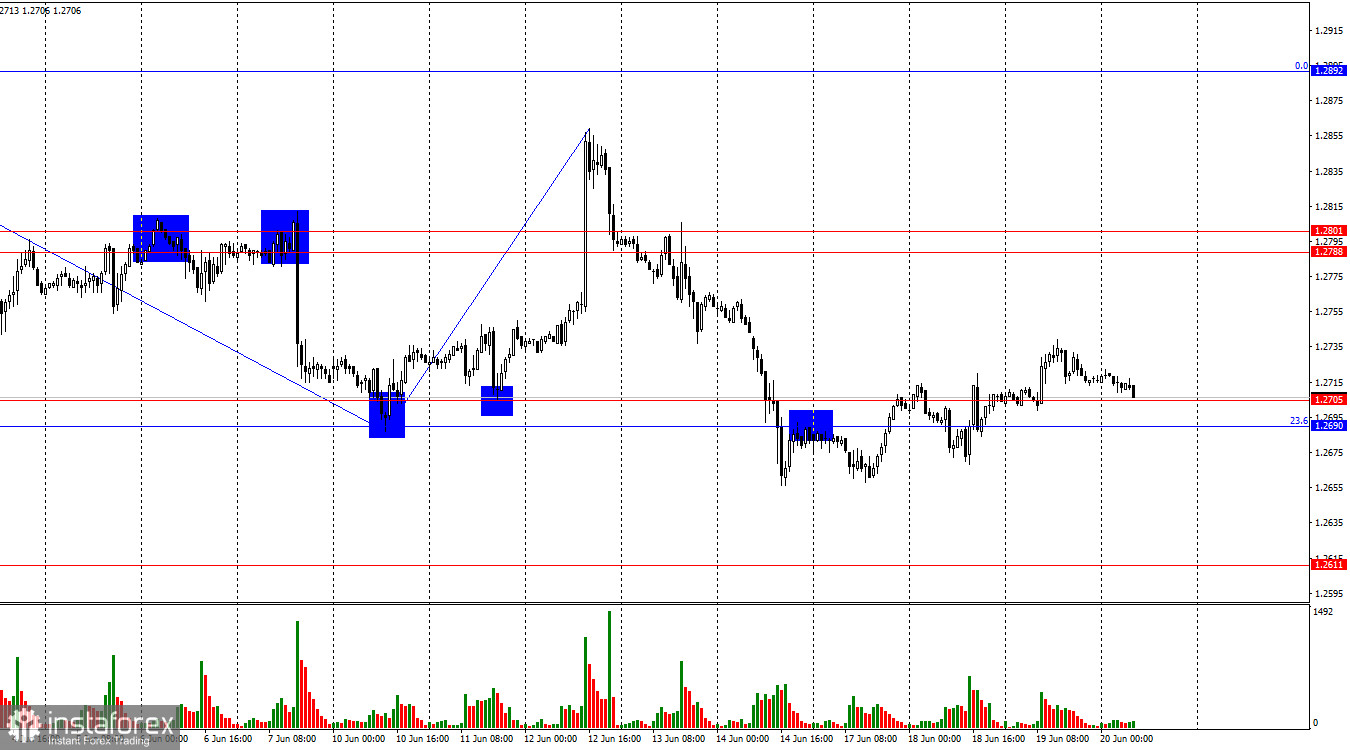

On the hourly chart, the GBP/USD pair continued its growth process on Wednesday after consolidating above the 1.2690-1.2705 zone. Today, the pair returned to this zone, and a new rebound from it could lead to further growth of the pound towards the resistance zone of 1.2788-1.2801. Consolidating below the 1.2690-1.2705 zone would indicate a more consistent decline toward the level of 1.2611.

The wave situation changed last Friday. The last upward wave broke the peak from June 4, while the new downward wave managed to break the low of the wave from June 10. Thus, the trend for the GBP/USD pair has turned bearish. I am cautious about concluding that a bearish trend has begun, as the bulls have not completely left the market. The emerging advantage of the bears can be easily overturned. The current upward wave may be corrective, after which a new downward wave could form, maintaining the bearish trend. However, the bears' advantage in the market is currently very weak (if it exists at all).

The information provided on Wednesday was extremely important for the pound. Unfortunately, traders once again saw what they wanted to see. Nevertheless, a major sale of the pound might be in preparation, as the Bank of England meeting is scheduled for today, and the likelihood of dovish results is very high. Even if the interest rate is not lowered, the MPC's stance may become significantly more dovish. This is because yesterday's core inflation report showed a decrease to 2.0% y/y, and the core inflation report showed a slowdown to 3.5% y/y. These figures allow the Bank of England to start easing monetary policy very soon, possibly even today. The fact that the bears did not take advantage of the situation on Wednesday suggests a potential sharp drop in the pound on Thursday. However, the 1.2690-1.2705 zone is strong. I expect a significant decline in the pound only below this zone.

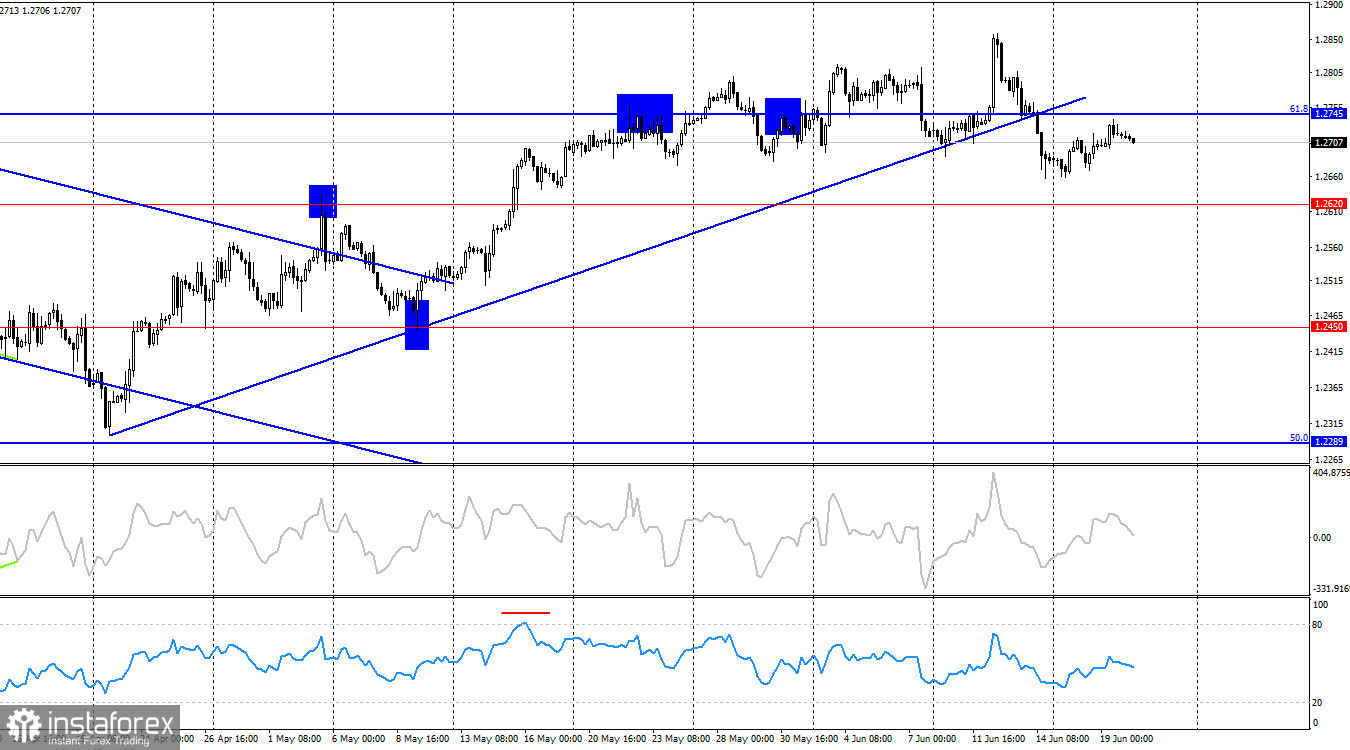

On the 4-hour chart, the pair reversed in favor of the US dollar and consolidated below the ascending trend line. Thus, the decline in quotations may continue toward the next level of 1.2620. A rebound from this level will allow the bears to take a small pause while consolidating below it could lead to further declines toward the next level of 1.2450. No impending divergences are observed in any indicator today.

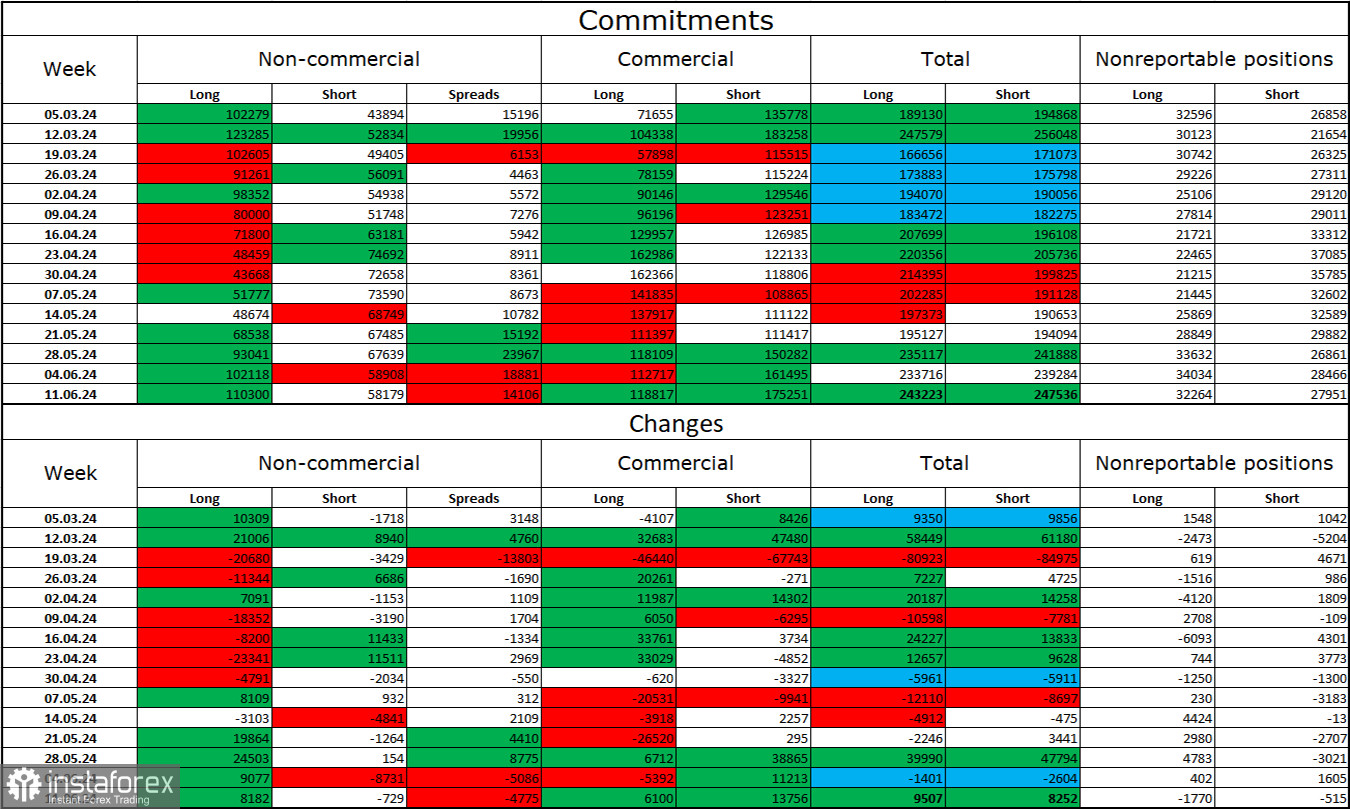

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category became even more bullish last week. The number of Long contracts held by speculators increased by 8,182 units, while the number of Shorts decreased by 729 units. The bulls again have a solid advantage. The gap between the number of Long and Short contracts is 52,000: 110,000 versus 58,000.

However, the pound still has excellent prospects for a fall. Technical analysis has issued several signals indicating the breakdown of the bullish trend, and the bulls cannot attack forever. Over the past three months, the number of Long contracts has grown from 102,000 to 110,000, while the number of Shorts has increased from 44,000 to 58,000. Over time, major players will continue to reduce their Buy positions or increase their Sell positions, as all possible factors for buying the pound have already played out. However, the key factor this week will be the news background from the UK.

News Calendar for the US and UK:

- UK – Bank of England interest rate decision (11:00 UTC).

- UK – MPC vote distribution on the rate (11:00 UTC).

- UK – Monetary Policy Committee meeting minutes (11:00 UTC).

- US – Philadelphia Fed manufacturing index (12:30 UTC).

- US – Initial jobless claims (12:30 UTC).

- US – Building permits (12:30 UTC).

On Thursday, the economic events calendar contains several entries, with the Bank of England meeting standing out. The influence of the information background on market sentiment until the end of the day could be significant.

Forecast for GBP/USD and Trader Advice:

Selling the pound will be possible again upon closing below the 1.2788-1.2801 zone, targeting 1.2690-1.2705. Purchases could have been opened upon consolidating above the 1.2690-1.2705 zone, targeting the 1.2788-1.2801 zone. Caution: today is the Bank of England meeting, and the pair's direction could change sharply.

The Fibonacci levels are constructed at 1.2036-1.2892 on the hourly chart and at 1.4248-1.0404 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română