GBP/USD traded higher for most of Wednesday. Let's dive straight into the details without any lengthy introductions. As expected, UK inflation slowed to 2.0% in May. This gives the Bank of England all the grounds to ease monetary policy as early as today. Take note that monetary easing is considered a dovish factor, which typically puts pressure on a currency, especially when the other central bank (in this case, the Federal Reserve) continues to maintain its interest rate at a high level and has no plans to lower it in the coming months. However, the market seems indifferent to these fundamentals. Right now, fundamental analysis simply does not apply to the GBP/USD pair. It might become relevant again today, next week, or next month, but not right now.

To recap, the last two US inflation reports showed a minor slowdown of 0.1%, both of which triggered a 100-pip drop in the dollar. In contrast, the last two UK inflation reports showed a slowdown of 1.2%, but surprisingly the British pound strengthened in both instances. This paradoxical situation suggests that the market currently allows only two scenarios: the dollar falls or the British pound rises.

We already mentioned that the British pound refuses to fall, and the market is against selling it, making fundamentals and macroeconomics irrelevant at this time. Even in our recent articles, we mentioned that another slowdown in inflation does not guarantee that the pound will fall. And this has been the case. We still believe that major market makers are behind the British currency, artificially holding its rate. The same situation has been observed for over six months now.

Today, the BoE can do whatever it wants with its interest rate. It can raise it by another 0.5%, lower it by 1%, any scenario will be insignificant for the British currency. Dovish actions of any scale will, at best, lead to a small bearish correction for the pound. We would even say that under current conditions, the British currency has a much higher chance of continuing its rise in the medium-term, because what else can you expect from a currency that simply doesn't want to fall? This situation implies that the demand for the pound is very high, regardless of whether it comes from market makers, central banks, large players, or retail traders. Demand remains high, and therefore the asset will rise, regardless of fundamentals, technicals, and macroeconomics.

Most traders are not used to such a situation, but such periods do happen. The main thing is to identify them in time and understand that the pair is currently moving in an illogical manner. On the 4-hour timeframe, another consolidation below the moving average line has led to absolutely nothing...

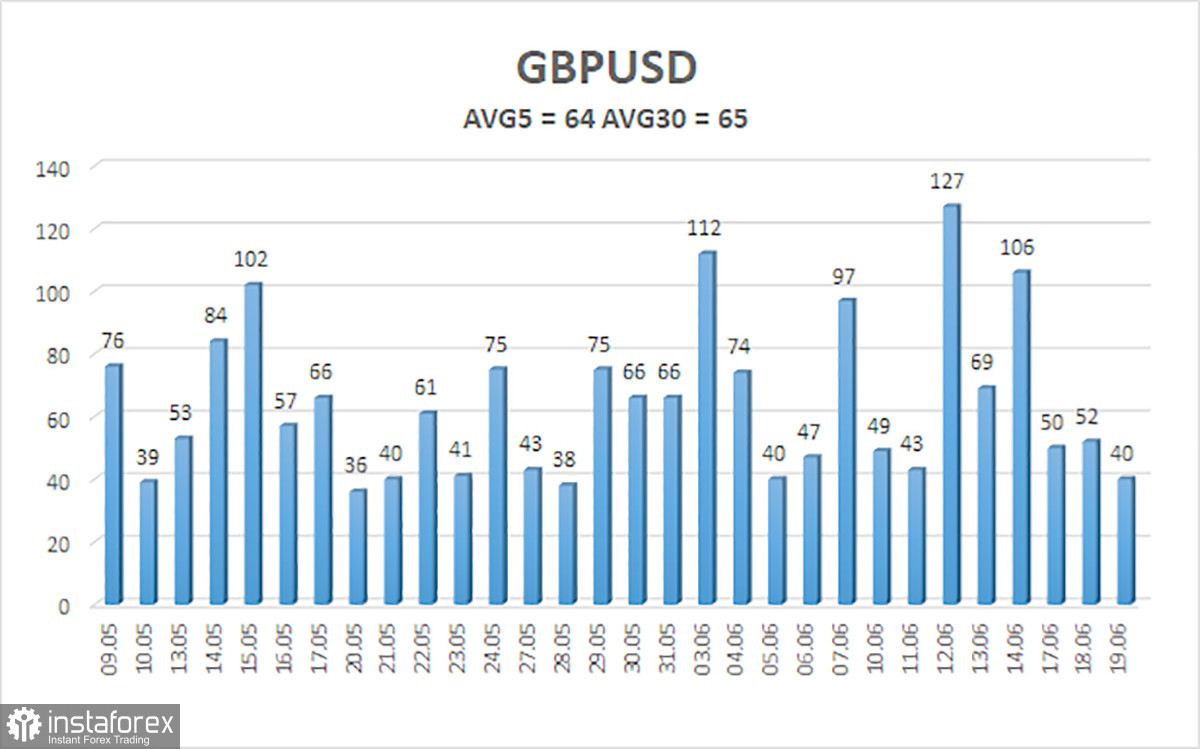

The average volatility of GBP/USD over the last five trading days is 64 pips. This is considered a moderately low value for the pair. Today, we expect GBP/USD to move within a range bounded by the levels of 1.2655 and 1.2783. The higher linear regression channel is pointing upwards, which suggests that the upward trend will continue. The CCI indicator entered the oversold area three times in the month before last, and the British currency started a new phase of growth. However, this correction should have ended a long time ago.

Nearest support levels:

S1 - 1.2695

S2 - 1.2665

S3 - 1.2634

Nearest resistance levels:

R1 - 1.2726

R2 - 1.2756

R3 - 1.2787

Trading Recommendations:

The GBP/USD pair consolidated above the moving average line and once again it is trying to break the upward trend that we've seen in recent months. Therefore, after consolidating below the moving average line and breaking through the area of 1.2680-1.2695, the pound has a good chance of falling further. However, traders should exercise caution with any positions in the British currency. There is still no reason to buy it, and selling it is dangerous, because the market ignored the fundamental and macroeconomic background for two months, and traders often refuse to sell the pair.

Explanation of Illustrations:

- Linear Regression Channels – Helps determine the current trend. If both are directed in the same direction, it means the trend is currently strong.

- Moving Average Line (settings 20.0, smoothed) – Determines the short-term trend and the direction in which trading should currently be conducted.

- Murray Levels – Target levels for movements and corrections.

- Volatility Levels (red lines) – The probable price channel in which the pair will spend the next day, based on current volatility indicators.

- CCI Indicator – Its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is imminent.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română