GBP/USD traded in a very sluggish manner for most of Thursday. Even after the results of the Bank of England meeting were announced, the pair's volatility did not change significantly. Yes, there was a spike in emotions, and the pound sterling even edged lower after the meeting. However, what difference does a movement of 40-60 pips make? We were even surprised that the pound depreciated – the market had every reason to buy the British currency again.

But let's move on to the meeting itself. UK interest rates have been left unchanged despite inflation falling to 2%. In fact, few believed that the BoE would start easing monetary policy in June. Even with inflation falling towards the target level. The fact is that UK inflation has been off the charts for a long time, so now the central bank doesn't want to make a mistake and start easing earlier than it should. Moreover, the inflation report was published just a day before the meeting's results were announced, right in the midst of the meeting. It was simply challenging for the Monetary Policy Committee to react quickly and simultaneously study and analyze all its components.

At the same time, we want to note that the number of Monetary Policy Committee members who voted to keep the rate unchanged and those who voted to lower it remained the same as in the previous meeting. And this is quite strange. Even if we take into account the previous value of inflation (2.3%), it is quite enough to increase the dovish sentiment within the Committee. Frankly speaking, we expected to see three or four doves on the results of the vote. However, this didn't happen, which means that the BoE took the most hawkish stance possible.

That's why it wouldn't have been surprising if the pound rose on Thursday. What is actually surprising is the market's reaction to the inflation report and how it is still reluctant to sell the pound, no matter what happens. Even considering the fact that the BoE's monetary policy has not changed, it is obvious that it is just a matter of time until the Bank lowers its rates. It is important to prevent inflation from falling back to 1% or dropping even lower.

Central banks believe that inflation must remain around 2% in order to achieve sustainable economic growth. Therefore, a significant drop in inflation well below this mark is just as bad as its position well above it. Hence, we believe that the BoE will not allow a significant decline. To prevent this, the key rate needs to be lowered.

However, the market and the British pound continue to ignore this information and these conclusions, which are quite obvious. We still believe that there is some serious force behind the British currency that simply prevents it from falling. In this case, regardless of the macroeconomic and fundamental background, we will not see a downward movement.

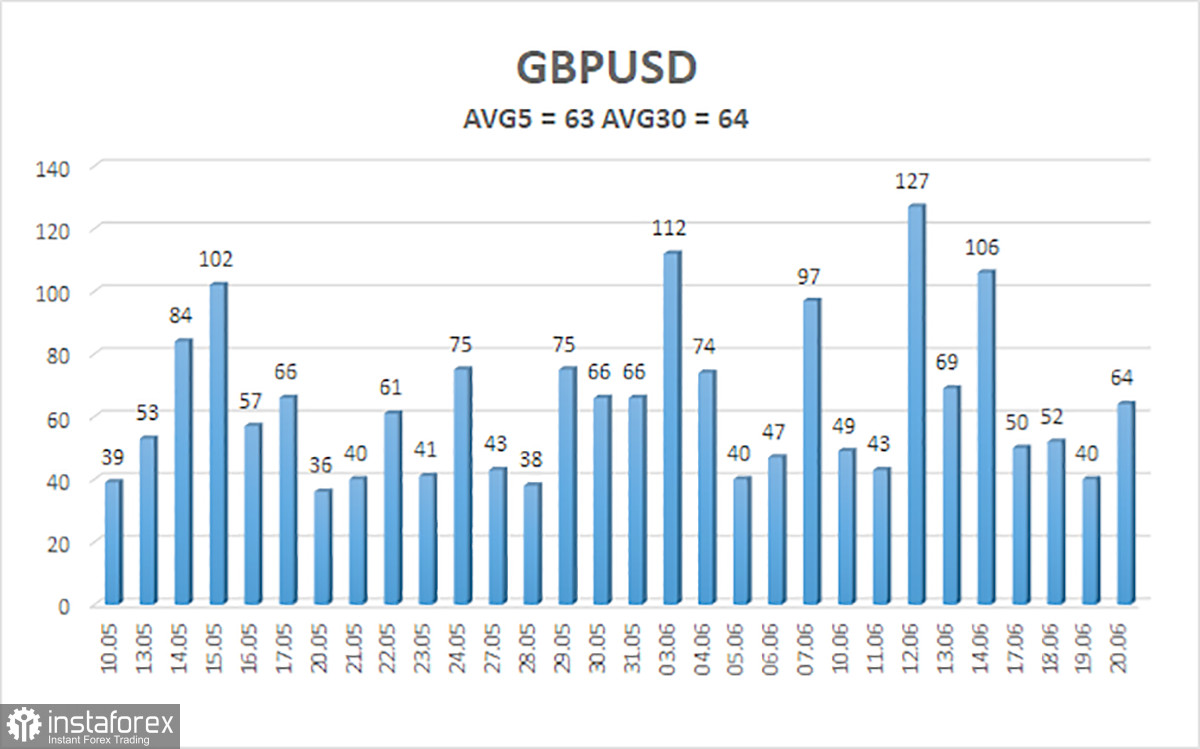

The average volatility of GBP/USD over the last five trading days is 63 pips. This is considered a moderately low value for the pair. Today, we expect GBP/USD to move within a range bounded by the levels of 1.2600 and 1.2726. The higher linear regression channel is pointing upwards, which suggests that the upward trend will continue. The CCI indicator entered the oversold area three times in the month before last, and the British currency started a new phase of growth. However, this correction should have ended a long time ago.

Nearest support levels:

S1 - 1.2665

S2 - 1.634

Nearest resistance levels:

R1 - 1.2695

R2 - 1.2726

R3 - 1.2756

Trading Recommendations:

The GBP/USD pair consolidated above the moving average line and once again it is trying to break the upward trend that we've seen in recent months. Therefore, after consolidating below the moving average line and breaking through the area of 1.2680-1.2695, the pound has a good chance of falling further. However, traders should exercise caution with any positions in the British currency. There is still no reason to buy it, and selling it is too risky, because the market ignored the fundamental and macroeconomic background for two months, and traders often refuse to sell the pair.

Explanation of Illustrations:

- Linear Regression Channels – Helps determine the current trend. If both are directed in the same direction, it means the trend is currently strong.

- Moving Average Line (settings 20.0, smoothed) – Determines the short-term trend and the direction in which trading should currently be conducted.

- Murray Levels – Target levels for movements and corrections.

- Volatility Levels (red lines) – The probable price channel in which the pair will spend the next day, based on current volatility indicators.

- CCI Indicator – Its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is imminent.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română