of nine directors voted for a rate cut. However the probability of monetary policy easing in August has increased which the bears sensed.

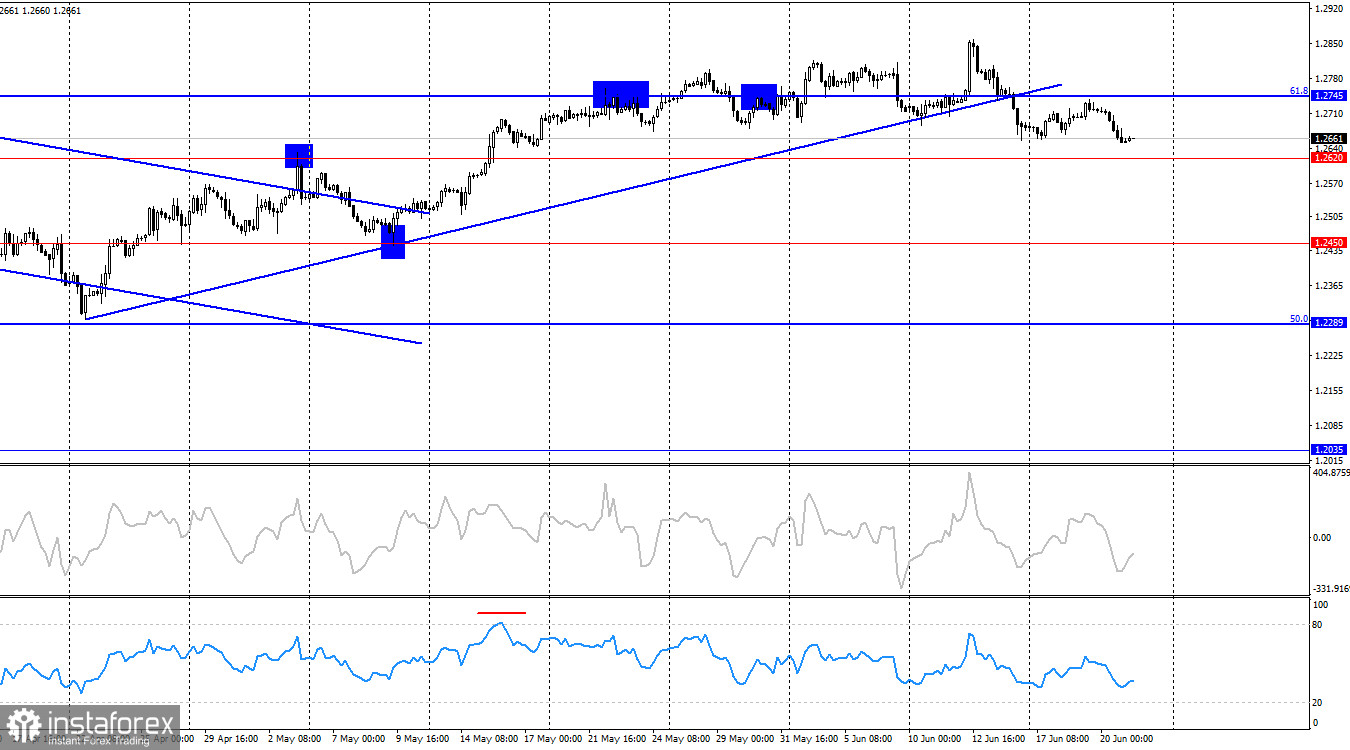

On the 4-hour chart the pair turned in favor of the US dollar and consolidated below the ascending trend line. Thus the process of falling quotes may continue towards the next level of 1.2620. A rebound of the pair's rate from this level will allow the bears to take a short break while consolidation below it will enable further decline towards the next level of 1.2450. There are no looming divergences in any indicator today.

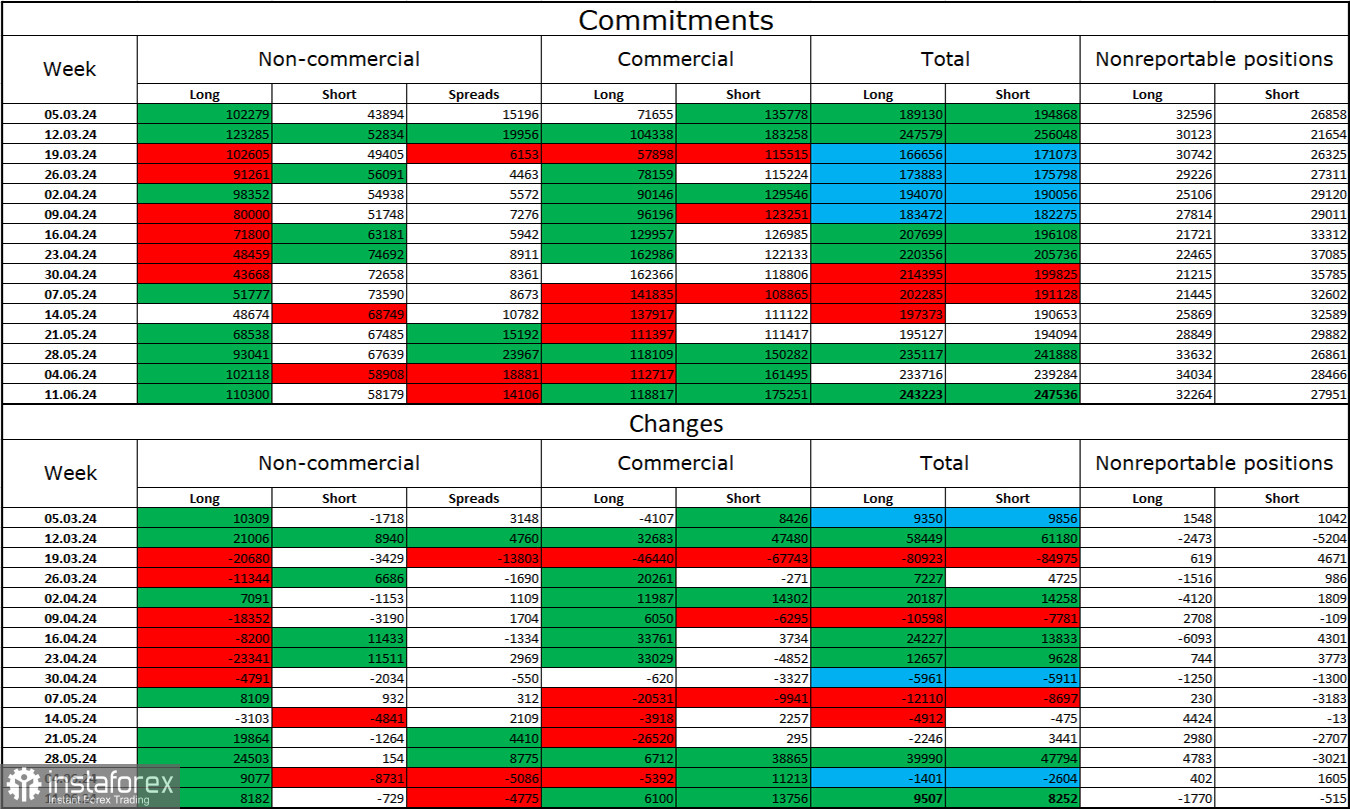

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" category of traders became even more "bullish" over the past reporting week. The number of Long contracts held by speculators increased by 8,182 units while the number of Short contracts decreased by 729 units. The bulls again have a solid advantage. The gap between the number of Long and Short contracts is 52,000: 110,000 versus 58,000.

However the pound still has excellent prospects for falling. Graphic analysis has given several signals about the breakdown of the "bullish" trend and the bulls cannot attack forever. Over the past three months the number of Long contracts has increased from 102,000 to 110,000 while the number of Short contracts has grown from 44,000 to 58,000. Over time major players will continue to get rid of Buy positions or increase Sell positions as all possible factors for buying the British pound have already been exhausted.

News Calendar for the US and the UK:

- UK – Manufacturing PMI (08:30 UTC)

- UK – Services PMI (08:30 UTC)

- US – Manufacturing PMI (13:45 UTC)

- US – Services PMI (13:45 UTC)

On Friday the economic events calendar contains several entries. The impact of the informational background on market sentiment today can be moderate.

Forecast for GBP/USD and Trading Tips:

Selling the pound was once again possible upon closing below the 1.2690–1.2705 zone with a target of 1.2611. Buying can be considered on a rebound from the 1.2611 level with a target of 1.2690.

The Fibonacci grid levels are constructed based on 1.2036–1.2892 on the hourly chart and 1.4248–1.0404 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română